Taxation Management

advertisement

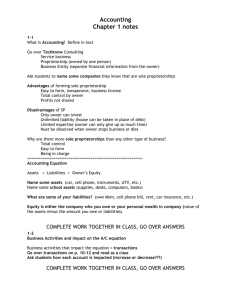

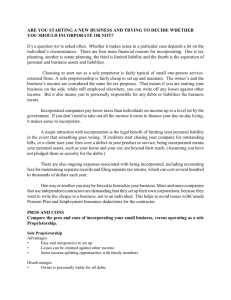

Taxation Management Income tax return of Sole Proprietorship Submitted by: Saira Khalid (Reg. No. 0201) Sana Riaz (Reg. No. 0185) Section: M.com 1A Submitted to: Sir Hafiz Waqas Kamran Date of submission: 07th-june-2013 Particulars of the selected business: Business selected is sole proprietorship with name “Tasawar Electric Concern”. Theorganization is situated in Faisalabad near Bhawana bazaar. The complete address of the company is as follows: Bhora Gali No. 3, Bhawana Bazar, Faisalabad. The sole proprietor’s name is Ghulam Murtaza. He is a resident person. The amount of capital contributed is just Rs. 200,000/- and Ghulam Murtaza does a business on very small level. Basically it is an electric supply company. He is a retailer. Documents attached: 1. Balance sheet (As on year ended 2009, 2010, 2011) 2. Trading profit/loss account (for the year ended 2009, 2010, 2011) 3. Income Tax return ( for the year 2009, 2010, 2011) Analysis of Financial statement: Balance sheet: 2009: Tasawar Electric Concern had fixed assets of Rs. 10159636. Current assets amount to Rs. 6335068. So the amount of total assets become Rs. 16494704. It has current liabilities and no fixed liability. This shows that the business carry all the capital as equity capital. Total liabilities are of Rs. 16494704. 2010: Tasawar Electric concern had fixed assets of Rs. 10016257. Current assets amount to Rs. 6571895. So the amount of total assets become, Rs. 16588152. It has current liabilities and no fixed liability. Total liabilities are of Rs. 16588152. 2011: Tasawar Electric Concern had fixed assets of Rs. 9881148. Current assets amount to Rs. 6648737. So the amount of total assets become equal to Rs. 16529885. It has current liabilities and no fixed liability. Total liabilities are of Rs. 16588152. There is no short term borrowing from bank even in 2011. Balance sheet carries no detail of fixed assets. Possibilities are there that only one type of asset may be in business. Or chances can be that there is no restriction by the board for sole proprietorship and hence some of the facts can be concealed. It may be because the owner is not responsible for the satisfaction of shareholders. Moreover, there is not debt taken from bank or any other financial institution. So, the facts are not properly disclosed. Profit and Loss accounts: 2009: Tasawar Electric concern, earns the profit of Rs. 1864714 annually. The profit is calculated very formally using the prescribed format. 2010: Tasawar Electric concern, earns the profit of Rs. 1971972 annually. 2011: Tasawar Electric concern, earns the profit of Rs. 2065776 annually The business progress is clearly shown from the profit and loss statement. We see every year the profit is going to be increased. About Rs. 100,000 increase in a sole proprietorship business is ranking on better position of the business. Analysis of Income Tax Return: 2009: income tax return of Ghulam Murtaza is attached. He has just one source of income that is “income from business”. His taxable income from business is shown as Rs. 168,000. Hence, his total taxable income is also just Rs. 168,000. No zakat is paid as per Zakat & Usher Ordinance 1980, so it is not allowable deduction. Tax computations are also shown. Rs. 168,000 x 3.00% = Rs. 5040. Minimum tax calculated is also shown amount to Rs. 3390. Whichever is higher is included. So actual tax liabilityis Rs. 5040. 2010: again He has just one source of income, that is “income from business”. His taxable income from business is shown as Rs. 175,000. Hence, his total taxable income is also just Rs. 175,000. He has no loss to be carried forward and adjusted in future years. No admissible deductions are there. Tax is calculated @ 3.00% which is Rs. 5250. Tax deptt. Has to refund amount of Rs. 235 to Ghulam Murtaza. 2011: He has just one source of income that is “income from business”. His taxable income from business is shown as Rs. 308,990. Hence, his total taxable income is also just Rs. 308,990. Such increase in income is due to increase in sales and decrease in expenses. Tax is calculated as 308990 x 7.5% = Rs. 23,174. Other taxes combinely form Rs. 26269 as tax expense for Ghulam Murtaza. Source of getting all documents: All the documents are collected from Alfalah bank limited, Bhawana Bazar. Faisalabad. The reference card of the person is attached with: