See - ADISA

advertisement

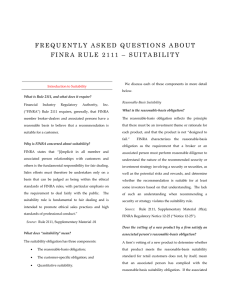

Due Diligence Under Current Regulatory Standards Prepared by: Brandon S. Reif WINGET SPADAFORA & SCHWARTZBERG LLP 1900 Avenue Of The Stars, Suite 450 Los Angeles, CA 90067 Tel: 310.836.4800 Reif.B@WSSLLP.COM Obligations of Broker Dealers Reasonable Basis Suitability: • Requires a reasonable basis to believe that the investment is suitable for some retail customer. • The broker dealer must understand the nature of the recommended security or the investment strategy and the potential risks and rewards. See Notice to Member 10-22; 13-31; FINRA rule 2111. Reasonable Basis Suitability Steps for Conducting a Due Diligence Investigation: • Examine the private placement memorandum (PPM); • Review current registration statements and financial reports; • Ascertain the personal history of sponsor’s managers and owners; • Verify any self serving statements by the sponsor or its managers; and • Follow up on any red flags. See Notice to Member 10-22; 13-31; FINRA rule 2111. Reasonable Basis Suitability Be Sensitive to Red Flags and Inquire Further: • Financial statements and back-up; • Level of cooperation and thoroughness of disclosures; • Presence or lack of clear research and investment processes; • Undisclosed potential conflicts of interest; and • Background checks of managers, i.e. regulatory history, bankruptcy, or valuation concerns. See SEC, Investment Advisor Due Diligence Processes for Selecting Alternative Investments and their Managers (Jan. 28, 2014). Obligations of Broker Dealers Customer specific suitability means the investment is suitable for the specific customer based on his/her: • Age; • Investment experience; • Liquidity needs and risk tolerance; • Other holdings; • Financial situation and needs; • Tax status; • Investment time horizon; and • Investment objectives. See FINRA, Notice to Member13-31; FINRA rule 2111. Customer Specific Suitability Customer Specific Suitability Applies To Recommendations Made To Customers. • Customers are individuals who are not broker dealers and (1) open a brokerage account with a broker dealer OR (2) purchase a security for which the broker dealer will receive compensation. • Recommendations include (1) suggestions to purchase securities and (2) explicit advice to hold securities. See FINRA, Notice to Member 12-55; 13-31; FINRA rule 2111. Recent FINRA Cases Madhany v. Citigroup Global Markets • FINRA arbitrators found that the registered representatives recommended unapproved securities that were not adequately investigated. • FINRA panel awarded claimants $1,047,334.00 in compensatory damages and up to $10,031,229.25 to indemnify claimants for third party liability. See FINRA Award, Madhany v. Citigroup Global Markets, Inc f/k/a Smith Barney Case No. 10-04929 (Sept. 16, 2013). Recent FINRA Cases Gruberman v. LaSalle Street Securities LLC • FINRA arbitrators found broker dealer liable for breaching their fiduciary duty based on: • Failure to complete due diligence before recommending securities and provide full disclosure relating to third party findings in due diligence report. • FINRA panel awarded claimants $135,000.00. See FINRA Award, Gruberman v. LaSalle Street Securities LLC Case No. 12-02021 (Jan. 30, 2014). Recent FINRA Enforcement Action In Re Sunset Financial Services, Inc. • Broker dealer failed to investigate the following red flags resulting in FINRA fines: • Sponsor’s financial difficulties; • Third party report detailing high default rate; • Same management of second offering where first failed; • Placement of securities on the approved list of offerings before due diligence was complete; and • Failure to supervise recommendations and due diligence procedures. See FINRA Letter of Acceptance, Waiver and Consent No. 2011026915701 In Re Sunset Financial Services, Inc. (July 2, 2013). Regulatory Priorities for 2014 2014 SEC Regulatory Priorities Include: • Assessment of alternative investments; • Leverage, liquidity, staffing, funding, and marketing to investors; • Representations and recommendations to investors; • Fraudulent sales practices and unsuitable recommendations; and • Firm supervision of private securities transactions. See SEC, Examination Priorities for 2014 (Jan. 9, 2014).