Employee Stock Options

advertisement

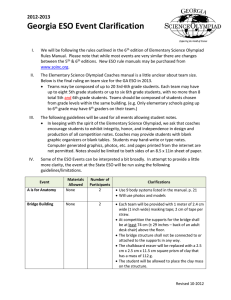

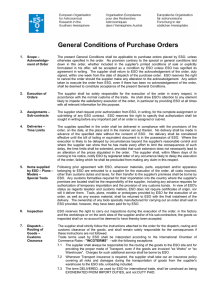

Employee Stock Options Presented by: Gary Liang Daniel Lee Joyce Yuen Agenda Employee Stock Option Definition Trend Pros and Cons Accounting Manipulation Outlook Adobe System Cisco System What is ESO? An employee stock option is a Warrant on a company's own stock issued as a form of non-cash compensation. Characteristics of Warrant Warrant is an option issued by a corporation Granting the purchaser the right to acquire shares The transaction results in a cash inflow to the corporation in exchange for a NEW issue of common shares. The Era of ESO Poitras (2004) –Executive Stock Option Disclosure: Is FAS 123 Adequate? Recent Trend of ESO - S&P 500 Companies Figure source:http://www.equilar.com/newsletter/september_2006/ect_sept_2006_article2.html Why ESO? 1. Agency Problem Moral Hazard Occur from separation of ownership and control Effort is unobservable, managers may shirk on effort ESO aims at aligning executives’ and employees’ interests with shareholders Long term incentive for execs and employees Why ESO? (cont.) 2. No Cash Requirement especially good for growing companies or companies with high intellectual capital 3. Accounting incentive (before 2004) Why ESO? (cont.) 3. Personal tax incentive No income taxed until exercised When taxed, categorized as capital gain (only 50% taxable) 4. Deferred dilutions of earnings and voting controls 5. Rising share price motivates employees to work harder and longer Critiques of ESOs The main criticisms against executive stock options: (i) The difficulty of accounting, expensing options in particular; (ii) The opportunity cost of options for the granting firm higher than the value of options to undiversified executives; (iii) Giving executives extra incentives to manipulate accounting information; (iv) Rewarding executives excessively in the boom market; (v) Failure to penalize bad performance by resetting option price in the down market (vi) Encouraging executives to take excessive risks at the cost of the shareholders. Reference: Chongwoo Choe, Xiangkang Yin (2006). Should Executive Stock Options Be Abandoned? Australian Journal of Management, 31(2), 163 Accounting of ESO (1972) Accounting Principle Board 25 (1972) Expense will be the fair value amount or the intrinsic amount Loophole: if a firm sets the exercise price of the option equal to the Market price at grant date, then $0 expense is recognized Accounting of ESO (1995) Financial Accounting Standard Board 123 (1995) Financial Accounting Standards Board (FASB) encouraged the use of fair value methods & mandated disclosure in the notes, but firms could still use the intrinsic method Accounting of ESO (2005) FASB 123 (2005 - revised) FASB made fair value method of expensing stock options mandatory for all annual and interim reports after June 15, 2005 Effects: Sliced 20% of reported income (Business week, 2003) Valuations of ESO Intrinsic Value = Market Price at grant day – exercise price Fair value of stock options = “intrinsic value + time value”: The Lattice Model (e.g. Binominal Model) Black-Scholes Model Other valuations Choice of Valuation Model The majority of public and private companies apply the Black-Scholes model, however, through September 2006, over 350 companies have publicly disclosed the use of a lattice model in SEC filings. Source: http://en.wikipedia.org/wiki/Employee_stock_option Black-Scholes and Lattice-Binominal Not Accurate! Black-Scholes Assume free transferability, but not for ESO Assume non-contingent exercisable option, but ESO void as soon as holders leave the company Contain lots of estimations Lattice-Binominal Can be applied to more different kinds of options Still contain estimations Black-Scholes Model C(S,T) = S*N(d1) – K℮-rt*N(d2) Lots of estimations in the valuation, another loophole for manipulation? The “Power” of Estimations Capital One Financial, 2002 Reduce option life from 8.5 to 5 years Cut option cost $29.3 million Broadcom Corp., 2002 Reduce volatility from 90% to 70% Save $79 million Evidences from Academic Studies One out of five companies in the Standard & Poor's 500-stock index reduced option life, stock volatility, or both, in 2002, increasing actual or pro forma earnings in the process. - Jack T. Ciesielski, The Analyst's Accounting Observer Compared accounting assumptions used to value options in 2002 with actual historical trends and found that many companies underestimated both volatility and the risk-free interest rate. - Derek Johnston-Wilson, Colorado State University Other Management Manipulations Other Management manipulation Management controls over stock option grants Stock repurchase instead of dividends Misrepresentation of company performance Executives influence the restrictions of the stock options in their own favour Forfeiting profitable but risky businesses Back-Dating Proposed by Erik Lie (2005) in his study dates on which options are granted to executives are chosen with the benefit of hindsight to be past dates when the stock price was particularly low SEC investigated the issue, big time Included Jack Welch, GE and Donald Tyson, Tyson Food Silicon Valley firms (30-40) Back-Dating Lynn Turner, a former SEC chief accountant, suspects it's a fairly common practice and ‘bigger than most people realize.’ Adds a Silicon Valley lawyer who asked not to be named: ‘I’d be surprised if there was even one public tech company that did not employ this practice in those [bubble] years.” Randall and Erik Lie, 2005 Outlook for ESO Loopholes still exist Decreasing trend due to changing accounting requirements Among the S&P 500 companies, stock option grants dropped 26% in 2005 Substitutes: Restricted Stocks In 2005 the S&P 500 companies increased such awards by 44% Recent Trend of ESO – S&P 500 Companies Figure source: http://www.equilar.com/newsletter/september_2006/ect_sept_2006_article2.html Company Overview Adobe Systems Incorporated offers business and mobile software and services worldwide It operates in five business segments: Creative Solutions, Knowledge Worker Solutions (KWS), Mobile and Device Solutions (MDS), Enterprise and Developer Solutions (EDS), and Other Stock Symbol: NASDAQ NM: ADBE Doesn’t have any debt Doesn’t pay a dividend How Adobe Grants Stock Options Based on relative position Based on responsibilities Based on performance Based on anticipated future performance Grants options at a exercise price equal to that day’s closing price Executive Compensation Summary Past Financial Statements 2006 Financial Statements Stock Options Outstanding Assumptions to Value Options and Employee Stock Company Overview Worldwide leader in networking for the Internet Founded in 1984 by a group of computer scientists from Stanford University. Stock Symbol: NASDAQ NM: CSCO (Common Stock) IPO: Cisco went public on February 16, 1990 at a split-adjusted price of about 6 cents. Employees: As of the end of Q2 FY 2007 (January 27, 2007) Cisco has 54,563 employees worldwide. COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN AMONG CISCO SYSTEMS, INC., THE S & P INFORMATION TECHNOLOGY INDEX AND THE S & P 500 INDEX Compensation Components The three material elements of Cisco’s executive officer compensation are: (i) base salary, (ii) variable cash incentive awards and (iii) long-term, equity-based incentive awards. Option Grants in 2006 Individual Grants Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term Number of Securities Underlying Options Granted % of Total Options Granted to Employees in Fiscal Year 1,300,000 0.6506 17.86 300,000 0.1501 350,000 Richard J. Justice Name Exercise Price ($/Share) Expiration Date 5% ($) 10% ($) 9/29/2014 12,800,739 31,528,829 17.80 8/12/2014 2,944,093 7,251,441 0.1751 17.86 9/29/2014 3,446,353 8,488,531 525,000 0.2627 17.86 9/29/2014 5,169,529 12,732,797 Dennis D. Powell 400,000 0.2002 17.86 9/29/2014 3,938,689 9,701,178 Randy Pond 425,000 0.2127 17.86 9/29/2014 4,184,857 10,307,502 John T. Chambers Charles H. Giancarlo Option Exercises and Holdings Number of Securities Underlying Unexercised Options at July 29, 2006 Name John T. Chambers Number of Shares Acquired on Exercise Value Realized ($) Exercisable Unexercisable Value of Unexercised In-theMoney Options at July 29, 2006 ($) Exercisable Unexercisable 5,850,000 69,674,752 25,316,667 4,533,333 34,149,856 3,882,999 Charles H. Giancarlo 900,000 12,569,877 5,129,999 1,545,001 9,282,901 1,088,048 Richard J. Justice 300,000 2,677,685 3,572,500 1,442,500 1,211,450 1,164,662 Dennis D. Powell 183,750 1,968,151 2,089,562 1,114,521 3,451,875 868,302 Randy Pond 150,000 1,181,314 3,279,416 1,249,584 3,604,181 1,167,200 Consolidated Balance Sheets (in millions, except par value) Consolidated Statements of Operations (in millions, except per-share amounts) Consolidated Statements of Cash Flows (in millions) Consolidated Statements of Shareholders' Equity (in millions) Ranges of outstanding and exercise options as of July 29, 2006 (in millions) Intrinsic value of stock options The aggregate intrinsic value in the preceding table represents the total pretax intrinsic value based on stock options with an exercise price less than the Company’s closing stock price of $18.08 as of July 29, 2006, which would have been received by the option holders had those option holders exercised their options as of that date. The total number of in-the-money stock options exercisable as of July 29, 2006 was 303 million. As of July 30, 2005, 906 million outstanding stock options were exercisable and the weighted-average exercise price was $28.80. Black-Scholes model with the weightedaverage assumptions The weighted-average estimated value of employee stock options granted during fiscal 2005 and fiscal 2004 were $6.19 and $8.77, respectively. Pro forma Financial Statement (1) Net income and net income per share prior to fiscal 2006 did not include stock-based compensation expense related to employee stock options and employee stock purchases under SFAS 123 because the Company did not adopt the recognition provisions of SFAS 123. (2) Stock-based compensation expense prior to fiscal 2006 is calculated based on the pro forma application of SFAS 123. (3) Net income and net income per share prior to fiscal 2006 represents pro forma information based on SFAS 123.