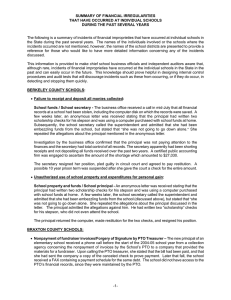

PTO Request for Audit, August 2015

advertisement

Radnor Middle School PTO Request for Audit, August 2015 Background Dennis McNamara- occupation- Director of an office which is part of the Office of the Chief Financial Officer of a federal government agency. One of my office’s primary missions is to assist federal agency business lines and be their representative in financial audits. These audits are conducted by both external and internal government auditors. While I am not an auditor, I have extensive knowledge of the general audit process and internal controls. My degree is in Mathematics. In mid-2015, I was approached by the Treasurer of the RMS PTO, and was asked to audit the RMS PTO. The goal of the audit was to validate current procedures and balances, identify risks, if any, and to make any suggestions for improvement. I was provided with an overview of the PTOs finances, current procedures. I then reviewed the supporting documentation regarding the monthly financial statements, invoice and check histories, and bylaws. Review The scope of this review is limited to the period beginning April 2014 to May 2015. performed a prior review covering the period from July 2013 to March 2014. I Without prior fiscal period audits (pre July 2013), I must make the assumption is that the beginning cash balance of July 2013 was a valid starting balance. Steps taken Bank Statements Bank statements from April 2014 to May 2015 were reviewed. These statements showed all deposits, checks, and transfers during that time. Nothing unusual was revealed in reviewing of the statements. Checks-Receipts Between May 2014 and May 2015 approximately 90 checks appeared on the bank statements [range #1579, 1602-1694, not 100% inclusive]. Due to the relative small number of total checks written during the review period, I reviewed the each check number to verify that a corresponding receipt created during the review period was provided. I found no unusual activity but could not locate any documentation on check #1631 or #1647. During last year’s review it was documented in the bylaws that all checks over $500 should be signed by 2 people. During this review period 23 checks were written for over $500. (#1605, 09, 11, 13, 15, 16, 22, 26, 34, 35, 52, 60, 62, 64, 65, 71, 72, 74, 76, 79, 85, 87, and 1690). Copies of the canceled checks were not available to me so I was unable to test this control. I would recommend that a review of these canceled checks be conducted to ensure compliance with this bylaw. Cash Like most small charities/PTOs/clubs/etc access to cash at events poses the highest risk. It was my understanding that for some events cash is needed to fund a ‘cash box’ [ie register, for ticket sales, to make change, etc]. Generally, at an event’s conclusion the money is counted and signed off by one or more people. However, these people might not be the same people who started with the cash box. So, although the ‘final balance’ might be verified, events occurring between when the treasurer funded the box and the event’s end are a risk. Ideally, when ever cash changes hands a validation of amounts should occur [i.e. a physical count of the cash by 2 people]. At busy events, with numerous volunteers, or when the amount of cash is relatively small, admittedly, this is impractical, but at the very least a recommendation is that cash should not be left to the responsibility of a single person without a validation of amounts occurring. Conclusion: My review found no evidence of any fraud or misuse of funds. The Treasurer’s records demonstrated strong internal controls over all RMS funds. The limited number of transactions helped limit the risk, however, there does exist some opportunity to increase controls to lower future risk.