Market Efficiency Lecture II

advertisement

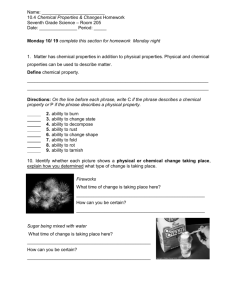

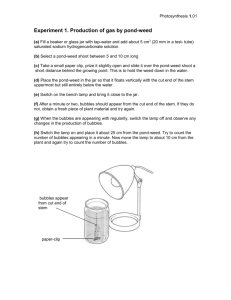

FIN 352 – Professor Dow Fama: Test the efficient market hypothesis using different information sets. Three categories: Weak Semi-Strong Strong Some tests directly use this categorization, others do not. All past-price information is fully reflected in stock prices. Can’t use past prices to forecast future prices. If true, technical analysis is not useful. All public information is fully reflected in stock prices. If true, fundamental analysis is not useful. All information is reflected in stock prices. Implies that trading on insider information shouldn’t be profitable. Not true But not legal A) Patterns in stock prices. B) Back-testing trading rules. C) Do categories of stocks earn abnormal returns? D) Event studies. E) Do stock prices move “too much?” F) Bubbles. G) Do some investors outperform the market? Serial Correlation > 0, Momentum Serial Correlation < 0, Mean Reversion Serial Correlation = 0, Random Walk Weak Form EMH predicts random walk See if trading rules are profitable when applied to historical stock price data. Data Mining In-Sample vs. Out-of-Sample Value stocks Small stocks Or is it microcap/neglected stocks? Is it is risk premium? Abnormal returns: Stocks earn greater returns than they “should”: Ri – E(R) Theory implies that stocks should earn abnormal returns when news first comes out, but not afterwards (stock prices are quick to adjust to news) Book gives example where they use excess returns (Ri-Rm) to measure response to event. Response is slower than it should be. Increases in asset prices not justified by “fundamentals” At some point, bubbles pop! Shouldn’t have bubbles if markets are efficient. Recent experience with real estate and stock price bubbles. Theory: Stock price is the present value of expected future dividend payments. Stock prices shouldn’t vary more than dividends or earnings do. But there is more variation Similar idea to bubbles: stock prices move based on psychological reasons rather than fundamental reasons. Why do some investors do well? Luck Higher risk Skill Mutual funds tests Markets are broadly efficient, but some important exceptions. Bubbles Some people understand the economy better – but do you? Build around index funds: Well-diversified and low cost Do bubbles imply market timing? Do you want to engage in fundamental analysis?