Document

advertisement

COS 444

Internet Auctions:

Theory and Practice

Spring 2009

Ken Steiglitz

ken@cs.princeton.edu

week 4

1

FP equilibrium for general v distribution

The set up:

• Baseline IPV model, values iid with cdf F(v)

• E[surplus of 1] = pr{1 wins} (v1 – b(v1 ))

• Bidders 2,…,n bid b (v)

• What is best b( v1 ) ?

week 4

2

In bid space…

We need to express the prob. that 1 wins,

which is

pr{b (vi ) b(v1 )} pr{vi b (b(v1 )) F ( b (b(v1 ))),

1

1

i 2,..., n

For this, we assume for now that β is

monotonically increasing, and hence

invertible. We thus need to check our

answer!

week 4

3

Because the v ’s are independent, we can now write

E[surplus ] (v1 b(v1 )) F ( b (b(v1 )))

1

n1

and the equilbrium condition is then

E[surplus ] / b b ( v ) b ( v ) 0

week 4

4

One more thing:

When we differentiate this, we’ll need the

derivative of β-1 .

If you rotate the picture it’s (almost)

obvious that

( b (b))

1

week 4

1

1

b ( b (b))

5

Use chain rule, set β=b, use v instead

Of v1 , so β-1(b(v1)) = v.

Leads to a linear, first-order

differential equation for b(v):

b [( n 1) f (v) / F (v)]b [( n 1) f (v) / F (v)]v

This is of the form:

b(v) C (v)b(v) D(v)

week 4

6

Use the ancient trick of multiplying by the

integrating factor

C ( v ) dv

e

Cdv

Cdv

Cdv

be

bCe

De

Cdv

d Cdv

be De

dv

be

Cdv

week 4

Cdv

Cdv

De dv e

7

In this case, C=(n-1)f/F; D=vC; and

Cdv

e

e

( n1) f

F

dv F

n1

Integrate by parts, use b(0)=0 to determine

γ=0.

Solution: (check monotonicity assumption)

v

b (v ) v F ( y )

0

( n 1)

dy / F (v)

( n 1)

…optimal shade

week 4

8

To check monotonicity assumption:

From the differential equation:

b [( n 1) f (v) / F (v)] b [( n 1) f (v) / F (v)]v

week 4

(n 1) f

b

(v b ) 0

F

11

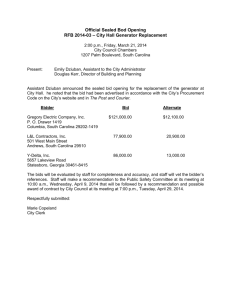

eBay observed

• Assignment 2 provides a tool for

visualizing behavior…

• We’ll look at some examples, but first…

week 4

12

eBay’s algorithm

• Open vs. secret reserve

• Increments

• Raising your own (highest) bid when

you're less than a bidding increment

above the posted second price

• Raising your own (highest) bid when you’re

below secret reserve

• Buy-it-Now with and without offer invitation, and

with and without bidding opportunity at lower

reserve, when bids will remove buy-it-now.

Question: is it rational to bid above buy-it-now?

week 4

13

Simplest case: Open reserve (minimum bid)

Assume for simplicity that bidding

increment = tick = $1; open reserve = $10

First bid: $20

Posted:

$10

Minimum next bid is this + tick = $11

New bid and bidder: $15

Posted:

$16 (“proxy bid”)

Minimum next bid is this + tick = $17

New bid: $19.90

Posted:

$ 20.00 (“proxy” can’t exceed high bid)

Minimum next bid is this + tick = $21.00

week 4

*In all cases the posted price is the one paid

14

If instead:

First bid: $20

Posted:

$10

Minimum next bid is this + tick = $11

New bid and bidder: $15

Posted:

$16

Minimum next bid is this + tick = $17

New bid: $20.10

Posted:

$20.10 would pay

Minimum next bid is this + tick = $21.10

New bid by high bidder:

$24.00

Posted:

$21.00 now pays (basis of law suit!)

Minimum next bid is this + tick = $22.00

week 4

15

With a secret reserve, say $100

First bid: $20

Posted:

$20 and “reserve not met”

Minimum next bid is this + tick = $21

Further bids: treated as usual if secret reserve not met,

with the warning “reserve not met”. (High bidder does not

bid against herself.) If and when secret reserve is met,

highest bidder’s bid is hidden and (formerly secret)

reserve is posted, plus “reserve met”.

week 4

16

The inside of the algorithm

After (open or secret) reserve is met:

H = max { H, acceptable bid by new bidder }

… tie keeps the same high bidder

L = min { H, acceptable bid by new bidder }

posted price = min {L + tick, H }

week 4

17

Early bidding vs. Sniping

• But early bidding

affects behavior

WAR

week 4

18

Dangers of early bidding, con’t

As bait

week 4

20

Dangers of early bidding, con’t

Curiosity

week 4

22

A (likely) shill

Reserve = $95 ______

• Bidder 3 bids

$94 when the

reserve is

$95 and the

high bid is

below that.

She has

feedback of

1. A likely

shill.

week 4

24

First-price equil. derivation in value space

A slicker way to do business, the way the

pros do it: If the assumed monotonically

increasing bidding function is b(v) , then bid

as if your value is z. The equil. condition is

then

E[surplus ] / z z v 0

where now

E[surplus] [v b( z )]F ( z )

week 4

n1

26

The rest is now much easier

Differentiating wrt z :

(n 1)[v b]F

n 2

n1

f b F 0

Leads to the same differential equation.

v

F

b v

0

F

week 4

n1

dy

n1

27