Accounting Cycle Worksheet Directions: Below are the steps to the

advertisement

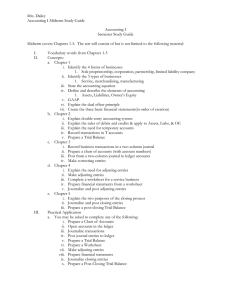

Accounting Cycle Worksheet Directions: Below are the steps to the accounting cycle. Each question is intended to guide as notes. ANSWER EACH QUESTION FULLY AND IN COMPLETE SENTENCES. Step 1 “Source Documents are checked for accuracy, and transactions are analyzed into debit and credit parts.” Chapter 1 1. What is the accounting equation? 2. What are the 5 classifications of accounts? Chapter 3 3. What are the names and abbreviations of all of source documents? Step 2 “Transactions, from information on source documents, are recorded in a journal.” Chapter 3 4. What is the name of the form used when journalizing daily transactions? 5. Does the GJ organize the information chronologically or by account? 6. What is special/different about journalizing the memorandum transaction that reads “bought supplies on account”? 7. What is special/different about journalizing the cash register tape transaction that reads “received cash from sales”? 8. What does it mean to prove and rule a journal page? How do you prove and rule? What numbers should equal each other? What do you write on the bottom of a page if you are continuing on to another page? What do you write a the top of a page if it is not the first page? 9. When you prove cash, what two numbers should equal each other? What errors should you look for if your cash does not prove (think of your monopoly game errors)? Chapter 5 10. A bank service charge is journalized to what account? 11. A dishonored check is journalized to what account? 12. How do you journalize a reimbursement/replenishment of petty cash? Step 3 “Journal Entries are posted to the general ledger” Chapter 4 Accounting Cycle Worksheet 13. In what order are accounts listed in the Chart of Accounts and GL? 14. There are two forms used in posting; what is the name of the form that you write/transfer the information onto? 15. Where do you GET this information from? 16. Does the GL keep track of the information chronologically or by account? 17. In the General Journal, what columns do you post first? 18. In the General Journal, how/what do you post for the sales credit, cash debit, and cash credit columns? 19. What number do you write in the Post Reference column on the General Journal? 20. What number do you write in the Post reference column on the General Ledger? 21. Explain how to calculate the “balance” in a General Ledger account. Step 4, “A worksheet, including a trial balance, is prepared from the general ledger.” Chapter 6 22. What three things are entered at the top of a worksheet? 23. What accounts are listed on a worksheet? What order do they appear? 24. Where do you get the numbers for each account that will be written on the Worksheet’s trial balance columns? 25. How accounts do you adjust? How do you calculate the adjustments? Where do you get the numbers for the adjustments? How is the adjustment written on the worksheet? 26. What accounts are extended to the Income Statement Columns? How do you calculate the numbers? 27. What accounts are extended to the Balance Sheet Columns? How do you calculate the numbers? 28. What numbers should equal at the bottom of the worksheet? 29. How do you know if you have a net income or a net loss? Step 5 “ Financial Statements are prepared from the worksheet.” Chapter 7 30. 31. 32. 33. 34. 35. What financial information does an income statement tell us? Where do you get the numbers from? How do you calculate the “% of sales” column? How do yo write the date on the Income Statement? How do you write the date on the Balance Sheet? How do you calculate the “capital” amount if there is a net income? How do you calculate the “capital” amount if there is a net loss? 36. What two numbers should equal on a balance sheet? Accounting Cycle Worksheet Step 6 “Adjusting and closing entries are journalized from the worksheet” Chapter 8 37. 38. 39. 40. 41. What do you write on the first line of the GJ when you journalizing the adjusting entries? Where do you get the information for journalizing the adjusting entries? What did you write first in the GJ when you journalize the closing entries? List and explain all 4 of the closing journal entries for fiscal period that has a net income? What closing entry changes if there is a net loss? Write the entry here. Step 7 “adjusting and closting entries are posted to the general ledger.” Chapter 8 42. Where do you post the adjusting entries? 43. After you post, what accounts should have balances and what accounts should have zero balances? Step 8 “A post-closing trial balance of the general ledger is prepared.” Chapter 8 44. 45. 46. 47. What is a PCTB? What accounts are listed on a PCTB? Why? What should be last account shown on the PCTB? What should equal? Create your own acronym or rhyme to remember the steps. Here is an example, notice the first letter of each word represents the first letter in the accounting cycle: Sally’s Jolly Pig Wilber Followed Aunt Clara’s Pony. Source Documents, Journalize, Post Worksheet, Financial Statements, Adjusting entries, closing entries, and Post closing trial balance. Please put your name in the header. Print 2-sided. Hand-in . Accounting Cycle Worksheet