05Sunaina Dhanuka-中文

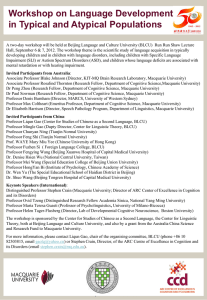

advertisement

棕榈油价格展望 2014 中国国际油脂油料大会 Sunaina Dhanuka Macquarie 资本证券(马来西亚)有限公司 +603 20598993 sunaina.dhanuka@macquarie.com 2014 年 11 月 6 日 本研究并未考虑读者的投资目的、财务状况和具体需求。在根据本研究作出投资决策之前,读者必须自行或在顾问的协助下考虑本建议是否符合其具体的投资需求、目的和 财务状况。具体见免责声明。 上年度食用油市场总结 2013/14 年度,四大食用油品种的库存均有所增加 库存变化 百万 吨 6.0 5.0 4.0 3.0 2.0 1.0 -1.0 -2.0 -3.0 2008/09 2009/10 豆油 2010/11 棕榈油 菜籽油 2011/12 葵花籽油 来源:Macquarie 研究,2014 年 10 月 第2页 2012/13 2013/14 上年度食用油市场总结 印度尼西亚棕榈油库存的增加情况…… 印尼部分毛棕榈油制造商库存的同比增长情况 137% 150% 100% 67% 50% 33% 18% 32% 11% 7% 0% -29% -50% -5% -8% -9% -13% -13% -23% -35% -41% -57% -66% -100% 1Q2013 2Q2013 A 公司(包含中游) 3Q2013 B 公司 ——纯粹生产毛棕榈油 4Q2013 1Q2014 C 公司(包含下游) 来源:公司数据,Macquarie 研究,2014 年 10 月 第3页 2Q2014 上年度食用油市场总结 不仅食用油库存增加,油籽库存也有所恢复,表明 2014/15 年度的食用油压 榨量可能很高 库存使用比 27.9% 30.0% 25.6% 24.5% 25.0% 21.9% 20.8% 20.0% 15.0% 12.8% 11.3% 11.0% 9.1% 10.0% 7.8% 5.0% 0.0% 09/10 10/11 11/12 菜籽 12/13 大豆 来源:美国农业部,Macquarie 研究,2014 年 10 月 第4页 13/14 上年度食用油市场总结 4 方“需求争夺战”大大压缩了价差 植物油价格(鹿特丹) 毛棕榈油价格折扣 美元/吨 美元/吨 1,350 1,250 1,150 1,050 950 850 葵花籽油 菜籽油 豆油 Oct-14 Sep-14 Aug-14 Jul-14 Jun-14 May-14 Apr-14 Mar-14 Feb-14 Jan-14 Dec-13 Nov-13 Oct-13 Sep-13 Aug-13 Jul-13 Jun-13 May-13 Apr-13 Mar-13 Feb-13 650 Jan-13 750 葵花籽油 当前 菜籽油 历史平均 棕榈油 来源:彭博社,Macquarie 研究,2014 年 10 月 来源:彭博社,Macquarie 研究,2014 年 10 月 第5页 豆油 2014/15 年度供应情况…… 菜籽油产量小幅增长,葵花籽油产量停滞不前 菜籽油产量 葵花籽油产量 百万吨 28.0 百万吨 17.0 27.0 26.2 26.0 26.8 23.8 24.0 13.6 14.0 23.7 12.9 13.0 23.0 12.6 12.4 12.0 21.4 22.0 11.0 21.0 20.0 15.3 15.0 25.1 24.4 25.0 16.2 16.0 10.1 10.0 19.6 9.0 19.0 来源:油世界,Macquarie 研究,2014 年 10 月 8.0 来源:油世界, Macquarie 研究,2014 年 10 月 第6页 16.0 2014/15 年度供应情况…… 大豆——我们预计南美洲将继续大面积种植 问题是单产能够达到什么水平;我们认为可能不太理想 大豆-玉米价格比 3.90 3.50 3.10 2.70 2.30 1.90 大豆-玉米价格比 平均 +1 S.D 来源:彭博社,Macquarie 研究,2014 年 10 月 第7页 -1 S.D. Jul-15 Jan-15 Jul-14 Jan-14 Jul-13 Jan-13 Jul-12 Jan-12 Jul-11 Jan-11 Jul-10 Jan-10 Jul-09 Jan-09 Jul-08 Jan-08 Jul-07 Jan-07 Jul-06 Jan-06 Jul-05 Jan-05 1.50 棕榈油供应情况 当前棕榈油市场熊市的种子在 2005-2011 年就已经种下 马来西亚 – 新增种植面积(公顷) 印度尼西亚 – 新增种植面积(百万公顷) 0.70 250,000 0.60 200,000 0.50 0.40 150,000 0.30 100,000 0.20 0.10 50,000 来源:MPOB,Macquarie 研究,2014 年 11 月 来源:BPS,Macquarie 研究,2014 年 11 月 第8页 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 0 2001 2000 - 第9页 Jan-14 Jan-13 Jan-12 Jan-11 Jan-10 Jan-09 Jan-08 Jan-07 Jan-06 吨 / 公顷 Jan-05 Jan-04 Jan-03 Jan-02 Jan-01 Jan-00 2014/15 年度棕榈油供应情况 但是,油棕的生物产量周期即将转负 马来西亚鲜果串单产同比变化情况 0.6 0.4 0.2 0 -0.2 -0.4 -0.6 2014/15 年度需求情况 所有主要消费国在过去两年中也增加了库存 如果他们计划在 2014/15 年度使用新增的库存,那么进口需求不太可能增长, 尽管消费量有所增加 主要消费国的进口需求 11.4 11.3 12.0 10.3 9.7 10.0 8.3 7.5 8.0 6.0 4.0 2.0 0.6 1.2 0.3 0.0 欧盟 13/14 年度净进口量 中国 库存增加(12-14 年度) 印度 14/15 年度净进口量预测 来源:Macquarie 研究,2014 年 10 月 第 10 页 毛棕榈油价格下跌能否拉高需求? 印度由于货币疲软,目前尚未从毛棕榈油价格下跌中显著获益 中国的棕榈油 – 豆油价差非常小 印度毛棕榈油到岸价格 天津棕榈油-豆油价差 卢比/吨 元/吨 60,000 500 50,000 0 -500 40,000 -1,000 30,000 -1,500 20,000 -2,000 10,000 -2,500 -3,000 - 2008 2009 2010 2011 2012 2013 2014 截至 目前 来源:彭博社,Macquarie 研究,2014 年 11 月 当前 -3,500 价格 来源:彭博社,Macquarie 研究,2014 年 11 月 第 11 页 600 500 400 300 200 100 -100 -200 -300 -400 毛棕榈油(-)汽油l 来源:彭博社,Macquarie 研究,2014 年 10 月 第 12 页 Oct-14 Jul-14 Apr-14 Jan-14 Oct-13 Jul-13 Apr-13 Jan-13 Oct-12 Jul-12 Apr-12 Jan-12 Oct-11 Jul-11 Apr-11 Jan-11 Oct-10 Jul-10 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 明年毛棕榈油面临的其它挑战 能源价格下跌导致生物柴油价差缩小 如果不提供补贴或加大执行力度,印度尼西亚短期内很难实现目标 棕榈油-汽油价差 美元/吨 -69 明年毛棕榈油面临的其它挑战 欧盟将从 2015 年开始用温室气体减排配额取代生物燃料配额 棕榈油制生物柴油可能丧失需求 生物燃料标准温室气体排放量 2018 年起 最低 60% 2017 年起 最低 50% 2010/13 年起 最低 35% 温室气体减排 % 菜籽油 加氢菜籽油 菜籽生物柴油 葵花籽生物柴油 废弃物生物柴油 大豆生物柴油 棕榈油生物柴油 甲烷棕榈油生物柴油 小麦乙醇 天然气热电联产小麦乙醇 种植 甜菜乙醇 加工 运输 甘蔗乙醇 化石燃料 2018 年起 最高 33.5g 来 源 : U F O P , R E D 2 0 0 9 /2 8 / E C , 2 0 1 4 年 1 1 月 第 13 页 2017 年起 最高 41.98g 2010/13 年起 最高 54.5g 温室气体排放量 这对棕榈油出口意味着什么 如果价差保持低位运行,毛棕榈油的替代品将失去发展动力 主要市场棕榈油出口量 百万吨 50.0 45.0 40.0 35.0 20.1 20.5 21.6 8.2 7.7 7.4 5.0 5.8 1.2 6.0 6.6 1.4 6.9 5.8 1.3 7.1 5.2 1.5 6.4 - 2011/12 2012/13 2013/14 2014/15E 30.0 16.0 25.0 20.0 15.0 10.0 7.4 欧盟 美国 中国 印度 其它地 区 来源:彭博社,Macquarie 研究,2014 年 11 月 第 14 页 将所有因素综合考虑…… 非棕榈油供应量的恢复将抑制棕榈油需求 食用油需求增长与供应增长 复合年均增长率 20.0% 15.0% 16. 8% 9.6% 9.3% 10.0% 7.0% 6.8% 8.7% 4.1% 7.2% 5.0% 4.1% 2.9% 4.4% 3.2% 3. 6%3.4%3. 0% 3.0% 4.9% 3.9% 2.9% 4. 2% 2.7%2. 7% 0.0% -0.5% -1.7% -5.0% 2001-05 食用油总体需求增长率 2005-10 2010-12 非棕榈油供应增长率 2012-13 棕榈油需求增长率 来源:MPOB,美国农业部,Macquarie 研究,2014 年 11 月 第 15 页 2013-14 2014-15E 棕榈油供应增长率 将所有因素综合考虑…… 去年增加的库存很可能抑制价格大幅上涨 但是,供应增速放缓可能导致库存略微下降 如果棕榈油价格在短期内下降则可能推高需求 库存使用比 35.0% 30.8% 30.0% 26.7% 25.0% 22.4% 20.0% 17.7% 15.4% 15.0% 10.0% 23.8% 12.4% 13.7% 11.3% 25.2% 16.4% 15.4% 17.2% 16.2% 15.1% 14.8% 15.7% 12.4% 11.2% 11.9% 11.2% 11.5% 11.6% 11.8% 10.1% 10.5% 14.4% 14.3% 16.6% 15.8% 5.0% 毛棕榈油库存使用比 食用油总体库存使用比 来源:MPOB,美国农业部,Macquarie 研究,2014 年 11 月 第 16 页 14/15F 13/14 12/13 11/12 10/11 09/10 08/09 07/08 06/07 05/06 04/05 03/04 02/03 01/02 00/01 0.0% 这对毛棕榈油价格意味着什么 短期来看,由于近期豆油/豆粕供应量下 降,毛棕榈油价格可能上扬,以菜籽油为 主力的食用油供应仍然充足。 油棕可能很快将进入生物产量周期的 下行阶段,产量将因此而受限 过去三个月主要国家出口情况 - 同比变化 mt 2.00 1.68 1.50 1.00 0.06 今年的干旱将对明年的产量造成影响 -0.50 出现较弱厄尔尼诺现象的可能性仍然存在 -1.00 棕榈油库存可能在夏季开始下降,毛棕榈 油价格上升 -2.00 油籽价格低位运行可能开始限制供应增 长,但需求量达到一定水平之后最终将 对价格起到支撑作用 -1.44 大豆 菜籽 棕榈油 “如果种地的话,你可能会小赚一 笔——但必须种很大一块地” 我们的观点 2015 年毛棕榈油价格的平均水平可能在 2,300 – 2,400 林吉特之间 2015 年上半年平均价格在 2,200 林吉特左右, 下半年上升至 2,500 林吉特左右 Important disclosures: Recommendation definitions Volatility index definition* Macquarie - Australia/New Zealand This is calculated from the volatility of historic price movements. Outperform – return > 3% in excess of benchmark return Neutral – return within 3% of benchmark return Underperform – return > 3% below benchmark return Benchmark return is determined by long term nominal GDP growth plus 12 month forward market dividend yield Macquarie – Asia/Europe Outperform – expected return >+10% Neutral – expected return from -10% to +10% Underperform – expected <-10% Very high–highest risk – Stock should be expected to move up or down 60-100% in a year – investors should be aware this stock is highly speculative. High – stock should be expected to move up or down at least 40-60% in a year – investors should be aware this stock could be speculative. Medium – stock should be expected to move up or down at least 30-40% in a year. Low–medium – stock should be expected to move up or down at least 25-30% in a year. Macquarie First South - South Africa Outperform – return > 10% in excess of benchmark return Neutral – return within 10% of benchmark return Underperform – return > 10% below benchmark return Low – stock should be expected to move up or down at least 15-25% in a year. Macquarie - Canada Financial definitions All "Adjusted" data items have had the following adjustments made: Added back: goodwill amortisation, provision for catastrophe reserves, IFRS derivatives & hedging, IFRS impairments & IFRS interest expense Excluded: non recurring items, asset revals, property revals, appraisal value uplift, preference dividends & minority interests EPS = adjusted net profit /efpowa* ROA = adjusted ebit / average total assets ROA Banks/Insurance = adjusted net profit /average total assets ROE = adjusted net profit / average shareholders funds Gross cashflow = adjusted net profit + depreciation *equivalent fully paid ordinary weighted average number of shares * Applicable to Australian/NZ stocks only Outperform – return > 5% in excess of benchmark return Neutral – return within 5% of benchmark return Underperform – return > 5% below benchmark return Recommendation – 12 months All Reported numbers for Australian/NZ listed stocks are modelled under IFRS (International Financial Reporting Standards). Note: Quant recommendations may differ from Fundamental Analyst recommendations Macquarie - USA Outperform – return > 5% in excess of benchmark return Neutral – return within 5% of benchmark return Underperform – return > 5% below benchmark return Recommendation proportions – For quarter ending 30 September 2014 Outperform Neutral Underperform AU/NZ Asia RSA USA CA EUR 48.73% 33.76% 17.52% 59.90% 24.97% 15.13% 35.63% 39.08% 25.29% 42.00% 52.67% 5.33% 60.28% 36.17% 3.55% 42.11% 38.42% 19.47% (for US coverage by MCUSA, 6.09% of stocks followed are investment banking clients) (for US coverage by MCUSA, 8.12% of stocks followed are investment banking clients) (for US coverage by MCUSA, 0.51% of stocks followed are investment banking clients) Page 19 Company-Specific Disclosures: Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/disclosures. Analyst Certification: The views expressed in this research accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in this research. The analyst principally responsible for the preparation of this research receives compensation based on overall revenues of Macquarie Group Ltd ABN 94 122 169 279 (AFSL No. 318062) (MGL) and its related entities (the Macquarie Group) and has taken reasonable care to achieve and maintain independence and objectivity in making any recommendations. General Disclaimers: Macquarie Securities (Australia) Ltd; Macquarie Capital (Europe) Ltd; Macquarie Capital Markets Canada Ltd; Macquarie Capital Markets North America Ltd; Macquarie Capital (USA) Inc; Macquarie Capital Securities Ltd and its Taiwan branch; Macquarie Capital Securities (Singapore) Pte Ltd; Macquarie Securities (NZ) Ltd; and Macquarie First South Securities (Pty) Limited; Macquarie Capital Securities (India) Pvt Ltd; Macquarie Capital Securities (Malaysia) Sdn Bhd; Macquarie Securities Korea Limited and Macquarie Securities (Thailand) Ltd are not authorized deposit-taking institutions for the purposes of the Banking Act 1959 (Commonwealth of Australia), and their obligations do not represent deposits or other liabilities of Macquarie Bank Limited ABN 46 008 583 542 (MBL) or MGL. MBL does not guarantee or otherwise provide assurance in respect of the obligations of any of the above mentioned entities. MGL provides a guarantee to the Monetary Authority of Singapore in respect of the obligations and liabilities of Macquarie Capital Securities (Singapore) Pte Ltd for up to SGD 35 million. This research has been prepared for the general use of the wholesale clients of the Macquarie Group and must not be copied, either in whole or in part, or distributed to any other person. If you are not the intended recipient you must not use or disclose the information in this research in any way. If you received it in error, please tell us immediately by return e-mail and delete the document. We do not guarantee the integrity of any e-mails or attached files and are not responsible for any changes made to them by any other person. MGL has established and implemented a conflicts policy at group level (which may be revised and updated from time to time) (the "Conflicts Policy") pursuant to regulatory requirements (including the FCA Rules) which sets out how we must seek to identify and manage all material conflicts of interest. Nothing in this research shall be construed as a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction. In preparing this research, we did not take into account your investment objectives, financial situation or particular needs. Before making an investment decision on the basis of this research, you need to consider, with or without the assistance of an adviser, whether the advice is appropriate in light of your particular investment needs, objectives and financial circumstances. There are risks involved in securities trading. The price of securities can and does fluctuate, and an individual security may even become valueless. International investors are reminded of the additional risks inherent in international investments, such as currency fluctuations and international stock market or economic conditions, which may adversely affect the value of the investment. This research is based on information obtained from sources believed to be reliable but we do not make any representation or warranty that it is accurate, complete or up to date. We accept no obligation to correct or update the information or opinions in it. Opinions expressed are subject to change without notice. No member of the Macquarie Group accepts any liability whatsoever for any direct, indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research. Clients should contact analysts at, and execute transactions through, a Macquarie Group entity in their home jurisdiction unless governing law permits otherwise. Disclaimer: The information contained in this e-mail is confidential and has been furnished to you solely for your use. You may not disclose, reproduce or distribute the information in any way. Macquarie does not guarantee the integrity of this e-mail or attached files. Macquarie Capital (USA) Inc. affiliate research reports and affiliate employees are not subject to the disclosure requirements of FINRA rules. Any persons receiving this report directly from Macquarie Capital (USA) Inc. and wishing to effect a transaction in any security described herein should do so with Macquarie Capital (USA) Inc. In Germany, this research is issued and/or distributed by Macquarie Capital (Europe) Limited, Niederlassung Deutschland, which is authorised and regulated by the UK Financial Conduct Authority and in Germany by BaFin. Macquarie salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions which are contrary to the opinions expressed in this research. Macquarie Research produces a variety of research products including, but not limited to, fundamental analysis, macro-economic analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research, whether as a result of differing time horizons, methodologies, or otherwise. Page 20 Country-Specific Disclaimers: Australia: In Australia, research is issued and distributed by Macquarie Securities (Australia) Ltd (AFSL No. 238947), a participating organisation of the Australian Securities Exchange. New Zealand: In New Zealand, research is issued and distributed by Macquarie Securities (NZ) Ltd, a NZX Firm. Canada: In Canada, research is prepared, approved and distributed by Macquarie Capital Markets Canada Ltd, a participating organisation of the Toronto Stock Exchange, TSX Venture Exchange & Montréal Exchange. Macquarie Capital Markets North America Ltd., which is a registered broker-dealer and member of FINRA, accepts responsibility for the contents of reports issued by Macquarie Capital Markets Canada Ltd in the United States and sent to US persons. Any US person wishing to effect transactions in the securities described in the reports issued by Macquarie Capital Markets Canada Ltd should do so with Macquarie Capital Markets North America Ltd. The Research Distribution Policy of Macquarie Capital Markets Canada Ltd is to allow all clients that are entitled to have equal access to our research. United Kingdom: In the United Kingdom, research is issued and distributed by Macquarie Capital (Europe) Ltd, which is authorised and regulated by the Financial Conduct Authority (No. 193905). Germany: In Germany, research is issued and distributed by Macquarie Capital (Europe) Ltd, Niederlassung Deutschland, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority (No. 193905). France: In France, research is issued and distributed by Macquarie Capital (Europe) Ltd, which is authorised and regulated in the United Kingdom by the Financial Conduct Authority (No. 193905). Hong Kong & Mainland China : In Hong Kong, research is issued and distributed by Macquarie Capital Securities Ltd, which is licensed and regulated by the Securities and Futures Commission. In Mainland China, Macquarie Securities (Australia) Limited Shanghai Representative Office only engages in non-business operational activities excluding issuing and distributing research. Only non-A share research is distributed into Mainland China by Macquarie Capital Securities Ltd. Japan: In Japan, research is Issued and distributed by Macquarie Capital Securities (Japan) Limited, a member of the Tokyo Stock Exchange, Inc., Osaka Securities Exchange Co. Ltd. (Financial Instruments Firm, Kanto Financial Bureau (kin-sho) No. 231, a member of Japan Securities Dealers Association and The Financial Futures Association of Japan and Japan Investment Advisers Association). India: In India, research is issued and distributed by Macquarie Capital Securities (India) Pvt. Ltd. (CIN: U65920MH1995PTC090696), formerly known as Macquarie Capital (India) Pvt. Ltd., 92, Level 9, 2 North Avenue, Maker Maxity, Bandra Kurla Complex, Bandra (East), Mumbai – 400 051, India, which is a SEBI registered stockbroker having membership with National Stock Exchange of India Limited (INB231246738) and BSE Limited (INB011246734). Malaysia: In Malaysia, research is issued and distributed by Macquarie Capital Securities (Malaysia) Sdn. Bhd. (Company registration number: 463469-W) which is a Participating Organisation of Bursa Malaysia Berhad and a holder of Capital Markets Services License issued by the Securities Commission. Taiwan: In Taiwan, research is issued and distributed by Macquarie Capital Securities Ltd, Taiwan Branch, which is licensed and regulated by the Financial Supervisory Commission. No portion of the report may be reproduced or quoted by the press or any other person without authorisation from Macquarie. Nothing in this research shall be construed as a solicitation to buy or sell any security or product. Research Associate(s) in this report who are registered as Clerks only assist in the preparation of research and are not engaged in writing the research. Thailand: In Thailand, research is produced with the contribution of Kasikorn Securities Public Company Limited, issued and distributed by Macquarie Securities (Thailand) Ltd. Macquarie Securities (Thailand) Ltd. is a licensed securities company that is authorized by the Ministry of Finance, regulated by the Securities and Exchange Commission of Thailand and is an exchange member of the Stock Exchange of Thailand. Macquarie Securities (Thailand) Limited and Kasikorn Securities Public Company Limited have entered into an exclusive strategic alliance agreement to broaden and deepen the scope of services provided to each parties respective clients. The strategic alliance does not constitute a joint venture. The Thai Institute of Directors Association has disclosed the Corporate Governance Report of Thai Listed Companies made pursuant to the policy of the Securities and Exchange Commission of Thailand. Macquarie Securities (Thailand) Ltd does not endorse the result of the Corporate Governance Report of Thai Listed Companies but this Report can be accessed at: http://www.thai-iod.com/en/publications.asp?type=4. South Korea: In South Korea, unless otherwise stated, research is prepared, issued and distributed by Macquarie Securities Korea Limited , which is regulated by the Financial Supervisory Services. Information on analysts in MSKL is disclosed at http://dis.kofia.or.kr/websquare/index.jsp?w2xPath=/wq/fundMgr/DISFundMgrAnalystStut.xml&divisionId=MDIS03002001000000&serviceId=SDIS03002001000. South Africa: In South Africa, research is issued and distributed by Macquarie First South Securities (Pty) Limited, a member of the JSE Limited. Singapore: In Singapore, research is issued and distributed by Macquarie Capital Securities (Singapore) Pte Ltd (Company Registration Number: 198702912C), a Capital Markets Services license holder under the Securities and Futures Act to deal in securities and provide custodial services in Singapore. Pursuant to the Financial Advisers (Amendment) Regulations 2005, Macquarie Capital Securities (Singapore) Pte Ltd is exempt from complying with sections 25, 27 and 36 of the Financial Advisers Act. All Singapore-based recipients of research produced by Macquarie Capital (Europe) Limited, Macquarie Capital Markets Canada Ltd, Macquarie First South Securities (Pty) Limited and Macquarie Capital (USA) Inc. represent and warrant that they are institutional investors as defined in the Securities and Futures Act. United States: In the United States, research is issued and distributed by Macquarie Capital (USA) Inc., which is a registered broker-dealer and member of FINRA. Macquarie Capital (USA) Inc, accepts responsibility for the content of each research report prepared by one of its non-US affiliates when the research report is distributed in the United States by Macquarie Capital (USA) Inc. Macquarie Capital (USA) Inc.’s affiliate’s analysts are not registered as research analysts with FINRA, may not be associated persons of Macquarie Capital (USA) Inc., and therefore may not be subject to FINRA rule restrictions on communications with a subject company, public appearances, and trading securities held by a research analyst account. Information regarding futures is provided for reference purposes only and is not a solicitation for purchases or sales of futures. Any persons receiving this report directly from Macquarie Capital (USA) Inc. and wishing to effect a transaction in any security described herein should do so with Macquarie Capital (USA) Inc. Important disclosure information regarding the subject companies covered in this report is available at www.macquarie.com/disclosures, or contact your registered representative at 1-888-MAC-STOCK, or write to the Supervisory Analysts, Research Department, Macquarie Securities, 125 W.55th Street, New York, NY 10019. © Macquarie Group Page 21