The EU Insolvency Regulation and EU Winding Up Directives

advertisement

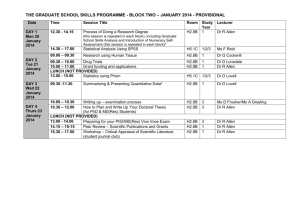

The EU Insolvency Regulation and EU Winding Up Directives and other Collateral Issues 26 September 2002 Ian Annetts Allen & Overy Introduction EU Insolvency Regulation EU Winding Up Directives for Credit Institutions and Insurance Undertakings EU Settlement Finality Directive Proposed Hague Convention Unidroit: Collateral with Intermediaries BK:969523v1 ALLEN & OVERY Introduction to Insolvency Regulation Council Regulation (EC) No 1346/2000 of 29 May 2000 on insolvency proceedings (the “Regulation”) Became effective on 31 May 2002 Directly applicable throughout the EU (with the exception of Denmark) BK:969523v1 ALLEN & OVERY Purpose of Regulation Recognition provisions for both the office-holder and the effects of main proceedings Clear choice of law rules regarding the effects of insolvency proceedings, co-ordination and other related issues, subject to exceptions But NOT an attempt to introduce a single European insolvency law BK:969523v1 ALLEN & OVERY When will the Regulation apply? The “centre of main interests” of the debtor must be in the EU Must be “collective insolvency proceedings” as listed in Annexes A and B of the Regulation Debtor may be natural or legal person, a trader or an individual Does not apply to insurance undertakings or credit institutions - Winding Up Directives BK:969523v1 ALLEN & OVERY Choice of jurisdiction provisions BK:969523v1 Jurisdiction to open three types of insolvency proceedings: main proceedings where debtor has its centre of main interests: recognised across EU secondary proceedings where debtor has an establishment: territorial scope territorial proceedings where debtor has an establishment and before main proceedings are opened ALLEN & OVERY Definitions (1) “Centre of main interests”: not defined but rebuttable presumption that place of registered office - article 3(1) should correspond to the place where the debtor conducts the administration of his interests on a regular basis and is therefore ascertainable by third parties (but can therefore change) - recital (13) BK:969523v1 ALLEN & OVERY Definitions (2) “Establishment”: defined as “any place of operations where the debtor carries out a non-transitory economic activity with human means or goods - article 2(h) equivalent to a branch office or agency? mere presence of assets unlikely to be sufficient BK:969523v1 ALLEN & OVERY Definitions (3) “Main proceedings”: can be opened in the Member State where the debtor has its centre of main interests - article 3(1) universal scope and aim to encompass all the debtor’s assets on an EU-wide basis any of the proceedings listed in Annex A (winding up or reorganisation proceedings) BK:969523v1 ALLEN & OVERY Definitions (4) “Secondary proceedings”: can be opened subsequently in any Member State where the debtor has an establishment article 3(3) opened by either the office-holder in the main proceedings or any other person authorised to open secondary proceedings under local insolvency law limited in scope to assets located in that Member State only winding up proceedings listed in Annex B ALLEN & OVERY BK:969523v1 Definitions (5) “Territorial proceedings”: can be opened before the commencement of main proceedings in any Member State where the debtor has an establishment - article 3(2) can only be opened: BK:969523v1 where main proceedings cannot be opened; or where requested by creditor with domicile, residence or registered office in Member State - article 3(4) ALLEN & OVERY Definitions (6) “Territorial proceedings” (cont): BK:969523v1 not limited to winding up proceedings but can be converted into winding up proceedings if requested by office-holder in main proceedings article 37 ALLEN & OVERY Choice of law provisions article 4(2) BK:969523v1 Law of Member State where proceedings opened generally to determine effect of those proceedings, for example: what assets form part of estate powers of office-holder conditions for set-off effects of proceedings on current contracts lodging and ranking of claims effects of closure of proceedings avoidance of transactions ALLEN & OVERY Recognition provisions Main proceedings to be recognised, and have same effects, in other Member States so long as no secondary proceedings - articles 16 and 17 Foreign officeholder to be recognised in other Member States - article 18 BK:969523v1 ALLEN & OVERY Co-ordination provisions Creditors may lodge claims in either or both of main and secondary proceedings - sharing rules if lodge claims in both Office-holders in main and secondary proceedings duty bound to communicate and cooperate Each office-holder to lodge claims in his proceedings in any other proceedings BK:969523v1 ALLEN & OVERY Impact of the Regulation on Security BK:969523v1 The “rights in rem”exception in Article 5 to the primary choice of law rule in Article 4 Opening of insolvency proceedings shall not affect rights in rem of creditors in respect of debtor’s assets situated within another Member State ALLEN & OVERY Impact of the Regulation on Security (continued) BK:969523v1 A “right in rem” includes: right to dispose and to be repaid from the proceeds of the assets right to the beneficial use of assets This does not preclude actions for voidness, voidability or unenforceability - Article 5(4) ALLEN & OVERY Impact of the Regulation on Security (continued) BK:969523v1 Determining location of right in rem under Article 2(g): tangible property, the Member State where the asset is situated registered property, the Member State where the asset register is kept claims, where the obligor of the claim has its centre of main interests ALLEN & OVERY Impact of the Regulation on Security (continued) Thus, a deposit at the London branch of a German bank would be situated in Germany for the purposes of Article 5 (and otherwise?) Practical impact on financial markets documentation (structure and drafting) BK:969523v1 ALLEN & OVERY Impact of the Regulation on Set-off The “set-off”exception in Article 6 to the primary choice of law rule in Article 4 Opening of insolvency proceedings shall not affect the right of creditors to demand set-off of claims where set-off is permitted by the law applicable to the insolvent debtor’s claims BK:969523v1 ALLEN & OVERY Impact of the Regulation on Set-off (continued) Thus, an insolvent French company’s deposit made with an English bank’s London branch under English law may be set off as a matter of English law, even if set-off is prohibited under French insolvency law This does not preclude actions for voidness, voidability or unenforceability - Article 6(2) Likely impact on financial markets practice and documentation (structure and drafting) ALLEN & OVERY BK:969523v1 Impact of the Regulation on Reservation of Title The “reservation of title”exception in Article 7 to the primary choice of law rule in Article 4 Opening of insolvency proceedings shall not affect the right of a seller to an asset based on reservation of title, and shall not rescind the sale, where the asset is situated in another Member State This does not preclude actions for voidness, voidability or unenforceability - Article 7(3) ALLEN & OVERY BK:969523v1 Avoidance Rules BK:969523v1 Consider avoidance rules and effects of Article 13: general rule is that law of Member State where insolvency proceedings opened will determine the insolvency avoidance rules Article 4(2)(m) BUT may be defence under Article 13 if the governing law of the transaction does not allow any means of challenging the detrimental act in the relevant case ALLEN & OVERY Avoidance rules (continued) Consider an Italian company which may be subject to main insolvency proceedings in Italy Under Italian insolvency law, it may be possible to challenge a transaction document under the Italian avoidance laws If the transaction document is governed by English law, and there is no means of challenging the transaction as a matter of English law, the counterparty will have a defence under Article 13 Care needed over choice of governing law ALLEN & OVERY BK:969523v1 Winding Up Directives Directive 2001/24/EC of 4 April 2001 on the reorganisation and winding up of credit institutions. Implementation by 5 May 2004 Directive 2001/17/EC of 19 March 2001 on the reorganisation and winding up of insurance undertakings. Implementation by 20 April 2003 BK:969523v1 ALLEN & OVERY Credit Institutions WUD Home Member State (which authorises a bank) has sole right to implement reorganisation measures or winding up proceedings under the laws of that Member State, subject to exceptions Those laws will be automatically and immediately effective throughout the Community BK:969523v1 ALLEN & OVERY Credit Institutions WUD (continued) Obligations to inform host Member States with branches and to publicise to third parties Rules corresponding to Articles 5, 6, 7 and 13 of the Insolvency Regulation Enforcement of proprietary rights re registered instruments governed by the law where the register is located BK:969523v1 ALLEN & OVERY Credit Institutions WUD (continued) Netting and repurchase agreements are governed by the chosen law of the relevant agreement Transactions on a regulated market are governed by the law of that market BK:969523v1 ALLEN & OVERY Insurance Undertakings WUD Home Member State (which authorises an insurance undertaking) has sole right to implement reorganisation measures or winding up proceedings under the laws of that Member State, subject to exceptions Those laws will be automatically and immediately effective throughout the Community BK:969523v1 ALLEN & OVERY Insurance Undertakings WUD (continued) Insurance claims must take precedence in any distribution on winding up Obligations to inform host Member States with branches and publicise to third parties Rules corresponding to Articles 5, 6, 7 and 13 of the Insolvency Regulation BK:969523v1 ALLEN & OVERY Insurance Undertakings WUD (continued) BK:969523v1 Transactions on a regulated market are governed by the law of that market ALLEN & OVERY Settlement Finality Directive Directive 98/26/EC of 19 May 1998 on settlement finality in payment and securities settlement systems Implemented by 11 December 1999 Purpose: to achieve finality of settlement within designated systems, even on insolvency of a participant BK:969523v1 ALLEN & OVERY Settlement Finality Directive (continued) Applies to participants (eg credit institutions, investment firms, public authorities) in systems designated by a Member State’s designating authority Rules of the system must be governed by the laws of a Member State BK:969523v1 ALLEN & OVERY Settlement Finality Directive (continued) Disapplies insolvency laws which would avoid, revoke or disrupt netting and settlement of a “transfer order” made through a system or collateral provided in connection with transfer orders Rules of system will be recognised throughout the Community BK:969523v1 ALLEN & OVERY Settlement Finality Directive (continued) Article 9(2): rights in respect of securities recorded in a register, account or centralised deposit system located in a Member State shall be governed by law of that Member State Place of the Relevant Intermediary Approach (PRIMA) BK:969523v1 ALLEN & OVERY Hague Convention Convention on the Law Applicable to Certain Rights in respect of Securities held with an Intermediary Concerned only with conflicts of laws Currently draft of June 2002, to be signed, after diplomatic session, on 14 December 2002 BK:969523v1 ALLEN & OVERY Hague Convention (continued) Requires adoption by at least three States and implementation as necessary Convention will conform private international law treatment of indirectly held securities in line with PRIMA BK:969523v1 ALLEN & OVERY Hague Convention (continued) Article 4 determines where PRIMA is located; likely to be law agreed between parties, either generally or for the purposes of Article 2(1) If no law is agreed, fallback is law where the intermediary is organised BK:969523v1 ALLEN & OVERY Unidroit International Institute for the Unification of Private Law (Unidroit) Project on “Harmonised Substantive Rules for the Use of Securities Held with Intermediaries as Collateral” Scope of project still being determined end 2004? BK:969523v1 ALLEN & OVERY Unidroit (continued) BK:969523v1 Likely to attempt to conform substantive law on creation, perfection and disposition of interests in securities held by intermediaries, including right of intermediary and collateral taker to use securities ALLEN & OVERY The EU Insolvency Regulation and EU Winding Up Directives and other Collateral Issues 26 September 2002 Ian Annetts Allen & Overy