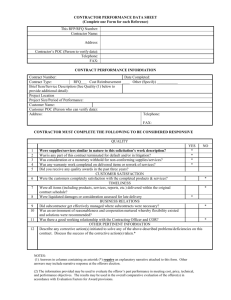

NMERB Name(s) and Titles of Applicable Public Officials

advertisement