INTRODUCTION TO ENGINEERING ECONOMICS Chapter 1

advertisement

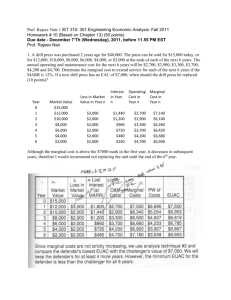

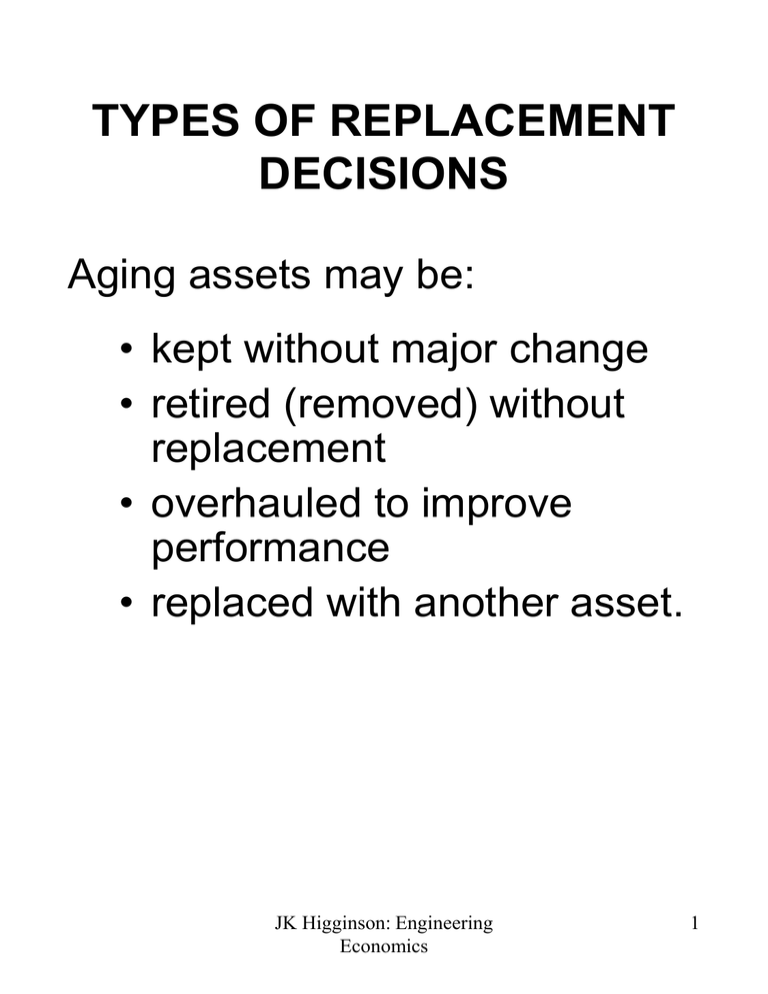

TYPES OF REPLACEMENT DECISIONS Aging assets may be: • kept without major change • retired (removed) without replacement • overhauled to improve performance • replaced with another asset. JK Higginson: Engineering Economics 1 WHY REPLACE ONE ASSET WITH ANOTHER? • If the current asset is inadequate and has to be replaced • If the current asset is adequate, but there is a less expensive or more efficient way to obtain the same service JK Higginson: Engineering Economics 2 RELEVANT COSTS FOR ANALYZING ASSET REPLACEMENT • Capital costs • Installation costs Installation costs occur at the beginning of the life of new assets and are not reversible once the asset has been put in place • Operating and maintenance costs Operating and maintenance costs typically increase as the asset ages. • Disposal costs and salvage costs JK Higginson: Engineering Economics 3 MAKING REPLACEMENT DECISIONS • Once a new asset has been put in place, the incremental cost of keeping it typically is low. This gives the existing asset (called the defender) an advantage over a potential replacement (called the challenger). • To make a replacement decision, all relevant costs must be considered. Typically, this is done through equivalent annual cost (EAC) computations. JK Higginson: Engineering Economics 4 TYPES OF REPLACEMENT DECISIONS Case 1: Challenger is the same as the Defender (the “economic life” problem). Case 2: Challenger is different than the Defender, and succeeding Challengers are the same as the first Challenger. Case 3: Challenger is different than the Defender, and succeeding Challengers are different from the first Challenger. JK Higginson: Engineering Economics 5 CASE 1: CHALLENGER IS THE SAME AS DEFENDER • In the case when technology is not changing quickly and when prices and interest rates are not changing rapidly, an asset often will be replaced with the same type of asset. • Each asset is replaced when its lifetime cost is minimized. At this time, the asset is said to have reached the end of its economic life. • The lifetime will be the same for all replacement assets for the time period over which the asset is needed (assumed to be a long time). This results in cyclic replacement. JK Higginson: Engineering Economics 6 ECONOMIC LIFE OF AN ASSET • Equivalent annual cost (EAC) of capital costs decrease as the asset is kept longer. • EAC of operating and maintenance costs increase as the asset is kept longer. • There will be a lifetime that will minimize: (EAC of capital costs) + (EAC of operating and maintenance costs) • This is the “economic life” of the asset. JK Higginson: Engineering Economics 7 CASES 2 AND 3: CHALLENGER IS DIFFERENT FROM DEFENDER Case 2: All succeeding challengers are the same as the current challenger. Case 3: The challengers after the current challenger will be different (most likely better). JK Higginson: Engineering Economics 8 CASE 2: SEQUENCE OF IDENTICAL CHALLENGERS Step 1: Find EAC at the economic life of the challenger. Step 2: Find the cost of keeping the defender one year. Step 3a: If EAC(defender, one more year) EAC(challenger), keep the defender at least one more year Step 3b: ELSE: IF: there is a “life” for the defender that will give an EAC less than EAC(challenger), keep the defender for that “life” and then replace ELSE: replace the defender immediately JK Higginson: Engineering Economics 9 ASSUMPTIONS MADE IN THE SOLUTION OF EXAMPLE 2 • The challenger will be replaced by a stream of machines with identical technology (that is what allowed us to compute the economic life of the challenger). • The installation cost of the Defender is irrelevant because we cannot change the past; ie., it is a “sunk cost”. • The “first cost” of keeping the Defender is its salvage value now, i.e. the revenue that we would receive if we sold it now. This is the “opportunity cost” of keeping it. JK Higginson: Engineering Economics 10 CASE 3: SEQUENCE OF DIFFERENT CHALLENGERS • Normally, we may expect the future challengers to be better than the current challenger. • Then, do we skip over the current challenger and wait for the next “new and improved” challenger? • Do we wait even longer for the nextgeneration “new and improved” challenger? • We would have to enumerate all possible combinations of decisions and evaluate all decisions to make a choice. JK Higginson: Engineering Economics 11 CASE 3: SEQUENCE OF DIFFERENT CHALLENGERS • The EAC for each project would have to be calculated (quite a bit of work!). • The list would increase geometrically if we expect that each Challenger was different from the preceding one. • Typically, we will have very little information about the costs and benefits of new challengers. • It is often reasonable to assume that all challengers in the future will be approximately the same as the current challenger. • How do we make a replacement decision when we need the asset for a finite period of time (e.g., for a contract of specified length)? JK Higginson: Engineering Economics 12