File - Holtville FFA Innovate, Integrate, Motivate.

advertisement

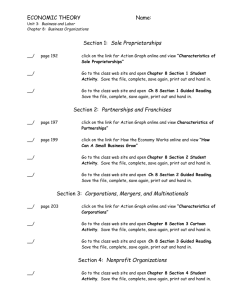

Objectives • Students will be able to : – Investigate the three major forms of business organization: sole proprietorships, partnerships, and corporations. – Offer a recommendation on their business type. – Research and prepare a report on a successful businessperson and the business she or he they founded. Chapter 8 Owning a Business • Have you ever thought about starting your own business? • It is an idea worth considering, for several reasons. – People who start up a business gain the opportunity to work at something that they really love, the power to control their work life, the ability to build something new, and the potential to earn a lot of money. Chapter 8 Three Types of Business Organization • There are many different goods and services that a new business can offer, but there are only a few ways to organize a business. • The vast majority of businesses start out as sole proprietorships or partnerships. • A third option is to set up a corporation. • In the United States, about 70 percent of all businesses are sole proprietorships, 20 percent are corporations and the remaining 10 percent are partnerships. Chapter 8 Three Types of Business Organization • A sole proprietorship is a business that is owned and managed by one individual who receives all the profits and bears all losses. Chapter 8 Advantages of a Sole Proprietorship • Easy and inexpensive to form: Costs are minimal, with legal costs limited to obtaining the necessary license or permits • Complete control. Because you are the sole owner of the business, you have complete control over all decisions. You aren’t required to consult with anyone else when you need to make decisions or want to make changes. • Easy tax preparation. Your business is not taxed separately, so it’s easy to fulfill the tax reporting requirements for a sole proprietorship. The tax rates are also the lowest of the business structures Chapter 8 Disadvantages of a Proprietorship • Unlimited personal liability. Because there is no legal separation between you and your business, you can be held personally liable for the debts and obligations of the business. This risk extends to any liabilities incurred as a result of employee actions. • Hard to raise money. Sole proprietors often face challenges when trying to raise money. Because you can’t sell stock in the business, investors won't often invest. Banks are also hesitant to lend to a sole proprietorship because of a perceived lack of credibility when it comes to repayment if the business fails. • Heavy burden. The flipside of complete control is the burden and pressure it can impose. You alone are ultimately responsible for the successes and failures of your Chapter 8 business. Three Types of Business Organization • A partnership a business that is owned and managed by two or more individuals who receive all profits and bear all losses. Chapter 8 Advantages of a Partnerships • Easy and Inexpensive. Partnerships are generally an inexpensive and easily formed business structure. The majority of time spent starting a partnership often focuses on developing the partnership agreement. • Shared Financial Commitment. In a partnership, each partner is equally invested in the success of the business. Partnerships have the advantage of pooling resources to obtain capital. This could be beneficial in terms of securing credit, or by simply doubling your seed money. • Complementary Skills. A good partnership should reap the benefits of being able to utilize the strengths, resources and expertise of each partner. • Partnership Incentives for Employees. Partnerships have an employment advantage over other entities if they offer employees the opportunity to become a partner. Partnership incentives often attract highly motivated and qualified employees Chapter 8 Disadvantages of a Partnerships • Joint and Individual Liability. Partnerships retain full, shared liability among the owners. Partners are not only liable for their own actions, but also for the business debts and decisions made by other partners. In addition, the personal assets of all partners can be used to satisfy the partnership’s debt. • Disagreements Among Partners. With multiple partners, there are bound to be disagreements. Partners should consult each other on all decisions, make compromises, and resolve disputes as amicably as possible • Shared Profits. Each partner must share the successes and profits of their business with the other partners. Chapter 8 Three Types of Business Organization • A corporation is a business that is owned by stockholders and that has legal rights and responsibilities as if it were a person. Chapter 8 Advantages of a Corporation • Limited Liability. When it comes to taking responsibility for business debts and actions of a corporation, shareholders’ personal assets are protected. Shareholders can generally only be held accountable for their investment in stock of the company. • Ability to Generate Capital. Corporations have an advantage when it comes to raising capital for their business - the ability to raise funds through the sale of stock. • Corporate Tax Treatment. Corporations file taxes separately from their owners. Owners of a corporation only pay taxes on corporate profits paid to them in the form of salaries, bonuses, and dividends, while any additional profits are awarded a corporate tax rate, which is usually lower than a personal income tax rate. • Attractive to Potential Employees. Corporations are generally able to attract and hire high-quality and motivated employees because they offer competitive benefits and the potential for partial ownership through stock options Chapter 8 Disadvantages of a Corporation • Time and Money. Corporations are costly and timeconsuming ventures to start and operate. Incorporating requires start-up, operating and tax costs that most other structures do not require. • Double Taxing. In some cases, corporations are taxed twice - first, when the company makes a profit, and again when dividends are paid to shareholders. • Additional Paperwork. Because corporations are highly regulated by federal, state, and in some cases local agencies, there are increased paperwork and recordkeeping burdens associated with this entity Chapter 8 Business Organizations • An entrepreneur is a person who starts up a new business, taking on risk and hoping to make a profit. Chapter 8 Sweet Activity Opportunity • Imagine you operate a consulting business, giving advice to people who are thinking about starting or expanding their own business. • Read the Sweet Opportunities client stories, then prepare a written recommendation as to which form of business organization you think is best for each. • As you prepare your report, keep in mind that starting a business involves more than just finding something to sell. The entrepreneur may need money needed for buildings, equipment and other start-up expenses. He or she must also know how to manage the business, or find someone else to work as a manager. Chapter 8 Sweet Success • You have probably noticed that all of your clients had opportunities in the “sweets” industry. In fact, all of these are true stories that ultimately led to very successful business ventures for people selling chocolate and chocolate-related products. Their success was sweeter than most! Did you recognize any of these entrepreneurs and their businesses? Chapter 8 Sweetness Project…. • Research and Read about one of the persons and their business on your clients list. Then prepare a power point to report your findings about what happened to the entrepreneur and the business. Be sure to answer the following questions: – What has happened to the founder of the business? – Is he or she still involved with the company? – What other things has he or she done? – Who owns the business? – How has the business changed? – Has the company been involved in any mergers or acquisitions? – What products does the company sell? Chapter 8 Sweetness….. • Client 1: Elise MacMillan and her brother Evan co-founded The Chocolate Farm in Englewood, Colorado, in the late 1990s. • Client 2: Milton Hershey broke ground for his chocolate factory near Lancaster, PA in 1903. It was the beginning of what would become Hershey Foods Corporation . • Client 3: Forest Mars invited Bruce Murrie, an investment banker and son of the Hershey company president, to be his partner in M&M Ltd. The M&Ms we still eat today were first sold to the public in 1941. The letters in "M&M" stand for Mars & Murrie. Eventually, Murrie left the business but Forest Mars became the owner of Mars, Inc. • Client 4: Wally Amos launched the Famous Amos Cookie Company in a Hollywood, CA storefront on Sunset Chapter 8 Boulevard in 1975. Bitter Sweet • Starting any business is risky. According to one report, two out of three new businesses fail within their first four years. You can reduce the risk – and increase your chance of sweet success—by choosing the form of business ownership that best suits your new business and personal interests. • Things to consider when starting a business: – The resources needed to start and expand the business. – Your level of expertise for starting and managing a business. – Your willingness to share decisions and profits. – The level of liability you and any potential partners are willing to accept. – The tax implications of your choices. – Your willingness to re-invest earnings into the business. – How long you see yourself and any partners involved in the venture. – Whether this venture is something you want to live on after you and Chapter 8any partners are gone.