Chapter 5

advertisement

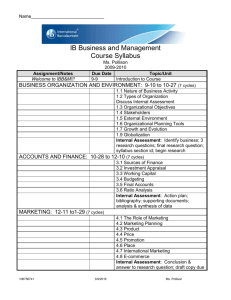

Chapter 5 Property Cycles Property Development (6th Edition) Publisher: Routledge www.routledge.com Authors: Professor R.G. Reed and Dr S. Sims 5.1 INTRODUCTION • There are no disagreements that property cycles exist, however they receive relatively little attention in the property profession. • A developer who understands the nature of the property cycle is able to plan a project ensuring (as much as is possible) that it is completed and released into the market at the best possible time, further reducing the risk and maximising the return on the development. • A smart developer will also carry out his own research to establish the impacts of the cycle on their business and adjust their development strategy accordingly. • Understanding property cycles will assist a developer to minimise their exposure to risk and maximise the likelihood of success. 5.2 THE EXISTENCE OF PROPERTY CYCLES • At a starting point, property cycles can be defined as: ‘Processes which repeat themselves in regular fashion’. • Predicting the timing and magnitude of these rises and falls in the marketplace has never been achieved to absolute perfection in any property market throughout the world. • The perfectly symmetrical example of a cycle in Figure 5.1 is unrealistic. Amplitude of Cycle Figure 5.1 Characteristics of a Typical Cycle Phase + Time – Length of each Cycle 5.2 THE EXISTENCE OF PROPERTY CYCLES Property market characteristics which contribute to property cycle behaviour include: • Limited availability of reliable property data • A time lag between the purchaser–seller transaction occurring and the release of this information into the public domain • The unique nature of each parcel of land and also each building • Property and real estate is a large ‘lumpy’ asset • The highest and best use of land is constantly changing • Land is physically only in one location and can’t be moved • Most investment in property is by individuals who infrequently trade. 5.3 TYPES OF PROPERTY CYCLES • Each property developer needs to conduct their own research into each individual market to identify the length and amplitude of the cycles in their prevailing market area (Figure 5.2). A generic property cycle does not exist. (a) Short-Term Cycles • Commonly accredited to Clement Juglar (1819–1905), these short-term cycles refer to a period of between 7 to 11 years and were based on historical financial information. Also known as the fixed investment cycle. (b) Medium-Term Cycles • Brought to prominence by Kuznet, the medium-term cycle is typically over a period of 15 to 25 years. (c) Long-Term Cycles • With a complete cycle stretching over a period of approximately 45 to 60 years, this theory was based on a number of ‘long waves’ where there was a series of oscillations with an initial over-investment in capital. (d) Extremely Long-Term Cycles • This cycle is based on international relations and refers to four generations over a period of 100–120 years (Modelski 1987). Significant events include the timing of global wars and variations in the balance of global power. Figure 5.2 Multiple Cycles in a Single Market Time 5.4 BUSINESS CYCLES AND STRUCTURAL CHANGE • As many property developments and investments are closely linked to the economic and business frameworks, there is usually a relationship between property cycles and business cycles. • This relationship is highlighted in Figure 5.3 where there is a clear relationship between (a) the property market, (b) the over-arching ‘real economy’ and (c) financial markets or the ‘model economy’. • The interaction of the short-run business cycle with property cycles creates great variability in a developer’s plans and the ability to progress schemes at different times. • The developer also needs to be responsive to the more evolutionary changes which occur in occupier preferences as a result of long-term changes in the structure of the economy. Figure 5.3 Property Market, Financial and Economic Framework Real Economy Real Estate Market Economic upturn Money Economy Credit expansion Increased real estate demand Supply shortage Rising rents/lower yields Economic boom Building boom Economic down turn Increased supply Lower demand Credit boom Increasing interest rates Rising rents/lower yields Recession Bottom of real estate market Credit squeeze 5.4 BUSINESS CYCLES AND STRUCTURAL CHANGE (a) The business cycle • Research in the last decade or so has established the nature of the link between the economic, or business, cycle and the property market. Useful references on this complex topic include various papers on building cycles by Richard Barras (for example see Barras 1994). • Three important cycles have been identified, all of which exhibit different periodicity: the business cycle (which drives the occupier market), the credit cycle (which influences bank and institutional funding) and the property development cycle itself. (b) Structural change • Underlying the short-term business cycle are longer-term shifts in occupier requirements which result from structural changes in the economy. • Developers (and investors) who monitor these long-term changes can begin to create new types of product ahead of the rest of the market; equally they can avoid being left with buildings which have a diminishing ‘shelf life’. 5.5 SURVIVING A MARKET DOWNTURN • Since the market constantly fluctuates in cycles, the central question to be asked is not if a market downturn will occur, but when will this downturn actually occur? • The inevitable downturn tests the survival skills of real estate developers with little or no cash inflow whilst somehow managing to keep on top of their existing repayment liabilities. • The lack of cashflow usually forces a property developer to downsize or cease operations with a loss of goodwill. • The cyclical nature of real estate markets can have a positive or negative effect on the operation of a real estate developer. • As observed in Figure 5.4 the optimal scenario for a property developer is when supply equals demand, i.e. avoiding an under-supply or over-supply relationship. • The model in Figure 5.5 highlights that an external structural change (e.g. higher or lower lending interest rate as set by the government) can affect the real estate market and also affect the level of market demand. Figure 5.4 Equilibrium in a Real Estate Market Figure 5.5 External Shift in Demand for Real Estate 5.5 SURVIVING A MARKET DOWNTURN • After there is a downward shift in the demand curve (Figure 5.5), this then creates the over-supply scenario in Figure 5.6 where this is a clear gap between the original Q(0) and the new Q(1). • At the same time there is a decrease in the agreed sale price of each lot, down from the original P(0) to a lower P(1). In order to return towards equilibrium there are only two realistic options, these being either to (a) increase demand or (b) decrease supply. • Since the real estate market is lumpy and not able to quickly reduce supply (i.e. it may take years), the property developer must be able to survive a sustained long-term period of depressed prices until the market recovers to a supply equals (or is less than) demand scenario. • Every successful property developer has a formal plan for surviving a major market downturn and prospering on the other side of the cycle during the upturn. • A successful real estate developer would argue the most important three words are actually ‘timing, timing, timing’. Figure 5.6 Over-supply Scenario due to Lower Demand Chapter 5 Property Cycles Property Development (6th Edition) Publisher: Routledge www.routledge.com Authors: Professor R.G. Reed and Dr S. Sims