Introduction

advertisement

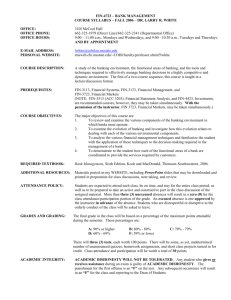

Introduction Course Introduction Syllabus – Course Description – Required Resources – Grading – Tentative Schedule Simulation Stanford Bank Game – Simulated Bank Operation – Management Team Experience Simulation Concentration on: – Mechanics: Capital, Cost of Funds, Maximizing Fee Income – Management: People Issues, Time Management and Delegation, “Stickwith-it-ness” and what to do when “you really don’t know” and that’s ok! Banking Fundamentals SPREAD: Investment Return – Cost of Funds Investment Return mainly from Loans and Securities Cost of Funds mainly from Capital and Borrowed Funds Banking Goals Profitability (Not Size!) – Spread 4% + – ROA 1-1.5% – ROE 12% + Solvency – Capital to Assets 7-8% (No More, No Less) Balance Sheet Production/ Service Firm Financial Services ASSETS ASSETS Cash Small Cash Small Accts. Rec. Medium Investments Medium Inventory Medium Loans LARGE Fixed Assets Large Premises Small Liabs/OE Liabs/OE Accts. Pay. Medium Deposits Large L/T Debt Large Savings Large Owner's Eq Large Other Borr’gs Medium Capital Tiny Income Statement Production/Svc. Financial Services Sales - COGS = Gross Margin - Optg Exp = EBIT - Interest Exp = EBT - Tax = Net Income Total Interest Income - Total Interest Expense = Net Interest Income + Non-Interest Income - Non-Interest Expense - Provision for Loan Losses = Pre-tax Optg Income +/- Securities Gains/Losses - Income Taxes +/- Extraordinary Items = Net Income Assignment for Next Time Go to Class Webpage (Syllabus) Go to Jan 10th entry Click on, print and bring to class Y1Q4Output.pdf