File

FIN 254

Capital Budgeting

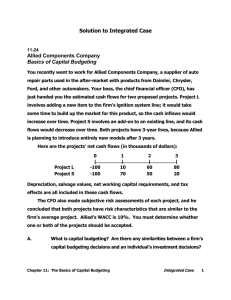

11-1:

PV FV

0

12%

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

-$52,125 12,000 12,000 12,000 12,000 12,000 12,000 12,000

Since the cash flow streams are equal, annuity formula may be applied.

NPV= -52,125+ PVIFAx12,000

8

|

12,000

=-52125+ (4.96764x12000)

NPV = $7,486.68.

Could be calculated by using the formula. Also, the value could be found from the table.

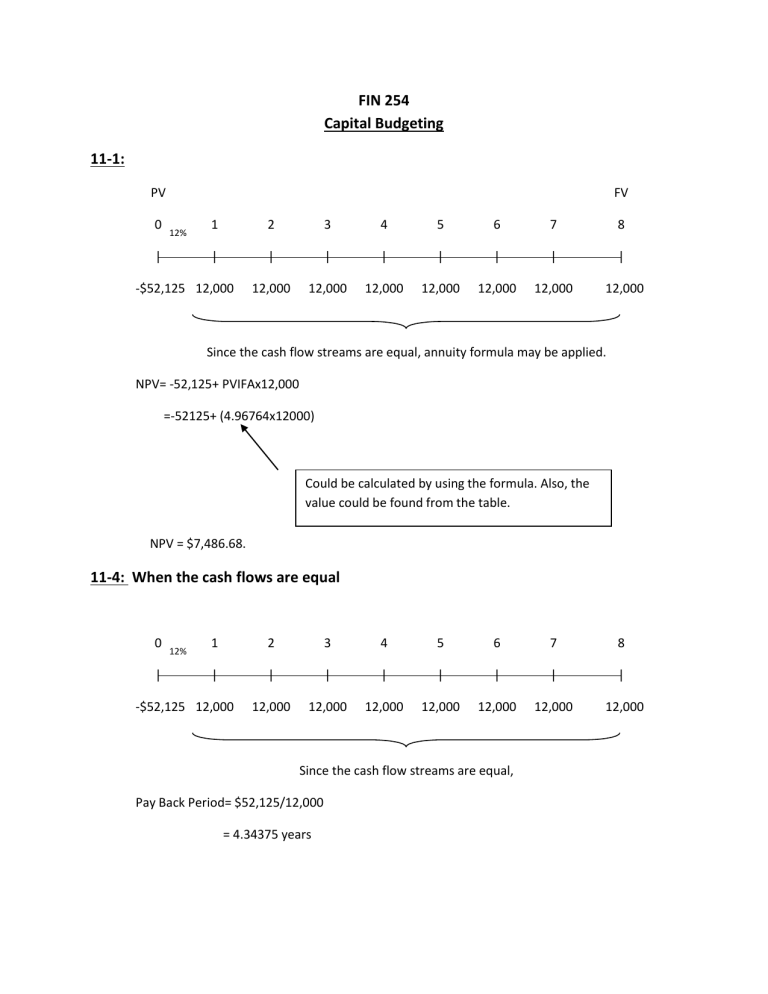

11-4: When the cash flows are equal

0

12%

|

1

|

2

|

3

|

4

|

5

|

6

|

7

|

-$52,125 12,000 12,000 12,000 12,000 12,000 12,000 12,000

Since the cash flow streams are equal,

Pay Back Period= $52,125/12,000

= 4.34375 years

8

|

12,000

11-4: (Alternative way: Used only when the cash flows are unequal)

0

|

12%

1

|

2

|

3

|

4

|

5

|

6

|

7

|

-$52,125 12,000 12,000 12,000 12,000 12,000 12,000 12,000

-52,125 -40,125 -28,125 -16,125 -4,125 7,875

Cumulative cash flow becomes positive from negative after 4 years.

Pay Back Period= 4+ (4,125/12,000)

= 4.34375 years

8

|

12,000

11-5:

Project K’s discounted payback period is calculated as follows:

Annual Discounted @12%

Period Cash Flows Cash Flows

0

1

2

3

($52,125)

12,000

12,000

12,000

($52,125.00)

10,714.29

9,566.33

8,541.36

6

7

4

5

8

12,000

12,000

12,000

12,000

12,000

7,626.22

6,809.12

6,079.57

5,428.19

4,846.60

The discounted payback period is 6 +

$2,788.

11

$5,42 8 .

19

years, or 6.51 years.

Cumulative

($52,125.00)

(41,410.71)

(31,844.38)

(23,303.02)

(15,676.80)

(8,867.68)

(2,788.11)

2,640.08

7,486.68

11-6: (a)

0 1 2 3

5%

| | | |

-$25 5 10 17

5

NPV (Project A) = -25+

1 .

05

10

+

( 1 .

05 )

2

17

+

( 1 .

05 )

3

= 3.52

10

NPV (Project B)= -20+

1 .

05

9

+

( 1 .

05 )

2

6

+

( 1 .

05 )

3

= 2.87

(b)

Calculation of IRR is not required for the exam. You only need to interpret.

If IRR (9%)>WACC (5%),then, accept the project.

If IRR (4%)<WACC (5%),then, reject the project.

For independent projects, accept both the projects, if IRR exceeds WACC.

But for mutually exclusive projects, accept the project with higher IRR. If both the projects have IRR less than WACC, then reject both.

(c) At a WACC = 5%, NPVA > NPVB so choose Project A.

At a WACC = 10%, NPVB > NPVA so choose Project B.

At a WACC = 15%, both NPVs are less than zero, so neither project would be chosen.

11-10 Project A: NPV = $30.16.

Project B: NPV = $22.80.

The decision rule for mutually exclusive projects is to accept the project with the highest positive NPV. In this situation, the firm would accept Project A since NPV

A

= $30.16 compared to

NPV

B

= $22.80.

11-11 Calculation of IRR will not be examined in the final.

Project S: NPV

S

= $448.86.

Project L: NPV

L

= $607.20.

The decision rule for mutually exclusive projects is to accept the project with the highest positive NPV. In this situation, the firm would accept Project L since NPV

L

= $607.20 compared to

NPV

S

= $448.86.

** However when NPV and IRR give conflicting conclusions then it is better to decide based on NPV.

(Print Q: pg-359-361, Huston 12ed book)