DOL Rules & Regs Student/Adjunct Staff Employee Timesheets

advertisement

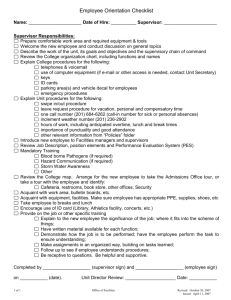

August 2011 1 Thank you for Attending! We will be discussing Adjunct Staff & Student Hourly Employees Employees who must track all of their hours worked and who must be paid overtime for working over 40 hours in a one week period. **All employees must complete a Form I-9 and W-4 upon employment and before the employee can be paid.** Time Sheet completion has to follow NH and Federal Department of Labor Rules & Regulations, as well as the Federal Fair Labor Standards Act. 2 Agenda Important Regulations Recordkeeping Requirements Lunch or Eating Period Required Pay Payment of Wages Payroll Advance Process – The Exception! Sunday Work, Day of Rest Time Sheet Completion What information is important to enter on time cards Common Errors on Time Sheets Q&A 3 NH RSA 279.27 and RSA 275:49 Recordkeeping Requirements Each employee must accurately enter the time they come in, leave and return for a lunch period and clock out at the end of the day. NH: “Record payroll information so that time records, showing the time work began and ended including any bonafide meal periods, shall support individual pay sheets and that payroll sheets, in turn, shall support canceled checks or cash receipts”. It is important to understand that the DOL also states that every employee should know what he/she is going to be paid for at the end of each pay period. This means employers cannot arbitrarily change time sheets when they come in to be entered. NH: “Require that time records with entries that are altered shall be signed or initialed by the employee whose record was altered”. 4 Time Sheet 5 NH RSA 279.27 and RSA 275:49 Recordkeeping Requirements All time sheets must have: the employee signature stating that the time card is an accurate accounting of the time that they have worked. the signature of the supervisor acknowledging that they have reviewed the time sheet and it is an accurate accounting of the time worked. We (you or I) do not have the right to alter the time sheet without employee permission. The employee must initial any changes to the submitted time sheet – even addition errors. 6 NH RSA 275.30-a Lunch or Eating Period NH: “An employer may not require an employee to work more than 5 consecutive hours without granting him/her a ½ hour lunch or eating period, except if it is feasible for the employee to eat during the performance of his/her work, and the employer permits him/her to do so”. Plymouth State University (PSU) does have a “Request to Waive the Lunch or Eating Period” waiver form (designed by DOL) for staff who may, on occasion, choose or need to work through their lunch/eating period. The employee would be paid for their hours worked and simply need to complete and sign a “Waiver” and have the supervisor sign their approval. Sometimes an employee thinks they have to clock out for a lunch period that they don’t take. Make sure that the employee enters all of the hours that they work on their time sheet. 7 Request to Waive the Lunch or Eating Period REQUEST TO WAIVE THE LUNCH OR EATING PERIOD RSA 275:30-a Lunch or Eating Period. – An employer may not require an employee to work more than 5 consecutive hours without granting him a ½ hour lunch or eating period, except if it is feasible for the employee to eat during the performance of his work, and the employer permits him to do so. ____________________________________________ (Employee Name) _________________ (Last 4 digits of SS#) I understand that my employer, Plymouth State University, offers a lunch or eating period as defined in RSA 275:30-a. I am requesting not to take this time as offered. I also understand that at any time I wish to take the lunch or eating time, I will be allowed to do so. ____________________________________________ ____________________________ Employee Signature ________________________________________ Supervisor Signature Date ______________________________ Date 8 NH RSA 275:43-a Required Pay NH: “On any day an employee reports to work at an employer’s request, he shall be paid not less than 2 hours’ pay at his regular rate of pay; provided, however, that this section shall not apply to employers of counties or municipalities, and provided further that no employer who makes a good faith effort to notify an employee not to report to work shall be liable to pay wages under this section. However, if an employee reports to work after the employer’s attempt to notify him has been unsuccessful or if the employer is prevented from making notification for any reason, the employee shall perform whatever duties are assigned by the employer at the time the employee reports to work”. 9 Less Than 2 Hour Acknowledgement I acknowledge and understand that certain shifts in the _______________________ Department are less than two hours in length. I agree to work these particular shifts and understand that my pay will be for the actual amount of time worked. I also understand that this acknowledgement formally notifies me in advance of the less than two (2) hour work opportunity and schedule. ____________________________ Signature ________________ Date ____________________________ Printed Name 10 NH RSA 275:43 Payment of Wages NH: “Every employer shall pay all wages due to employees within 8 days including Sunday after expiration of the pay period in which the work is performed.” A late timesheet is not an excuse for non payment of wages due according to the DOL. The DOL states that the supervisor should know what hours the employee is working and therefore the employee should be paid for those hours. For example: Pay period ending Friday, August 5th, 2011 would require the employee being paid no later than Saturday, August 13, 2011. The employer should set a clear expectation with the employee when time sheets are due for entry. 11 Payroll Advance Process: Payroll advances should be the exception and not the normal way of paying wages. Payroll advances cause a hardship to the employee and are NOT cost effective for the University. Many people are involved when an advance is required, and additional required transactions increase the likelihood of errors and cause confusion to the employee. Payroll advances must be requested by the Supervisor and not the employee. The supervisor should provide a signed time sheet and a detailed reason for the payroll advance request. Any issue an employee brings to Human Resources relating to their pay will be referred back to the supervisor. 12 Payroll Advance Process cont: The employee must bring a photo identification with them to HR when they come to pick up their check and they will have to sign receipt of the check. You must remember to add the Retro hours (Code 156) into the next pay period for any advances that do occur so that the employee receives the correct amount of pay on their next check. Overtime hours are entered by multiplying the number of hours times 1.5 and the total (Straight) hours are entered through Code 157. The system will not calculate the time and half hours for you! A suggestion would be to note, on the time sheet and in Banner (notation is required), that an advance occurred and why. In case of an audit the explanation is readily available. Example: Late time sheet, missing Form I-9, advance requested, with initials of person making the notes on the time sheet or person entering payroll. 13 Time Sheet Completion 14 NH RSA 275:32 Sunday Work and NH RSA 275:33 Day of Rest Sunday Work – An employer cannot require an employee engaged in any occupation to do work on Sunday the usual work of his occupation, unless he is allowed during the 6 days next ensuing 24 consecutive hours without labor Day of Rest: The employee understands that they are entitled to a day of rest within the next six consecutive days In other words; each employee must be allowed a day off of work after working six consecutive days. 15 Time Sheet Completion: On the time sheet, fill-in “Begin Date: _________ for Week 1 and Week 2 Then, the employee must enter the hours, with the times in and out, that they actually work. A total for each day must be entered in the “Daily Total Hours”. The Weekly and Pay Period Totals must also be completed. Errors: The employee must put a line through an entry needing correction, enter the correct information and then initial any and all changes. (No white out or correction tape) 16 Time Sheet Completion The employee must sign and date their time sheet upon completion. The supervisor must then sign and date the time sheet approving and acknowledging the hours worked by the employee. Overtime: OT = The payroll system will automatically pay time and a half if the hours worked are over 40 hours in a one week period. OT is not paid for time worked over 8 hours in one day. Exception is when you pay overtime through a retro entry – you must multiply the hours by 1.5 and enter the total hours under Code 157. 17 Examples of Time Sheet Entry Issues Year Missing Pay Period # Missing Timesheet Org Missing Pay Period End Date Missing Employee Class Missing Week 1 & 2 Begin dates are Missing Week 1 Total Missing Pay Period Total Missing Expense Distribution information is missing Employee did not date when completing time sheet 18 Examples of Time Sheet Entry Issues Supervisor did not sign and date the time sheet Time sheet completed in pencil – must be in ink Employee worked more than five (5) hours without lunch break – Waiver completed? Cross outs on the time sheet – simply put a line through the error, correct and initial it – problem solved. Paid to minute where we adjust to quarter (.25) hours (Example 8:07 and less would be 8:00 and 8:08 and more would be 8:15). This is a good conversation to have with the employee. **Addition errors – this can easily be resolved by going to HR website and downloading the fill-in/electronic version of the timesheet and having the employee complete it and email it to you. 19 Examples of Time Sheet Entry Issues Example 1: Week 1 shows the incorrect way to enter your time – Arrows, ditto marks, missing info on top portion of the time sheet. Week 2 shows correct way to enter your time but is still missing supervisor signature and date. Back of this sheet is the correct version of this time sheet. Example 1-B: On example 1 there were two days where Shirley only worked one hour – is there a 2 Hour Waiver completed for Shirley? 20 Examples of Time Sheet Entry Issues Example 2: Shirley worked more than 5 hours without a break. Is there a Lunch Waiver completed for this employee? Example 3: Year is missing – Employee Class is not checked off - date employee signed is missing. Addition error on Monday in the first week – she worked 3.0 hrs not 2 hrs that day – resulting in all the totals being wrong going across – initials needed at all changes. This is where the fill-in time sheet is so handy. Also worked more than six days without a day of rest – DOL violation. 21 Examples of Time Sheet Entry Issues Example 4: Time crossed out on time sheet; Monday crossed out – didn’t work? – initials please. This does make the addition correct. Time changed on Wednesday of the second week – all those places changes were made need to be initialed. Worked more than six days without a day of rest – DOL violation…. Example 5: Shirley enter odd minutes on her timesheet; Wed 1st wk is okay (3 minutes), Thurs 1st wk needs to be rounded to 1.75 hrs not 1.67, Sat of 2nd wk works out to exactly 6 hrs so okay but Sun 2nd wk should be 5.75 hrs not 6 hrs – 9:10 is beyond 9:08. All changes will need to be initialed. 22 for attending! Is there any area that you wanted to discuss that we haven’t? Any other questions? Feel free to contact us with any future questions. 23