Shareholders' Agreements - present.knowledgevision.com

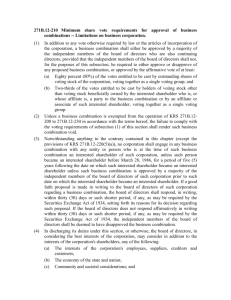

advertisement