chapter 9 - Human Kinetics

advertisement

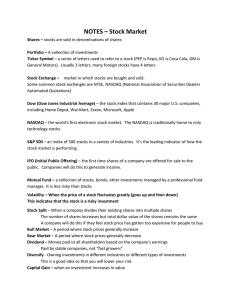

chapter 9 Capital Stocks Lonni Steven Wilson, Medaille College Key Chapter Objectives • Compare the different classes of stock available. • Describe the rights of a stockholder. • Understand how a company decides whether to go public. • Describe how a smaller sport business can issue stock. Key Terms stock certificates—Represent an investor’s ownership right in a business. stockholder—Pays a designated amount to acquire an ownership interest in a company; also referred to as a shareholder. Types of Stock Common stock • Represents an equity ownership in a company • Voting rights • Risks include loss of one’s investment • Obligations could include the prohibition of selfdealing or taking a business opportunity for oneself Preferred stock • Requires dividend payment before common stockholders can receive their dividends • Dividend cumulative if not paid in a given year Preferred Stock Benefits • The right to dividend payments before common stock shareholders receive dividend payments • Preference as to assets in distribution • Voting power for preferred stock, available under limited circumstances • Strong redemption provisions • Subscription privileges to future stock offerings • The right to convert preferred stock to common stock (Bogen, 1966) Shareholder Rights • To receive evidence of ownership such as a stock certificate (see figure 9.1) • To transfer the stock freely, within limited rules • To exercise the right to vote in person or by proxy as set forth in the corporation’s bylaws • To receive dividends and other disbursements on a pro rata basis according to the number of shares held (Bogen, 1966) (continued) Shareholder Rights (continued) • To receive disbursements on a pro rata basis when a partial or complete liquidation of corporate assets occurs • To bring action on behalf of the corporation against board members who do not act in the corporation’s best interest (commonly referred to as stockholders’ derivative actions) (Bogen, 1966) (continued) Shareholder Rights (continued) • To obtain information from the corporation to help safeguard the stockholders’ investment (such as an annual report) • To subscribe pro rata to new shares of company stocks when authorized by law (commonly referred to as stockholders’ preemptive right) (Bogen, 1966) Decision #1: Going Public The first step for any corporation is the decision whether or not to go public A company must consider the following: • Advantages of going public • Disadvantages of going public Advantages of Going Public • Owners are allowed to diversify their investments instead of having all their assets locked into the company. • A liquid asset is created (a privately held company would be harder to sell). • Going public helps raise new cash for growth. • A value for the company is established based on the combined value of outstanding shares. Disadvantages of Going Public • Increased operating costs are associated with all the quarterly and yearly reporting requirements. • The company is required to disclose sensitive data that a competitor can use against the business. • Self-dealing and nepotism are not allowed. • There is a risk that the value of shares will drop if the market for the shares is slow and they are not traded enough, or if the company or its sector falls into disfavor. • Loss of control of the business is possible if investors acquire enough stock. (Brigham & Gapenski, 1994) Advantages of Financing Through Stock • There is no fixed cost associated with issuing stock, whereas a company that issues bonds or commercial paper will have to allocate a fixed amount in the budget for debt service. • Common stocks do not carry any fixed maturity date at which they will need to be paid. • Issuing common stock can help raise new capital without affecting the company’s bond rating. • At times, such as when interest rates are low and the demand for bonds is also low, it is easier to sell common stock. Disadvantages of Financing Through Stock • Issuing bonds or commercial paper provides a predictable fixed cost for repayment in contrast to stocks, which represent a stake in the company’s future profits. • The costs associated with issuing stocks and all ancillary activities can make issuing common stock more expensive than issuing preferred stocks or debt instruments. • Some investors may see issuing new stock as a negative sign that the company needs to sell more of itself in order to survive. (Brigham & Gapenski, 1994) Decision #2: Publicly Traded Stock The second step, after a corporation decides to go public, is to determine whether the stock will be publicly traded. • Going public is the process of making a company’s ownership available to new potential owners and investors. • Going public does not mean that the shares will be available to the general public. Phases of Selling Shares to the Public • Initial public offering (IPO) – private offering: the first time shares are ever sold • The secondary market • The primary market, which exists for companies that have already had an IPO but want to issue more shares to generate additional funds Buyers of New Shares • Existing shareholders on a pro rata basis • Investment bankers, who will then sell the shares to the general public in an IPO • Several major purchasers in a private placement • Employees in an employee stock purchase plan • Buyers in a dividend reinvestment plan Investment Bankers or Houses Their services include the following: • Giving advice on the security type to offer and the exact terms of the issue • Giving assistance in underwriting a security issue • Purchasing a security issue outright • Helping a company comply with state and federal requirements • Distributing new securities to investors • Helping stabilize the price of a new issue by buying shares in the marketplace to support interest in the issue • Providing additional advice after a security is issued (Bogen, 1966) Securities With Little Regulation • Government-issued securities • Short-term notes that mature in less than nine months • Securities offered by nonprofit issuers such as youth sports organizations • Insurance and annuity contracts issued by insurance companies • Securities issued through a corporate reorganization in exchange for prior securities (Cheeseman, 2001) External Factors Affecting Stock Values • Labor disputes and unwillingness of players to cross the picket lines to play • Environmental regulations affecting the arena • A change in workplace safety rules that apply to operating the team • New rules related to employment practices in the workplace such as the classification of food vendors as employees rather than independent contractors • The folding of a rival league or the success of another league Internal Factors Affecting Stock Values • Whether to trade a star player or hire a new coach • Whether to increase the number of preseason games • Whether to borrow money for expansion or issue more stocks • Whether to declare a dividend • Whether to consolidate television and radio broadcasting operations in-house Questions for In-Class Discussion 1. Have you ever purchased stocks yourself or been given stocks? If you purchased them yourself, what factors went into buying those shares? 2. Would you ever buy any sport stocks? Why or why not? Which ones would you purchase? 3. Have you ever lost money on an investment? Explain what happened and what you learned from the process. 4. Do you think it is a good investment to buy the publicly available shares in the Green Bay Packers?