taxes

advertisement

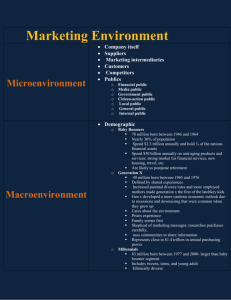

• • • • • • Shallow river crossing Sandler, Ant, Smith To puncture To allow Lasagna loving cat State capital (4 answers) Adam Smith • “An Inquiry into the Nature and Causes of the Wealth of Nations” • aka “The Wealth of Nations” • “Invisible Hand” • Laissez-Faire Demand-side Economics John Maynard Keynes WPA WPA Supply-side Economics • Aka “trickle-down” • Reaganomics 1. Eddie Murphy – Returns $2.30 for every $1 paid. 2. Katherine Heigl – Returns $3.40 for every $1 paid. 3. Reese Witherspoon – Returns $3.90 for every $1 paid. 4. Sandra Bullock – Returns $5 for every $1 paid. 5. Jack Black – Returns $5.20 for every $1 paid. 6. Nicolas Cage – Returns $6 for every $1 paid 7. Adam Sandler – Returns $6.30 for every $1 paid. 8. Denzel Washington – Returns $6.30 for every $1 paid. 9. Ben Stiller – Returns $6.50 for every $1 paid. 10. Sarah Jessica Parker – Returns $7 for every $1 paid. Fiscal Policy • Government use of taxes and spending to influence the economy. • Government revenue and expenditure Budget Terms • Mandatory versus Discretionary • Deficit / Balanced Budget / Surplus • Debt • Expenditure versus Revenue By the Numbers • 2013 Expenditure = 3.45 trillion – 3,450,000,000,000 • 2013 Revenue = 2.77 trillion – 2,770,000,000,000 • 2013 Deficit = 680 billion – 680,000,000,000 • National Debt = 17 trillion DSM Criteria • • (I) Qualitative impairment in social interaction, as manifested by at least two of the following: (A) marked impairments in the use of multiple nonverbal behaviors such as eye-to-eye gaze, facial expression, body posture, and gestures to regulate social interaction (B) failure to develop peer relationships appropriate to developmental level (C) a lack of spontaneous seeking to share enjoyment, interest or achievements with other people, (e.g.. by a lack of showing, bringing, or pointing out objects of interest to other people) (D) lack of social or emotional reciprocity • (II) Restricted repetitive & stereotyped patterns of behavior, interests and activities, as manifested by at least one of the following: • (A) encompassing preoccupation with one or more stereotyped and restricted patterns of interest that is abnormal either in intensity or focus (B) apparently inflexible adherence to specific, nonfunctional routines or rituals (C) stereotyped and repetitive motor mannerisms (e.g. hand or finger flapping or twisting, or complex whole-body movements) (D) persistent preoccupation with parts of objects • (III) The disturbance causes clinically significant impairments in social, occupational, or other important areas of functioning. (IV) There is no clinically significant general delay in language (E.G. single words used by age 2 years, communicative phrases used by age 3 years) (V) There is no clinically significant delay in cognitive development or in the development of age-appropriate self help skills, adaptive behavior (other than in social interaction) and curiosity about the environment in childhood. (VI) Criteria are not met for another specific Pervasive Developmental Disorder or Schizophrenia." Income Tax • PROGRESSIVE Tax – Higher incomes are taxed at a higher rate Payroll Taxes • Employee-taken directly from paycheck • Employer- paid based on wages paid out • Examples: – Social Security (employer match) – Medicare (employer match) – Unemployment tax (employer only) Customs Duties (Tariffs) • • • • Tax on imported goods 0-20% Average 3% (1% with FT) Free-Trade (20 Countries) Australia Bahrain Canada Chile Colombia Costa Rica Dominican Republic El Salvador Guatemala Honduras Israel Jordan Korea Mexico Morocco Nicaragua Oman Panama Peru Singapore Federal Excise Tax • Fuel ($0.184 per gallon) • Tobacco ($1.01 per pack) • Alcohol • Air Travel Estate (Death Tax) • Estates over $5,250,000 • Top % of 40% By the Numbers • 2013 Expenditure = 3.45 trillion – 3,450,000,000,000 • 2013 Revenue = 2.77 trillion – 2,770,000,000,000 • 2013 Deficit = 680 billion – 680,000,000,000 • National Debt = 17 trillion #s to Know • • • • Spending- 3.5 trillion Revenue- 2.3 Trillion Deficit1.2 Trillion Debt16 trillion Biggest to Know • Mandatory Program- Social Security • Discretionary Program- Defense General Fund Excise taxes Cigarettes $1.01 pkg 20 Cigars $0.40 ea. cigar Distilled Alcohol 80 proof $2.14 750 ml Wine 14% Alcohol or Less $0.21 750 ml Wine 14 to 21% $0.31 750 ml Wine 21 to 24% $0.62 750 ml Wine Sparkling $0.67 750 ml Wine Carbonated $0.65 750 ml Hard Cider $0.04 750 ml Beer $0.05 12 oz Pistols and Revolvers 10% price Other Firearms and Ammunition 11% price Tanning Salon 10% price Gas guzzler 21.5-22.5 mpg $1,000.00 vehicle Gas guzzler 12.5-13.5 mpg $6,400.00 vehicle Telephone Calls 3% local Today • • • • Tax Types Tax Reform Ideas State Budget AS and AD problems Tax Types based on percentage of income • Progressive • Flat • Regressive Tax Revision Ideas • Progressive Tax with limits on deductions • Flat Tax with no/few deductions • “Fair Tax” Tax Revision • Obama- “Buffet Rule” – Minimum Federal Rate of 30% on incomes over 1 million/year – Ave. America= 16% – Millionaires = 20.1% State Revenue State Budget • Top Revenue Source- 6% sales tax • Top Expenditure- Education Sides Game Revenue EXCEEDS EXPENDITURE Current Debt • • • • 15 trillion 16 trillion 17 trillion 18 trillion Sum of All Deficits and Surpluses Supply-side • Funny nickname Spending that Requires Annual Congressional Approval Revenue EQUALS Expenditure Mandatory or Discretionary • Largest % of Federal BUdget Largest Mandatory Spending Expenditure EXCEEDS Revenue Largest Discretionary Spending 2013 Deficit 2013 Revenue • • • • 1.45 trillion 2.77 trillion 3.45 trillion 6.2 trillion PL measurement Automatic Spending 2013 Expenditure • • • • 1.45 trillion 2.77 trillion 3.45 trillion 6.2 trillion Aggregate Means Largest Source of Revenue Supply-side Example of Excise Tax # of Countries Free Trade Death Tax (real name) Example of Payroll Tax Adam Smith Book Largest State Expenditure Largest State Revenue Source Demand-side PL stands for Output Measurement Laissez-Faire Keynes supported _____-side Reagan supported _____-side Invisible Hand Adam Smith • What controls the economy? Start the Test! • I will hand out scantrons while you work