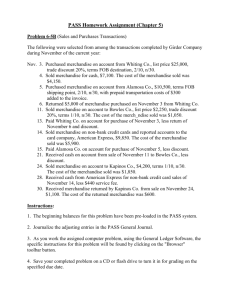

Merchandising - WordPress.com

advertisement

MERCHANDISING BUSINESS -joemargarciacunanan DEFINITION OF TERMS • Merchandise inventories – represent goods intended for sale. Inventories include only items that are held for sale in the normal course of business operations. • Wholesaler – an intermediary that buys products from manufacturers or other wholesalers and sells them to retailers or other wholesalers. • Retailer – buys products from the manufacturers or wholesalers and sells them to consumers or endusers. ACCOUNTING FOR MERCHANDISING BUSINESS • Analyzing business transactions through source documents • Journalizing or recording of transactions in a journal • Posting or transferring of the entries from the journal to the ledger • Preparing the trial balance • Adjusting entries are assembled • Preparing 10-column worksheet • Preparing the Financial Statements based on adjusted balances • Recording/Posting adjusting entries • Recording/Posting closing entries • Preparing a post-closing trial balance • Preparing reversing entries MEASURING PROFIT • Profit to a merchandiser implies that revenue from selling merchandise exceeds both the cost of merchandise sold to customers and the cost of other expenses for the period. • Sales – accounting term for revenues from selling merchandise. • Cost of Goods Sold – accounting term for cost of buying and preparing the merchandising. • Operating Expenses – merchandiser’s expenses COST OF GOODS SOLD • Is the total cost of merchandise sold during the period. • It is often the largest single deduction on a merchandiser’s income statement. • Sales Revenue minus Cost of Goods Sold is called Gross Profit • For example, when a pair of shoes costing P850.00 is sold for P1,000.00, the gross profit is P150.00. OPERATING EXPENSES • Are deducted from gross profit to determine profit or loss. Operating expenses may be distribution costs (selling expenses) or administrative expenses. • Distribution costs – are expenses incurred in the process of earning sales revenue which was not found in a service enterprise like commission paid to salesmen, store supplies, etc. ACCOUNTING FOR SALES SALES • Sales revenue like service revenues, is recorded when earned. • Sales are earned when the goods are transferred from the seller to the buyer. • On December 1, 2012, sold P100,000 worth of merchandise for cash. Cash 100,000 Sales 100,000 ACCOUNTING FOR SALES RETURNS AND ALLOWANCES • When customers return merchandise that have been previously recorded in the sales account, the return is recorded by a debit to the account Sales Returns and Allowances. On December 18, 2012, Mr. B, a customer returned defective merchandise purchased last December 1 with a selling price of 20,000. Sales Return and Allowances 20,000 Cash 20,000 SALES DISCOUNT • The terms of a credit sale may include an offer of a cash discount called sales discount to encourage customers to pay their accounts promptly. • Common examples of cash discount terms are the following: 2/10, n/30 – two percent may be deducted from the amount due if the customer pays within 10 days from the date of sale. The 10-day period during which the customer can avail the discount is known as the discount period. TRADE DISCOUNTS • Trade discounts are used to reduce the list price to actual sales price which may be due to volume of transactions. This is different from cash discounts which are given to induce prompt payment. • List price – usually not the item’s intended selling price, also called a catalog price. Cunanan Co. sold merchandise with a list price of P52,000 and with trade discounts of 20% and 10%. The sales price will be computed as follows: ACCOUNTING FOR PURCHASES PURCHASES • The purchase account is used only for goods purchased for resale. • Purchase is normally recorded by the purchaser when the goods are received from the seller. On December 6, 2012, purchased goods for P170,000. The journal entry is: Purchases 170,000 Cash 170,000 PURCHASE RETURNS AND ALLOWANCES • A sales return and sales allowances on the seller’s books is recorded as a purchase return or allowance . On December 8, 2012, the company returned P10,000 worth of defective goods. The journal entry for this transaction would be: Cash 10,000 Purchase Return & Allowances SHIPPING CHARGES ON MERCHANDISE PURCHASED OR SOLD • When goods are purchased by the buyer, the cost of shipping the merchandise may be shouldered by the buyer or seller depending upon the arrangements. • FOB destination – means that the seller has agreed to pay all the shipping costs and the purchaser receives title at point of destination. • FOB shipping point – means that the buyer has agreed to shoulder all the shipping costs and the purchaser receives title to goods at shipping point. VALUE ADDED TAX ACCOUNTING FOR VAT • Any person who in the course of trade or business, sells, barters, exchanges, leases goods or properties, renders services and any person who imports shall be subject to the value added tax (VAT) 12% • Any person whose sales or receipts are exempt from the payment of value added tax and who is not a VAT-registered person shall pay a tax equivalent to three percent (3%). ACCOUNTING FOR VAT • A 12% output tax is imposed to customers and added to the selling price. On December 1, 2012, sold P100,000 worth of merchandise for cash. Output tax is 12%. Cash 112,000 Sales 100,000 Output Tax 12,000 ACCOUNTING FOR VAT • In purchase transactions, 12% input tax is being paid to our suppliers in addition to the purchase price. On December 6, 2012, purchased goods for P100,800 Input tax is 12% of the purchase price. Purchases 90,000 Input Tax 10,800 Cash 100,800 ACCOUNTING FOR VAT • The enterprise should remit to the BIR the excess of output tax over input tax. In our example: Output tax 12,000 Less: Input Tax 10,800 VAT payable 1,200 VAT payable should be remitted to BIR within 25 days from the end of the month.