Present Value Calculations

advertisement

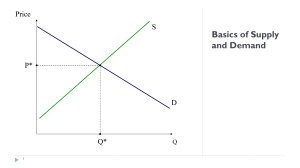

Cost and Time Value of $$ Prof. Eric Suuberg ENGINEERING 90 Cost and Time Value Lecture What is our goal? » To gain an understanding of what is and what is not a good project to undertake from a financial point of view. What are our tools? » Material presented by Prof. Crawford » Discounting / Time Value of Money » Tax Savings through Depreciation So, what are we starting today? Go through some of the “fun” math for Present Value Calculations Do a teaching example of purchasing a machine for a manufacturing plant Talk about costs – both the obvious kind as well as the non-obvious types Time value of money calculations Cost Comparisons Depreciation Put it all together – inc. continuous discounting and after-tax cost comparisons Have I Got a Deal for You Would you be interested in investing in a company that has $1 million in annual sales? What More Would You Like to Know? Annual operating expenses (salaries, raw materials, etc.) Suppose these were $900,000/yr Are you interested? (Come on - I’ve got to know now. There are a lot of people interested) Profit Profit = Sales (revenues) - expenses (costs) Basis for taxation - What goes into the calculation is of great interest to Uncle Sam In Our Example = $1,000,000/yr - $900,000/yr = $100,000/yr Is this a good business? Profit What Would You be Willing to Pay Me for this Business? $1 million? $2 million? How do you decide? This is one of the questions that we will answer in this part of the course. Present Value Calculations Essential element of evaluating a business opportunity Different variants » Simple discounting » Replacement and abandonment » Venture Worth, Present Value, Discounted Cash Flow Rate of Return What information do we need? Investment (Capital assets, working capital) Lifetime and Salvage Values Operating Costs » Fixed » Variable Interest Rate Tax Rate Depreciation Method Revenues Capital Investment Facility Purchased Process Equipment Field Constructed Equipment Wiring, Piping, Instrumentation Construction, Installation Costs Site Preparation, Buildings Storage Areas Utilities Services (Cafeterias, Parking lots, etc.) Contingency Capital InvestmentManufacturing Costs of process equipment may represent only 25% of actual investment! Costs of process equipment scale according to the “six-tenths rule” » C2/C1 = (Q2/Q1)0.6 See, for example: » “Cost and Optimization Engineering” by F.C. Jelen and J.H. Black, McGraw-Hill, 1983. Other Items Working Capital » Raw materials and supplies inventory » Finished goods in stock and Work in Progress » Accounts Receivable, Taxes payable Operating Costs » Labor and Raw Materials » Utilities and Maintenance » Royalties Fixed Costs » Insurance, rent, debt service, some taxes Time Value of Money $1 today is more valuable than the promise of $1 tomorrow » Has nothing to do with inflation “Discounting” is the term used to describe the process of correcting for the reduced value of future payments Discount rate is the return that can be earned on capital invested today Future Worth of an Investment P = Principal i = Annual Interest Rate S = Future value of investment Compound Interest Law S1 = P (1+i) at the end of one year S2 = S1(1+i) = P(1+i)2 at end of year 2 Sn = P (1+i)n at end of year n Present Value of a Future Amount P = Sn / (1 + i)n = Sn (1 + i)-n (1 + i)-n = Present Value Factor or Discount Factor The promise of $1 million at a time 50 years in the future @ i = 15%/yr P = $1,000,000(1+0.15)-50 = $923 Simple Example What is the PV of $10.00 today if I promise to give it to you in fifteen years, given a discount rate of 20%? PV = 10(1.20)-15 = $.65 Not enough to buy a soda these days Take Home Message Not all dollars of profit are the same Those that come earlier are “worth” more Start with Simple Example from Everyday Life Do you buy the better made equipment with the higher price tag? or the low first cost equipment that has high maintenance? Cost Comparisons What are we doing here? Comparing one project to another Deciding to buy the expensive computer that has free maintenance versus the cheap one that makes you pay for service vs. Simple Cost Comparisons Strategy » Reduce costs (and/or revenues) to a common instant, usually the present time » Work on full year periods » approximate costs or revenues which occur over the year as single year-end amounts Basic Rule: All comparisons must be performed on an equal time period basis Unequal Lifetime Cost Comparisons Repeatability Assumption (to get to same time basis) Annuity Comparison Co-termination assumption First Some Useful Mathematical Machinery Uniform periodic annual payments (annuities) Projects frequently generate recurring income or cost streams on an annual basis x 1 x 2 x 3 0 x = annuity x 4 x 5 x 6 x (m-1) x m Discounting a Series of Payments 1 1 1 1 P X X ... j 2 m (1 i) (1 i) (1 i) (1 i) j1 m 1 (1 i) a 2 3 m P X a a a ... a 2 3 4 m 1 Pa X a a a ... a m1 P X(1 a) x(a a ) Discounting a Series of Payments con’t a am1 1 am P X Xa 1 a 1 a 1 m m 1 1 i 1 1 1 i X X m 1 1 i i(1 i) 1 1 i (1 i) 1 (1 i) P X X m i i(1 i) m1 m Capital Recovery Factor i 1 (1 i)m captial recovery factor i X P m 1 (1 i) Future Equivalents of Annuities P S(1 i)m (1 i)m 1 X i(1 i)m (1 i)m 1 SX i i X S m (1 i) 1 Link to summary of useful formulae Examples What future payment N years from now shall I accept in return for an investment of $P now, given I could instead invest my money elsewhere (e.g. a bank) and earn i %/yr? S P(1 i) N What set of annual revenues for N years will entice me to invest $P, given the same alternative as above? i X P N 1 (1 i) Examples What price should I pay for an investment which returns $X/yr for N years, if i %/yr is available to me in a bank? 1 (1 i)N P X i What annual interest rate (bank, etc.) would be required to make an investment returning $S in N years on a present investment of $P? S i 1 P N A Simple Replacement Problem Process to be operated for 4 years and then junked Do you buy a new low-maintenance machine now or not??? DATA (neglect tax effects) Options Purchase Price ($) Operating Cost ($/yr) Lifetime (yrs) Stick w/old 0 2000 4 Buy new 4000 500 4 Cash Flow Time Lines OLD 0 1 $2000 NEW 2 3 4 $2000 $2000 $2000 0 1 2 3 $4000 $500 $500 $500 4 $500 1 (1 i)4 Pold $2000 i Pnew 1 (1 i)4 $4000 500 i The Key Role of Interest Rates 1 (1 i)4 Pold $2000 i Pnew 1 (1 i)4 $4000 500 i If management demands i = 10 %/yr Pold=$6340, Pnew=$5585 new is better choice If management demands i = 20 %/yr Pold=$5180, Pnew=$5295 old is better choice Note In a replacement problem like this you could have added revenues to the analysis, but no need to do so if they are the same for both options. Financial Comparisons with Unequal Lifetimes Simple Example: Choose between 2 pieces of equipment, one of which is better built and has a longer lifetime N is not the same for both 20 year life Well Built Poorly Built 2 year life Not a fair comparison with N=2 unless process is to be shut down and both options have no residual value What to Do? Option 1 - Repeatability Well Built 20 year life Poorly Built 2 year life (Buy 1) (Buy 10) Option 2 - Annualized Costs Convert the investment and maintenance for both options into a single annual payment Purchase Price ($) Alternative 1 Alternative 2 10,000 20,000 Annual Op. Cost ($/yr) 1500 Salvage Value ($) Service Life (yrs) 500 2 i = 0.15 / yr 1000 1000 3 Annualized Cost of Alternative 1 0 500 2 1 10,000 1500 1500 1500 1500 500 P 10,000 $12,060 2 1 .15 (1 .15) Now i X P 2 1 (1 i) i .15 X 12060 12060 $7418 2 2 1 (1 i) 1 (1.15) 50 1 $10,000 0 500 $1500 2 $1500 = 1 $7418 2 $7418 Annualized Cost of Alternative 2 1000 0 1 20,000 1000 2 1000 3 1000 = 0 1 9472 2 9472 In this case, choose alternative 1 because yearly cost is lower. 3 9472