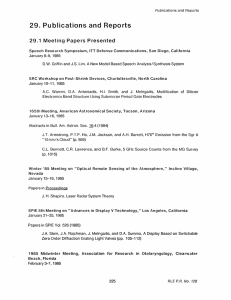

Deretailization: Is “Going Private” Here to Stay?

advertisement

Deretailization: “Going Private” or “Staying Public”? Prof. Alan Palmiter Wake Forest School of Law “Going Private” Conference Brooklyn Law School Feb. 29, 2008 “Going private” phenomenon [Thanks to Prof. Robert Bartlett, U Ga] What is “going private”? DISCLOSURE Public OWNERSHIP Public Private Private Why go private? Attractions twofold: money and freedom. Money • CEO pay can be “outrageously good” • CEOs have freer hand to do tough but necessary things for long term / less focus on quarterly results, placating public Shs Freedom / flexibility • Less annoyance from the Sarbanes-Oxley Act • avoid SEC “excruciating detail” of pay to highest-paid executives at public companies • dodges another nuisance: activist hedge Feb 27, 2006 US markets going private… Going-Private Transactions as a Percent of Public Company Acquisitions 35% Enactment of SOX 30% 25% 20% 15% 10% 5% 0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 % of Public Company Acquisitions (by transaction value) US markets going private… Going-Private Transactions as a Percent of Public Company Acquisitions, 1998-2001 & 2003-2006 (by transaction value) Enactment of SOX 35.0% Going-Private Transactions where Surviving Firm Files SEC Reports 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 Going-Private Transactions where Surviving Firm Does NOT File SEC Reports Source of funds Sources of Funds - U.S. NonFarm, NonFinancial Corporate Businesses 120% 100% 60% Net Equity Issues 40% Debt Instruments 20% Internal Funds 0% -20% -40% Year 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 -60% 1987 % of Total Sources 80% Pendulum? Trading / disclosure • Going (staying) private • “Eclipse of public corporation” Ownership • Institutional investors • “Deretailization” Copyright © 2007, Securities Industry Financial Markets Association Deretailizatio n 100% 75% 50% Institutions Households 25% 0% 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2006 * Households includes nonprofit organizations Source: Federal Reserve Flow of Funds Accounts Deretailizatio n 100% 100% institutional in 2033 75% 50% Institutions Households 25% 0% 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2006 * Households includes nonprofit organizations Source: Federal Reserve Flow of Funds Accounts Requiem for the retail investor? Retail ownership (brokerage accounts / % US population) 120,000,000 40% Accounts 100,000,000 35% Accounts 30% % (population) 80,000,000 25% 60,000,000 20% 15% 40,000,000 10% 20,000,000 5% 0 0% 1980 1985 1990 1995 2000 2005 Sources: SEC Office of Economic Analysis US Census Bureau Retail ownership ($ v alue / % GDP) 12,000 120% Value ($) 100% GDP (%) 8,000 80% 6,000 60% 4,000 40% 2,000 20% 20 05 20 00 19 95 19 90 19 85 19 80 19 75 19 70 19 65 19 60 19 55 0% 19 50 0 19 45 Billions ($) 10,000 Sources: Federal Reserve Flow of Funds Accounts Bureau of Economic Analysis Vanishing public markets? Listed companies (NYSE, AMEX, NASDAQ) 10,000 9,000 8,000 7,000 6,000 20 06 20 04 20 02 20 00 19 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 80 5,000 Sources: Federal Reserve Bulletin, NYSE Listed companies (NYSE, AMEX, NASDAQ) 10,000 9,000 8,000 7,000 6,000 SOX 20 06 20 04 20 02 20 00 19 98 19 96 19 94 19 92 19 90 19 88 19 86 19 84 19 82 19 80 5,000 Sources: Federal Reserve Bulletin, NYSE Public US underwritings 4,000 Debt * Billions ($) 3,000 Equity ** 2,000 1,000 0 1985 1990 1995 2000 2005 * Includes straight corporate, convertible, asset-backed, MBS debt ** Includes preferred stock, common stock Source: Thomson Financial (excludes best-efforts deals) IPOs (not including closed-end funds) 80 Billions ($) 60 40 20 0 1985 1990 1995 2000 2005 Source: Thomson Financial (excludes best-efforts deals) IPOs (not including closed-end funds) 80 Billions ($) 60 40 20 SOX 0 1985 1990 1995 2000 2005 Source: Thomson Financial (excludes best-efforts deals) “Dark matter”? Total US offerings (public vs. private) 100% 80% 60% 40% Private placement 20% Public underwriting 0% 1985 1990 1995 2000 2005 Source: Thomson Financial Total US offerings (public vs. private) 100% 80% Leveraging 60% 40% Private placement 20% Public underwriting 0% 1985 1990 1995 2000 2005 Source: Thomson Financial Institutionalization (and future of private markets) Institutional equity ownership ($ valiue over time / % of total market 6,000 5,000 2006 4,000 P ens ion funds (2 3.1 %) Foreign ins titutions (1 3 .7 %) 3,000 I ns uranc e c os (7 .9 %) Broker/dealers (0 .9 % ) State/loc al govts (0 .5 %) 2,000 Financ ial ins t's (0 .3 %) 1,000 0 19 80 19 82 19 84 19 86 19 88 19 90 19 92 19 94 19 96 19 98 20 00 20 02 20 04 20 06 Billions ($) M utual funds (2 6 .9 %) Source: Federal Reserve Flow of Funds Accounts Reports of my death … The end