Drill 9-D1 Determining accounts affected by

advertisement

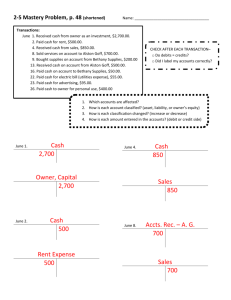

Name: Date: Period: Accounting I State Test Review Standard 2: Students will list and identify characteristics of the three basic accounting equation elements. (Chapter 1) 1. Write the accounting equation. 2. List and define each part of the accounting equation. 3. Classify each item listed below as an asset, liability, or owner’s equity by placing a check mark in the Asset, Liability, or Owner’s Equity column. Account Asset Liability Owner’s Equity Cash Alice Jones, Capital Prepaid Insurance Accounts Payable – Steward Supply Company Supplies Any amount owed Owner’s capital account Anything owned 4. Balance the accounting equation. Assets 19,000 = Liabilities 9,000 6,500 + Owner’s Equity 21,000 51,570 39,750 28,000 22,000 10,000 24,985 17,000 5,000 10,000 10,000 25,000 34,879 18,450 125,540 36,000 5. Explain why the accounting equation must be in balance. 46,000 Standard 3: Students will apply the theory of debit and credit to the accounting equation, define a business transaction, and show how and why accounts are increased and decreased. (Chapter 2) 1. What is a business transaction? 2. For each account listed, assign an account number in the chart of accounts. Account Title Cash in Bank George Smith, Capital Accounts Payable – Allen Systems Accounts Receivable – Abe Dunn Revenue/Sales George Smith, Drawing Advertising Expense Supplies Rent Expense Prepaid Insurance Account Number 3. Decide which accounts in the accounting equation are changed by each of the following transactions. Place a plus (+) in the appropriate column if the account is increased. Place a minus (-) in the appropriate column if the account is decreased. Transactions 1. Received cash from owner as an investment. 2. Received cash from sales. 3. Paid cash for telephone bill. 4. Paid cash for advertising. 5. Paid cash to owner for personal use. 6. Paid cash for rent. 7. Paid cash for equipment repairs. 8. Bought supplies on account from Maxwell Company. 9. Paid cash for insurance. 10. Paid cash on account to Maxwell Company. Assets Trans. No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Cash + Supplies + Prepaid Insurance = Liabilities + Owner’s Equity = Accts. Payable Maxwell Company + Susan Sanders, Capital 4. Determine how each transaction affects the accounting equation; analyze transactions into debit and credit parts. Cash Supplies Prepaid Insurance Accounts Payable—Miller Supplies Jeff Dixon, Capital Jeff Dixon, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense 1. 2. 3. 4. Using the account titles shown above, write the accounts affected in Column 2. For each account title, write the account classification in Column 3. For each account title, place a check mark in either Column 4 or 5 to indicate the normal balance. For each account title, place a check mark in either Column 6 or 7 to indicate if the account is increased (+) or decreased (-) by this transaction. 5. For each account title, place a check mark in either Column 8 or 9 to indicate if the account is changed by a debit or a credit. Transactions 1. Received cash from owner as an investment. 2. Paid cash for supplies. 3. Paid cash for insurance. 4. Bought supplies on account from Miller Supplies. 5. Paid cash on account to Miller supplies. 6. Paid cash for rent. 7. Received cash from sales. 8. Paid cash to owner for personal use. 9. Paid cash for telephone bill (utilities expense). 1 2 3 Trans. No. Accounts Affected Account Classification 1. 2. 3. 4. 5. 6. 7. 8. 9. 4 5 Account’s Normal Balance Debit Credit 6 7 How is Account Affected? + - 8 9 Entered in Account as Debit Credit Standard 4: Students will identify and use source documents for journalizing transactions; students will post journal entries to a ledger. (Chapter 3 & 4) 1. List five different source documents and identify what type of transaction each source document would be used for. 2. What is the purpose of the General Journal? 3. What are the steps in journalizing? (in order) 4. What is the purpose of the General Ledger? 5. What the steps in posting? (in order) 6. Explain the purpose of the posting references? 7. What is recorded in the Post. Ref. column of the General Ledger account? 8. What is recorded in the Post. Ref. column of the General Journal? 9. Analyze each transaction listed below. 1. Write the source document for each transaction in Column 2. 2. Using the following account titles, write the accounts affected by each transaction in Column 3. Cash Accounts Receivable—Darnell Lee Supplies Prepaid Insurance Accounts Payable—Gable Supplies Mary Jacobs, Capital Mary Jacobs, Drawing Sales Advertising Expense Miscellaneous Expense Rent Expense Repair Expense Utilities Expense 3. For each account title, write the account classification in Column 4. 4. For each account title, place a check mark in either Column 5 or 6 to indicate the normal balance. 5. For each account title, place a check mark in either Column 7 or 8 to indicate if the account is increased (+) or decreased (-) by this transaction. 6. For each account title, place a check mark in either Column 9 or 10 to indicate if the account is changed by a debit or a credit. Transactions 1. Paid cash for advertising. 2. Paid cash for repairs. 3. Received cash from owner as an investment. 4. Paid cash for miscellaneous expense. 5. Bought supplies on account from Gable Supplies. 6. Paid cash on account to Gable Supplies. 7. Paid cash for water bill. 8. Paid cash for supplies. 9. Paid cash for rent. 10. Sold services on account to Darnell Lee 11. Received cash from sales. 12. Paid cash for insurance. 1 Trans. No. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 2 Source Document 3 4 Accounts Affected Account Classification 5 6 Account’s Normal Balance Debit Credit 7 8 How Is Account Affected? + - 9 10 Entered in Account as a Debit Credit Standard 5: Students will prepare, analyze and interpret financial statements. (Chapter 6) 1. Determine the General Ledger account balance. 1. Beg. Balance Debit Credit Debit 800 500 2. 3. 650 New Balance Debit Credit 250 575 360 4. 5. Credit 435 150 6. 0 100 775 300 400 690 7. 290 850 40 8. 0 239 100 2. What is the purpose of the trial balance? 3. What are the steps for preparing a Work Sheet? 4. Extending account balances on a work sheet 1. Place a check mark in either Column 1 or 2 to indicate the Trial Balance column in which each account’s balance will appear. 2. Place a check mark in Columns 5, 6, 7, or 8 to indicate the column to which each up-to-date account balance will be extended. Account Title 1. Advertising Expense 2. Accts. Pay.--Bell Supply 3. Cash 4. Miscellaneous Expense 5. Maria Dorn, Capital 6. Maria Dorn, Drawing 7. Prepaid Insurance 8. Rent Expense 9. Repair Expense 10. Sales 11. Supplies 12. Utilities Expense 1 2 Trial Balance Debit Credit 5 6 Income Statement Debit Credit 7 8 Balance Sheet Debit Credit 5. Calculating net income or net loss on a work sheet The column totals from five different work sheets are given on the form below. Complete the following for each company. 1. Calculate the amount of net income or net loss. Write the amount on line 2 in the correct columns. Label the amount as Net Income or Net Loss. 2. Add the amounts in each column. Write the totals on line 3. 3. Verify the accuracy of your proving totals. Debit 1. Column totals Income Statement Credit Balance Sheet Debit Credit $9,000 $9,500 $35,500 $35,000 $1,500 $2,000 $7,500 $7,000 $5,200 $4,800 $26,500 $26,900 $5,300 $8,150 $34,950 $32,100 $5,300 $4,130 $33,400 $34,570 2. 3. Proving totals 1. Column totals 2. 3. Proving totals 1. Column totals 2. 3. Proving totals 1. Column totals 2. 3. Proving totals 1. Column totals 2. 3. Proving totals Standard 5: Students will prepare, analyze and interpret financial statements. (Chapter 7) 1. What document is used to prepare the financial statements? 2. What is the purpose of the Income Statement? 3. What information is reported on the Income Statement? 4. What is the purpose of the Balance Sheet? 5. What information is reported on the Balance Sheet? 6. Preparing an Income Statement and Balance Sheet From the work sheet below, prepare an income statement and balance sheet for The Sound of Stone. Complete the following. 1. Total all columns of the work sheet 2. Calculate and record the amount of net income or net loss. 3. Using the form on the next page, prepare an income statement for the month ended September 30, 20--. 4. Calculate and record the component percentages for total expenses and net income. Round percentages to the nearest 0.1% 5. Prepare the September 30, 20-- balance sheet for The Sound of Stone. Account Title 1. Cash 2. Petty Cash 3. Accts. Rec.—HartCo 4. Accts. Rec.—Starlite Club 5. Supplies 6. Prepaid Insurance 7. Accts. Pay.—First Audio 8. Accts. Pay.—Office Supply Co. 9. Shannon Stone, Capital 10. Shannon Stone, Drawing 11. Income Summary 12. Sales 13. Advertising Expense 14. Insurance Expense 15. Miscellaneous Expense 16. Rent Expense 17. Supplies Expense 18. Utilities Expense 20. Net Income 1 2 Trial Balance Debit Credit 3 4 Adjustments Debit Credit 8,272 200 100 720 4,051 1,200 5 6 Income Statement Debit Credit 7 8 Balance Sheet Debit Credit 8,272 200 100 720 1,487 1,100 2,564 100 1,360 20 10,000 1,360 20 10,000 600 600 4,411 4,411 273 100 10 250 2,564 115 273 100 10 250 2,564 115 Income Statement % of Sales Balance Sheet 7. Determine the ending capital balances. 1. 2. 3. 4. Beginning Capital Investments Revenue Expenses Withdrawals 10,000 0 25,000 45,785 5,000 25,000 10,000 0 20,000 30,000 50,000 66,350 5,000 50,000 10,000 15,900 3,000 5,000 6,000 5,000 Ending Capital Standard 6: Students will prepare adjusting and closing entries and a post-closing trial balance. (Chapter 8) 1. What is the difference between permanent and temporary accounts? 2. Determining accounts affected by adjusting and closing entries 1. For each account title on the chart, place a check mark in either Column 2 or 3 to indicate whether the account is affected by an adjusting entry. 2. For each account title on the chart, place a check mark in either Column 4 or 5 to indicate whether the account is affected by a closing entry. 3. For each account title on the chart, place a check mark in either Column 6 or 7 to indicate whether the account has a balance after closing entries are posted. 1 Account Title 2 3 Account Is Affected by an Adjusting Entry Yes No 4 5 Account Is Affected by a Closing Entry Yes No 6 7 After Closing Entries Are Posted, Account Has a Balance Yes No 1. Advertising Expense 2. Accts. Pay.--Baer Supplies 3. Cash 4. Accts. Pay.--Gates Office Supplies 5. Alisha Downs, Capital 6. Alisha Downs, Drawing 7. Income Summary 8. Insurance Expense 9. Miscellaneous Expense 10. Prepaid Insurance 11. Rent Expense 12. Sales 13. Supplies 14. Supplies Expense 15. Utilities Expense 3. Why is the post-closing trial balance prepared? 4. Why do only the balances of permanent accounts appear on the post-closing trial balance? 5. Journalize adjusting and closing entries using the information from the worksheet on the previous page. General Journal Date Account Title Doc. No. Post. Ref. Debit Credit Standard 7: Students will demonstrate proper cash management. (Chapter 5) 1. Define and show an example of a blank endorsement. 2. Define and show an example of a restrictive endorsement. 3. What are the steps for preparing a bank reconciliation? 4. Using the information below, calculate the adjusted checkbook balance: Balance on last unused check stub is $3,000; outstanding deposits of $400, bank service charge of $25, outstanding checks totaling $450, and a dishonored check for $75. What is the adjusted checkbook balance after the bank reconciliation is prepared? 5. Using the information below, calculate the adjusted bank balance: Bank statement balance is $5,000; outstanding deposits of $150, bank service charge of $30, and outstanding checks totaling $600. What is the adjusted bank balance after the bank reconciliation is prepared? 6. Which accounts are affected when journalizing a bank service charge? Debit: Credit: 7. Which accounts are affected when journalizing a dishonored/NSF check? Debit: 8. What does it mean to “prove cash”? Credit: 9. Why is it important for a company to establish a petty cash fund? 10. What accounts are affected when establishing a petty cash fund? Debit: Credit: 11. What accounts are affected when replenishing a petty cash fund? Debit: Credit: 12. Journalize entries to replenishing a petty cash fund KeepClean replenished petty cash on the dates shown in Column 2 of the following table. The information in Columns 3 to 5 is obtained from the petty cash reports. Record the journal entry for each petty cash replenishment. 1 2 Trans./Doc. No. Replenished on A / C43 B / C54 C / C67 D / C79 3 July 31 August 31 September 30 October 31 Supplies 4 Summary of Petty Cash Slips Advertising 32.00 21.00 40.00 10.00 25.00 20.00 20.00 5 Miscellaneous 5.00 15.00 20.00 General Journal Date Account Title Doc. No. Post. Ref. Debit Credit