Economics211Problems5

advertisement

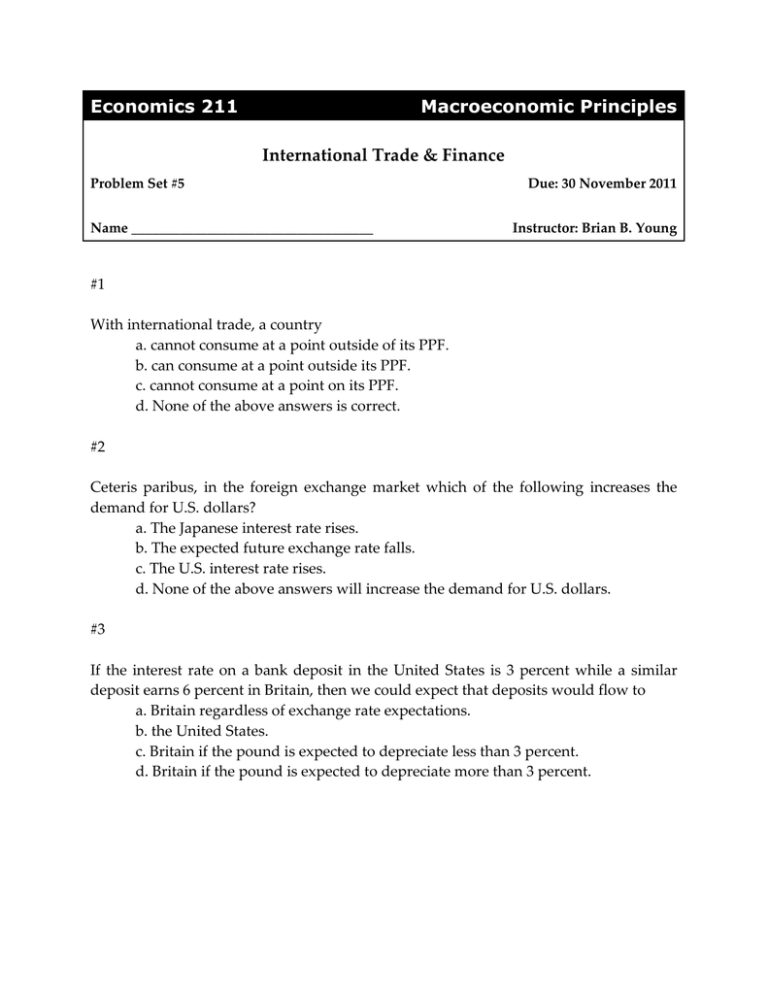

Economics 211 Macroeconomic Principles International Trade & Finance Problem Set #5 Name ___________________________________ Due: 30 November 2011 Instructor: Brian B. Young #1 With international trade, a country a. cannot consume at a point outside of its PPF. b. can consume at a point outside its PPF. c. cannot consume at a point on its PPF. d. None of the above answers is correct. #2 Ceteris paribus, in the foreign exchange market which of the following increases the demand for U.S. dollars? a. The Japanese interest rate rises. b. The expected future exchange rate falls. c. The U.S. interest rate rises. d. None of the above answers will increase the demand for U.S. dollars. #3 If the interest rate on a bank deposit in the United States is 3 percent while a similar deposit earns 6 percent in Britain, then we could expect that deposits would flow to a. Britain regardless of exchange rate expectations. b. the United States. c. Britain if the pound is expected to depreciate less than 3 percent. d. Britain if the pound is expected to depreciate more than 3 percent. #4 “Fluctuations in exchange rates, other things remaining the same, creates a situation in which money buys the same amount of goods and services in different currencies.” What does the previous statement describe? Will these fluctuations occur in the short run or the long run? #5 Visit the web site of the World Trade Organization (www.wto.org) and enumerate the main goals, aims, and functions of the organization. #6 The short-term interest rate in Switzerland is 0% while in Brazil it is 11.5%. In the spot market, one Swiss franc (CHF) buys two Brazilian reals (BRL). Explain how you could employ a naked currency carry trade to exploit this opportunity. What could go wrong? The December 2012 futures contract for CHF is trading at US$1.107; the same contract on BRL is trading at US$0.5194. If you cover your carry trade position with futures, is there still an opportunity to profit? If so, exclusive of leverage, what is your annual rate of return?