Problem Set

advertisement

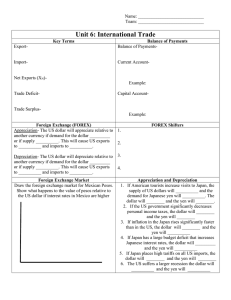

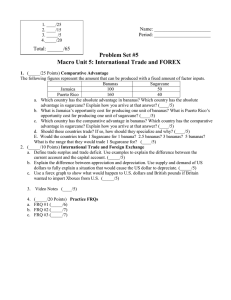

1. ____/60 4. ____/20 2. ____/20 5. ____/15 3. ____/20 6. ____/15 Name: _______________________ Total: ______/150 AP Macroeconomics Problem Set #4 and #5 Money, Banking and Monetary Policy International Trade and FOREX 1. ( ____/60) Money, Banking and Financial Markets Define and give specific examples of each of the following: a. Definition of financial assets: money, stock and bonds ( ____/10) b. Time Value of Money (present and future value). ( ____/5) c. Measures of Money Supply. ( ____/5) d. How banks create money. ( ____/5) e. Money Demand. ( ____/5) f. Money Market – Make sure to include a graph! ( ____/15) g. Loanable Funds Market – Make sure to include a graph! ( ____/15) 2. ( ____/20) Central Bank and Control of the Money Supply Define and give specific examples of each of the following: a. Tools of Central Bank Policy Make sure to provide a complete response here! ( ____/10) b. Quantity Theory of Money ( ____/5) c. Real vs. Nominal Interest Rates ( ____/5) 3. ( ____/20 Points) Monetary vs. Fiscal Policy Complete the attached chart comparing the two 4. (_____/20 Points) Comparative Advantage The following figures represent the amount that can be produced with a fixed amount of factor inputs. Bananas Sugarcane Jamaica 100 50 Puerto Rico 160 40 a. Which country has the absolute advantage in bananas? Which country has the absolute advantage in sugarcane? Explain how you arrive at that answer? (____/5) b. What is Jamaica’s opportunity cost for producing one unit of bananas? What is Puerto Rico’s opportunity cost for producing one unit of sugarcane? (____/5) c. Which country has the comparative advantage in bananas? Which country has the comparative advantage in sugarcane? Explain how you arrive at that answer? (____/5) d. Should these countries trade? If so, how should they specialize and why? (____/5) 5. (_____/15 Points) International Trade and Foreign Exchange a. Define trade surplus and trade deficit. Use examples to explain the difference between the current account and the capital account. (_____/5) b. Explain the difference between appreciation and depreciation. Use supply and demand of US dollars to fully explain a situation that would cause the US dollar to depreciate. (_____/10) 6. (_____/15 Points) International Trade and Foreign Exchange Study Guide Complete the attached study guide International Trade Key Terms Export- Balance of Payments Balance of Payments- Import- Current Account- Net Exports (XN)Example: Trade Deficit- Capital Account- Trade SurplusExample: Foreign Exchange (FOREX) Appreciation- The US dollar will appreciate relative to another currency if demand for the dollar _________ or if supply __________. This will cause US exports to __________ and imports to __________. Depreciation- The US dollar will depreciate relative to another currency if demand for the dollar _________ or if supply __________. This will cause US exports to __________ and imports to __________. FOREX Shifters 1. 2. 3. 4. Foreign Exchange Market Appreciation and Depreciation Draw the foreign exchange market for Mexican Pesos. 1. If American tourists increase visits to Japan, the Show what happens to the value of pesos relative to supply of US dollars will __________ and the the US dollar if interest rates in Mexico are higher demand for Japanese yen will __________. The dollar will ________ and the yen will ________. 2. If the US government significantly decreases personal income taxes, the dollar will ________ and the yen will ________ 3. If inflation in the Japan rises significantly faster than in the US, the dollar will ________ and the yen will __________ 4. If Japan has a large budget deficit that increases Japanese interest rates, the dollar will _________ and the yen will __________ 5. If Japan places high tariffs on all US imports, the dollar will ________ and the yen will ________ 6. The US suffers a larger recession the dollar will __________ and the yen will __________ Fiscal Policy Monetary Policy What is it? Who does it? Political Concerns Specific Tools Expansionary Policies Process= Process= Process= Process= Close Recessionary Gap Concretionary Policies Close Inflationary Gap Fiscal vs. Monetary Policy