Pillar 3 Disclosures - Henderson Global Investors

advertisement

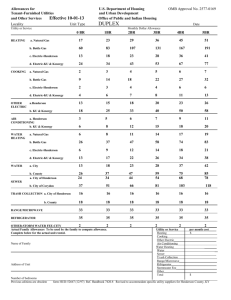

Henderson Group plc Pillar 3, 31 December 2014 PILLAR 3 DISCLOSURES As At 31 December 2014 1| Henderson Group plc Pillar 3, 31 December 2014 1. Introduction Henderson Group plc (the “Group” or “Henderson”) is subject to prudential oversight by the various regulators of the countries in which it operates. Its primary regulator is the Financial Conduct Authority (“FCA”) in the UK. The European Capital Requirements Directive (“CRD” or “the Directive”) introduced a revised capital adequacy framework implementing Basel II in the European Union. Basel III is an international initiative aimed at implementing a more risk sensitive framework for the calculation of regulatory capital. On 1 January 2014, a fourth iteration of the CRD came into effect (“CRDIV”). All disclosures in the document are based upon data and rules existing as at 31 December 2014. The FCA is responsible for the implementation and enforcement of the Directive. The framework consists of three ‘pillars’: Pillar 1 sets minimum capital requirements that firms must meet for credit, market and operational risk. These comprise: base capital resources requirements; credit risk and market risk capital requirements; and the fixed overhead requirement. 1.1 Pillar 2 requires that firms undertake an overall assessment of their capital adequacy, taking into account all risks to which the firm is exposed and whether additional capital should be held to cover risks not adequately covered by Pillar 1 requirements. Pillar 3 complements Pillars 1 and 2 and improves market discipline by requiring firms to disclose information on their capital resources and requirements, risk exposures and their risk management framework. Scope of Application The Pillar 3 disclosures, set out in this document, are made in accordance with the requirements contained within Part Eight of the Capital Requirements Regulation (CRR). Specifically, they cover Henderson’s risk management objectives and policies; the processes for managing material risks; the structure and organisation of the risk management functions within the Group; the scope and nature of risk reporting and measurement systems; and the policies for mitigating risk. Article 432 permits institutions to omit disclosures if the information is not regarded as material. The Group has been granted a waiver from the consolidated supervision capital adequacy requirements. The waiver is effective until April 2016. The capital tables are shown on a solo basis. With regard to the risk management and control framework, this information is disclosed at the Group level as Henderson operates a Group-wide risk management framework. At 31 December 2014 the Group had seven subsidiaries registered with and regulated by the FCA as follows: IFPRU Limited Licence Investment Firms (“LLIFs”): Henderson Global Investors Limited (“HGIL”); Henderson Alternative Investment Advisor Limited (“HAIAL”); Henderson Equity Partners Limited (“HEPL”); Henderson Fund Management Limited (“HFML”); and Gartmore Investment Limited (“GIL”) BIPRU LLIFs: Henderson Investment Management Limited (“HIML”) Regulated firms not subject to CRD: Henderson Investment Funds Limited (“HIFL”) 2| Henderson Group plc Pillar 3, 31 December 2014 The CRD and Pillar 3 disclosures are applicable to the Group’s LLIFs. HIFL is an Alternative Investment Fund Manager (“AIFM”) and is not subject to the directive. In addition, Henderson Management SA (“HMSA”) is a firm regulated in Luxembourg and is not subject to the directive. 1.2 Frequency of Disclosures These disclosures are required to be made at least annually and, if appropriate, some disclosures will be made more frequently. Henderson Group plc has a financial year end reporting date of 31 December and disclosures will be made as at 31 December as soon as is practicable after publication of its Annual Report and Accounts. Disclosures will be made at other dates if appropriate. 1.3 Verification, Media and Location Henderson disclosures explain the basis of preparation of certain capital requirements and provide information about the management of specific risks. They do not constitute, in any form, audited financial statements and have been produced solely for the purposes of Pillar 3. These disclosures are published on the Group’s website (www.henderson.com) within the Corporate Governance section on internal controls. 1.4 Governance Arrangements Details of the Group’s approach to corporate governance is contained within pages 44-87 of the 2014 Annual Report and Accounts. 2. Henderson’s Risk and Control Framework 2.1 Risk Management The Board considers risk assessment and the existence of effective controls to be fundamental to achieving its corporate objectives within an acceptable risk and reward profile. Throughout 2014 and up to the date of this report, there has been in place an ongoing process for identifying, evaluating and managing significant risks within the Group’s control, which accords with the guidance set out in ‘Internal Control: Guidance to Directors’ (formerly known as the Turnbull Guidance). No significant failings or weaknesses were identified during this process. A summary of the Group’s risk policy is on the Group’s website and the key risks and their mitigation are outlined in the Strategic Report section of the Group’s Annual Report and Accounts. The responsibility for managing risk lies with the Group’s Executive Committee (“ExCo”). There are also a number of management committees chaired by, and consisting of, senior managers that have responsibility for specific areas of risk. These provide a forum for managing and resolving significant risk and regulatory issues. Day-to-day responsibility for the management of risk is delegated to line management who work closely with the Risk function to maintain an effective system of controls. The Group’s framework utilises a ‘three lines of defence’ approach to managing risk: the first line is represented by business management managing risk and having in place effective controls; the second line comprises an independent Risk function monitoring the operation of those controls and ensuring risks are not overlooked and by the Compliance team, which monitors regulatory risks. The third line is provided by Internal Audit, which operates and reports independently of management to the Audit Committee and is responsible for assessing the effectiveness of controls and, where necessary, making recommendations for improvements and monitoring management action plans to implement such improvements. Quarterly risk reports are provided to the Board Risk Committee (“BRC”) which include material business risks such as credit, market and operational risks and the Chief Risk Officer (“CRO”) provides regular reports to the BRC on these topics. The Risk function also maintains an incident management process and reports regularly to the ExCo. The Board considers the scope of the activities of the BRC and the reporting framework gives it sufficient information upon which to assess 3| Henderson Group plc Pillar 3, 31 December 2014 the effectiveness of the Group’s system of internal controls and to assess the actual and potential risks facing the Group. 2.2 Oversight of Internal Controls The Board has overall responsibility for the Group’s system of internal controls and for reviewing its effectiveness. The system of internal controls is designed to manage, rather than eliminate, the risk of failure to achieve business objectives and can provide only reasonable, and not absolute, assurance against material misstatement or loss. The effectiveness of the Group’s system of internal controls is reviewed at least annually by the Board in order to safeguard the Group’s assets as well as clients’ and shareholders’ interests. For 2014, this review covered all material controls including financial, operational and compliance controls and risk management systems. As part of its review the Board received assurances from the Chief Executive (“CEO”), the Chief Financial Officer (“CFO”) and others that the statement included on page 87 of the 2014 Annual Report is founded on a sound system of risk management and internal controls and that the system is operating effectively in all material respects in relation to financial reporting risks. In addition the ExCo reported positively to the Board on the effectiveness of the Group’s system of internal controls and the mitigation of any material business risks. The Board has delegated certain responsibilities to the Audit and Board Risk committees. Terms of Reference for these committees are available on the Group’s website. The Group’s system of internal controls requires line managers to confirm regularly that controls in their areas have operated effectively. These controls, and the risks which they are designed to mitigate, are maintained within the Group’s operational risk database, which in turn reflects the risk profiles of each part of the Group’s business. Additional assurance is provided by the Internal Audit function. 2.3 Risk Appetite Statement (RAS) It is both necessary and desirable for the Group to accept, tolerate or be exposed to a level of risk in pursuit of achieving its corporate strategy. However, it is also necessary to ensure that the amount of risk taken is within acceptable boundaries that are commensurate with the financial strength of the Group. Good risk management does not imply avoiding all risks at any cost; rather it implies making informed and coherent choices regarding the risks the Group wants to take in pursuit of its strategy and objectives, having regard to the methods used to manage and mitigate those risks. The RAS has been developed and agreed by the Group Board and it is inextricably linked with the Group strategy, business plans and shareholder and client expectations; it is a fundamental component of the overall Group risk management framework. The RAS will also inform capital management plans, both with regard to capital capacity to absorb unexpected losses and the maintenance of appropriate capital buffers. There are seven main themes regarded as essential to the successful delivery of Henderson’s corporate strategy and goals and the RAS addresses the key risks within each of these themes. The themes are: Client and fund investor focus: Henderson is committed to providing our clients and fund investors with a standard of service that meets or exceeds their expectations. Henderson sets outsourced service providers targets that ensure Henderson is supported in achieving this objective. Group Financial stability: It is essential for Henderson to maintain its financial strength since this is fundamental in supporting its business plans, maintaining the confidence of its stakeholders, providing shareholders with an acceptable return and sustaining the corporate brand. This is achieved by sound management of key financial risks. Group growth and performance: The delivery of sustainable performance over the long term and growth in the AUM and profit are regarded as an essential element of Henderson’s corporate strategy. 4| Henderson Group plc Pillar 3, 31 December 2014 Operational excellence: Henderson people, processes and systems need to work efficiently and effectively together to ensure that clients receive high standards of service. The ability to provide a continuous level of service, and to be able do so when unforeseen events occur, is part of this quest for excellence. People: The employment of talented, committed people is critical to Henderson’s success. Motivating and appropriately rewarding Henderson’s people is a key objective. Regulatory and Legal compliance: Henderson operates in a number of different countries and is therefore under the jurisdiction of several different regulators. Its aim at all times is to operate within the laws and regulatory rules of the countries concerned and to be proactive, cordial and responsive with regulators. Trust: Henderson wants to be seen as a trusted, reliable and highly respected investment manager. This is fundamental to the way the Group seeks to do business. 3. Risk Exposure Overview The material risks to which Henderson is exposed are set out below. 3.1 Operational Risk Operational risk is the risk that the Group will sustain losses through inadequate or failed internal processes, people, systems and external events. In addition, it could also suffer indirect losses through damage to its reputation arising from operational failures. The Group operates a system of controls which is designed to ensure operational risks are mitigated to the required level. The operation and effectiveness of the controls is regularly assessed and confirmed through the work of the Group’s assurance functions: the Risk function, Compliance and Internal Audit. As part of regularly updating the Group’s Internal Capital Adequacy Assessment Process (“ICAAP”), the Risk function facilitates a series of business wide workshops to gather expert opinion on the key operational risks and to provide an assessment of the future frequency and potential impact of each risk. Senior management are selected by the Risk function on the basis of their expertise in their relevant business area, knowledge of business process and controls and the specific risk categories under review. The workshops consider a combination of internal and external historical data to determine the severity and frequency of each key risk on both an average and worst case basis. The workshops also consider the internal control environment around each risk and any mitigating actions that would be brought to bear in the event of the risk occurring. The outputs from the workshops are then statistically modelled to produce a 1 in 200 year capital impact estimate for the Group, which is an estimate of the capital required to cover direct losses to Henderson and any costs of making good to clients as a result of an operational incident. The model aggregates the risks and calculates an operational value at risk (OpVaR) figure for each key risk category. The model uses ‘fat-tailed’ distributions to adequately allow for extreme events and also incorporates a degree of correlation between risks. The model was developed by an external actuarial firm in 2010 and is periodically revalidated to ensure that it remains appropriate and operates as intended. Once quantified, each operational risk capital impact is allocated across the various regulated entities in the Group based upon appropriate drivers for each risk. 3.2 Foreign Currency Risk Foreign currency risk is the risk that the Group will sustain losses through adverse movements in exchange rates, as a result of its exposure to non-GBP income and expenses and assets and 5| Henderson Group plc Pillar 3, 31 December 2014 liabilities of its overseas subsidiaries; as well as certain other assets and liabilities denominated in a currency other than GBP. The Group mitigates this risk through the effect of natural hedges i.e. holding financial assets and liabilities of equal value in the same currency; by limiting the net exposure to an individual currency; and by entering into hedging instruments such as foreign exchange contracts, which are primarily used to hedge seed investments. A Hedge Committee oversees this risk and reports to the Board when a report is sent. 3.3 Credit Risk Credit risk is the risk of a counterparty to the Group either defaulting on Group funds deposited with it or the non-receipt of a trade debt, and, in respect of seed capital investments, the risk that market conditions lead to a decline in the value of those investments. The Group has an established credit risk policy to ensure its counterparties meet strict minimum rating requirements consistent with the Group’s risk appetite, and the Credit Risk Committee (“CRC”) meets regularly to approve, review and set limits for all new and existing counterparties. The CRC monitors exposures to counterparties against the limits it sets and reports quarterly to the BRC on its decisions, counterparty exposures, any credit concerns and actions taken to mitigate credit risks. The CRC includes members from Risk, Compliance, Credit Analysis, Dealing, Legal and Derivative Operations functions and meets monthly. In addition, the Group has many clients that have fees deducted directly from their assets or alternatively are billed regularly with strict payment terms which significantly reduces credit risk on receivables. The Group mitigates the credit risk of the seed capital portfolio by ensuring that it is invested in a range of asset classes and hedging against risk where appropriate. New investments and divestments are considered by the CEO and CFO (executive directors), with full reporting to the ExCo and Board on a monthly basis. The Group adopts the standardised approach to credit risk and uses Fitch ratings. These ratings are used to assess the exposure classes for cash balances held with banks. Other exposures, such as trade debtors and accrued income, are treated as unrated. 3.4 Exposures To Equities Not Included In The Trading Book The Group does not have a trading book. It is exposed to equities through its seed capital investments which comprise holdings in various Henderson funds and those of TIAA Henderson Real Estate, a property investment management joint venture, representing a mix of short and long term investments ranging from investment management pooled funds to private equity closed end funds. Detail of how the Group mitigates the risk of this portfolio is disclosed on page 126 of the 2014 Annual Report and Accounts. 3.5 Exposures To Interest Rate On Positions Not Included In The Trading Book The Group does not have a trading book. It is exposed to interest rate movements on cash balances held on short term deposit with banking institutions in the ordinary course of business. Investments in the form of seed capital are hedged against interest rate risk where the Group’s hedging policy deems it necessary. The Group’s £150m loan notes yield a fixed rate of interest of 7.25% and mature in March 2016. 3.6 Market Risk Market risk is mainly due to foreign currency position risk which arises through adverse movements in currency exchange rates. 6| Henderson Group plc Pillar 3, 31 December 2014 3.7 Liquidity Risk Liquidity risk is the risk that the Group may be unable to meet its payment obligations as they fall due. The Group manages its liquidity on a daily basis within the Finance function, which ensures that the Group has sufficient cash and/or highly liquid assets available to meet its liabilities. The Group ensures that it has access to funds to cover all forecast commitments for at least the following 12 months. Henderson does not bear any liquidity risk associated with its clients’ funds and has no obligation to provide short term liquidity to its clients. 3.8 Key Personnel Risk Key Personnel risk is the risk of losing either a member of the ExCo or one of the Group’s key investment or distribution professionals. This could have an adverse effect on both the growth of the business and/or the retention of existing business. The Group operates competitive remuneration structures designed to recognise and reward performance. It also has succession planning to ensure that there is cover for key roles should they become vacant. In addition, staff surveys identify any issues which could adversely impact staff retention and comprehensive training is offered ensuring skills and knowledge reside in more than one individual. 3.9 Investment Performance Risk Investment Performance risk is the risk that funds fail to achieve performance hurdles or benchmarks. This might cause clients to redeem their investments, which in turn would result in a reduction in revenue earned by the Group. Poor fund performance will also result in lower performance fees. The Group mitigates this risk through a robust investment process which includes detailed research. It also has a clearly articulated investment philosophy and analyses its funds by comparing their performance against appropriate benchmarks. In addition, the Group has a broad range of funds to reduce the probability of all funds underperforming at the same time. An independent Investment Risk function monitors risk and performance against appropriate benchmarks and works closely with fund managers and senior management to review the monitoring reports. 3.10 Regulatory/Legal Risk Regulatory/Legal risk is the risk that a change in laws and regulations will materially affect the Group’s business or markets in which it operates. The Group’s business is subject to many regulations in different jurisdictions and currently the pace of change is significant and may affect the business either directly or indirectly by reducing investors’ appetite for products, increasing capital requirements or in some other way. Regulatory developments are continuously monitored and where there is likely to be an impact, working groups are formed to implement the changes. The Compliance team in particular monitors ongoing regulatory obligations and engages in dialogue with our main regulator. 4. Capital Adequacy 4.1 Capital Resources At 31 December 2014 and throughout the year, all of the LLIFs in the Group complied with their individual capital requirements as set out by the FCA. The table below summarises the total capital for each of the LLIFs as at 31 December 2014. It is based on the disclosure template within Annex IV 7| Henderson Group plc Pillar 3, 31 December 2014 of the ITS regarding the disclosure of own fund requirements contained within Commission Implementing Regulation (EU) No1423/2013. Only those lines that are applicable are disclosed. The sequencing and row numbering are consistent with those shown within Annex IV of EU No 1423/2013. Line * Capital resources HGIL £'000 HAIAL £'000 HEPL £'000 HFM £'000 GIL £'000 HIML £'000 Common equity tier 1 capital: instruments and reserves 1 2 3 6 19 28 29 45 59 60 61 62 63 Capital instruments and the related share premium accounts Retained earnings Accumulated other comprehensive income (and other reserves) Common equity tier 1 capital before regulatory adjustments Common equity tier 1 capital: regulatory adjustments Direct, indirect and synthetic holdings by the institution of the CET1 instruments of financial sector entities where the institution has a significant investment in those entities (amount above 10% threshold and net of eligible short positions) (negative amount) Total regulatory adjustments to Common Equity Tier 1 (CET1) Common Equity Tier 1 (CET1) capital Tier 1 capital (T1 = CET1 + AT1) Total capital (TC = T1 + T2) Total risk weighted assets** 11,750 92,343 1,833 105,926 250 30,474 30,724 22,000 28,125 50,125 900 13,735 14,635 3 9,457 85 9,545 400 8,122 8,522 - - - - (4,943) - 105,926 105,926 105,926 216,952 30,724 30,724 30,724 37,583 50,125 50,125 50,125 54,241 14,635 14,635 14,635 12,118 (4,943) 4,602 4,602 4,602 5,269 8,522 8,522 8,522 18,263 92.4% 92.4% 92.4% 120.8% 120.8% 120.8% 87.3% 87.3% 87.3% 46.7% 46.7% 46.7% Capital ratios and buffers*** Common Equity Tier 1 (as a percentage of total risk exposure amount) 48.8% 81.7% Tier 1 (as a percentage of total risk exposure amount) 48.8% 81.7% Total capital (as a percentage of total risk exposure amount) 48.8% 81.7% * The line reference corresponds to numbering shown within the ITS ** Total risk weighted assets is the higher of the Fixed Overhead Requirement, or, the sum of Market Risk and Credit Risk. *** Capital ratios and buffers are calculated on a Pillar 1 basis. Tier 1 capital comprises of share capital, share premium, profit and loss and other reserves. None of the entities has additional Tier 1 or Tier 2 capital. 4.2 Capital Requirements The Pillar 1 variable capital requirement for each LLIF is calculated as the higher of: the base capital resources requirement; the sum of the credit and market risk capital requirements; and the fixed overhead requirement. A summary of the capital requirements for each entity is shown in the table below: 8| Henderson Group plc Pillar 3, 31 December 2014 Capital requirement (a) Base Capital requirement (b) Credit risk (see separate table) (c) Market risk (d) Sum of (b) and (c) (e) Fixed overhead requirement HGIL £'000 97 14,919 2,437 17,356 15,304 HAIAL £'000 97 1,618 1,388 3,006 1,976 HEPL £'000 97 4,324 15 4,339 558 HFML £'000 97 618 352 970 203 GIL £'000 97 417 5 422 10 HIML £'000 39 578 687 1,265 1,461 Total Exposure amount - higher of (a), (d) and (e). 17,356 3,006 4,339 970 422 1,461 The market risk for firms relates to foreign exchange. The Pillar 1 credit risk capital requirement is calculated in accordance with the standardised approach. The components of the credit risk capital requirement, calculated as 8% of the risk weighted exposure amount, for each entity are shown in the table below. Credit risk Institutions Corporates Other HGIL £'000 1,047 13,506 366 HAIAL £'000 661 957 - Total credit risk and counterparty risk 14,919 1,618 4.3 HEPL £'000 5 4,258 61 HFML £'000 178 230 210 4,324 618 GIL £'000 1 416 - HIML £'000 197 381 - 417 578 Leverage Ratio Disclosure of the leverage ratio is required by Part Eight of CRDIV. It is calculated as Tier 1 capital over the total exposure measure, the sum of the exposure values of all assets and off balance sheet items not deducted from Tier 1. Leverage Ratio 4.4 HGIL £'000 44% HAIAL £'000 60% HEPL £'000 94% HFML £'000 89% GIL £'000 137% HIML £'000 69% ICAAP The Group’s Individual Capital Adequacy Assessment Process (ICAAP) methodology is designed to capture the key risks faced by the business under Pillar 2. Taking the FCA’s IFRPU and BIPRU Rules and Guidance as a starting point, the key risk types defined therein have been assessed for relevance and appropriateness to the Henderson business model. Henderson’s policy is to review its ICAAP methodology at least once a year, and more frequently if necessary. Reports are prepared for ExCo and the Board, giving an assessment of the amounts, types and distribution of capital resources that Henderson considers appropriate for the nature and level of risks to which it is or might be exposed. Section 3.1 above details the approach to operational risk with the use of risk workshops and statistical modelling to generate capital required to be held under this category. Each other risk exposure that would cause potential future capital losses is considered and measured accordingly using a mixture of relevant internal and external data. For those risks that would cause either reputational damage or reduce future revenue, rather than causing an immediate capital loss to the Group, assessment has been made through downside stress and scenario testing of the impact on Group financial forecasts. The ICAAP also considers the Group’s long term capital outlook, along with a downside scenario, a process which is incorporated into the Group’s annual budgeting process and reviewed by ExCo and the Board. In addition, it considers a wind-down analysis which looks at whether the Group would be required to hold additional capital over the period that it would take to wind up the Group. 9| Henderson Group plc Pillar 3, 31 December 2014 5. Remuneration Code These disclosures should be read in conjunction with the Directors’ Remuneration Report on pages 62 to 86 of the 2014 Annual Report and Accounts (available on the Group’s website – www.henderson.com/ IR), which provides more information on the activities of the Remuneration Committee and the Group’s remuneration principles and policies. 5.1 Decision-making process for determining the remuneration policy The Group has an established Remuneration Committee consisting of independent non-executive Directors of Henderson Group plc. The Remuneration Committee met five times during 2014. It is responsible for making recommendations to the Board on the Group’s remuneration plans, policies and practices and for determining, within agreed terms of reference, specific remuneration packages for the Executive Directors and other members of the Group’s ExCo. The Remuneration Committee also maintains and periodically reviews a list of Code Staff to ensure that their remuneration structures are compliant with the FCA Remuneration Code. The Committee’s Terms of Reference are available on the Group’s website. 5.2 Code Staff criteria Henderson Group plc complies with the FCA Remuneration Code for Tier 3 firms. Under the Pillar 3 disclosure requirements, the Remuneration Committee must report annually on the remuneration policy and practice for employees termed Code Staff, including Material Risk Takers defined under the recently published Regulatory Technical Standard. The list of individuals reviewed in determining those who are Code Staff and included in the Pillar 3 disclosure includes: Executive Directors of Henderson Group plc; Non-Executive Directors of Henderson Group plc; Members of the Group ExCo; Employees in key control function roles; Material Risk Takers; and Employees who are remunerated at the same levels as senior management and Material Risk Takers identified above. This is enhanced disclosure relative to those individuals reported in the Related Party disclosures in the Annual Report and Accounts which covers only 1-4 above. 5.3 Link between pay and performance The main elements of fixed and variable remuneration are set out below. Fixed pay: principally comprised of salaries or fees. All Code Staff receive either a salary (for employees) or fees (for non-executive directors) which are commensurate with the incumbent’s role, responsibilities and experience and with reference to competitive market rates within the industry. Fixed pay also includes pensions and benefits in kind which are provided in line with all other employees across the Group to enable employees to undertake their role by ensuring their wellbeing and security. Variable remuneration includes the following: Short Term Incentives: performance-related awards principally comprised of annual bonus awards. Non-executive directors do not receive variable performance-related pay. The overall size of the annual incentive is determined by reference to: a scorecard of financial and non-financial metrics which are set out in the Directors’ Remuneration Report; and target compensation ratios which are set by the Board. This ensures that the aggregate spend on compensation is directly linked to the Group’s financial performance. All Code Staff who are permanent employees are eligible to be considered for an annual bonus award each year, taking into account overall Group, team and individual performance against agreed 10 | Henderson Group plc Pillar 3, 31 December 2014 objectives and Group values, including both financial and non-financial measures, risk performance and any other relevant factors. Code Staff who are fund managers are also entitled to share in Performance Fees, further enhancing the alignment with investors through the investment performance of the funds that they manage. Under the Company’s current mandatory deferral policy, 40% of aggregate short term variable incentives above an annual threshold of £50,000 (or local equivalent) are deferred into Company shares and/or products, vesting in equal tranches over a three year period. The deferral for employees who are a member of ExCo increases to 50% in respect of aggregate short-term incentive awards in excess of £500,000 in any year. The amount deferred in 2014 was: £4.0m (2013: £2.3m) in respect of Senior Management; £20.3 in respect of Other Code Staff (no comparator for 2013). Long term incentives: The Company operates a long term incentive plan (LTIP) for Executive Directors, Executive Committee members and other key staff to provide a mechanism to deliver a proportion of their reward which is aligned to performance of the Group over future three and four year periods respectively. The plan is targeted at those key executives whose contribution is, or is expected to be, critical to the long term performance of the Group. Awards under LTIP are made in the form of nil cost options or restricted shares, and vest 2/3 after three years and 1/3 after four years subject to the achievement of performance conditions measured over the relevant three or four year period. Further details of our remuneration policy, our deferred remuneration arrangements and LTIP structure and performance conditions are provided in the 2014 Directors’ Remuneration Report. 5.4 Quantitative Remuneration Disclosures Henderson Group is considered as a single business unit for the purposes of these disclosures. In respect of the 2014 performance year, 64 individuals have been identified as Code Staff, of whom 13 were classified as Senior Management. The aggregate annual remuneration for these individuals is set out in the table below: Senior Management Other Code Staff £000’s £000’s Fixed remuneration 3,341 8,704 Variable remuneration 20,754 56,982 Total remuneration 24,095 65,686 Aggregate remuneration disclosed includes, in respect of the 2014 performance year: Annual base salaries paid during the year; Non-executive director fees received during the year; Employer paid pension contributions and the value of benefits in kind delivered during 2014; Short-term incentives awarded in respect of the year (prior to any mandatory deferral), comprising; o discretionary annual bonus; o other short term variable incentive awards (predominantly a share of Performance Fees); Long-term incentives awarded during the year, comprising: o the total amounts awarded under executive and employee share plans; o in respect of the LTIP, the value of awards proposed to be granted in early 2015 subject to shareholder approval at the 2015 AGM. As LTIP awards are subject to material performance conditions which can result in the award vesting between 0% and 100%, the figures above assume 50% vesting. 5.5 Disclosures under AIFMD The Alternative Investment Fund Managers Directive (AIFMD) in the UK came into effect in respect of performance periods beginning 1 January 2015. There are 2 authorised AIFMs within the Group, 11 | Henderson Group plc Pillar 3, 31 December 2014 which will be required to comply with the remuneration regulations and disclosure requirements of the AIFMD Remuneration Code in respect of remuneration earned from that date. It is anticipated that the financial disclosures required under AIFMD will be made within the Annual Reports of the relevant AIFMs for accounting periods ending on or after 31 December 2015, being the first full performance period following authorisation. Prior to this date, the AIFMs would be part way through their first performance period and the information available would not be relevant or provide a proper basis for comparison. 12 |