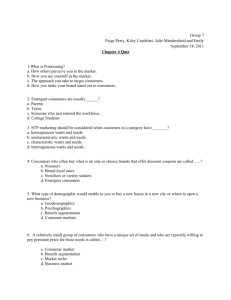

Eric Sohn Presentation. - Alabama Department of Commerce

advertisement

Doing Business In China Building value for foreign enterprises in Asia Agenda 1. Selling to China: Commercial Options The most difficult business issues according to people working in China 2. IP and Relationships The most difficult business issues according to people not working in China 3. Pitt-falls Companies struggling to sell in China a. Case Study I b. Case Study II 2 Selling to China: Commercial Options Opportunistic / Well Executed Opportunistic Business Stage U.S.A. CHINA #1 Opportunistic Agent American Company Distributor Distributor Employee #2 Well Executed Opportunistic Agent American Company Treating it like you would another region in the US Market Feedback, Targets, etc. Distributor 1 Distributor Distributor 2 Employee Distributor 3 Market Feedback to U.S. Company 3 Selling to China: Commercial Options Opportunistically Invested / Strategically Invested Business Stage U.S.A. CHINA Agent American Company Distributor Employee Employee works through an “incubator” Most likely still no RMB Invoicing. DISTRIBUTORS #3 Opportunistically Invested 1 2 Dedicated 3 Employee(s) 4 on-the-ground 5 n Market Feedback to U.S. Company Your Business Established. Employees Inventory RMB Invoicing 1 2 3 4 5 n Market Feedback to U.S. Company Agent American Company DISTRIBUTORS #4 Strategically Invested Distributor Employee 4 Selling to China: Commercial Options Summary No Resource in China Resource in China High High Stage #4 Strategically Invested Stage #3 Opportunistically Invested RETURN and/or MARKET SHARE RISK Stage #2 Opportunistic Well Executed Stage #1 Opportunistic Low Low Low INVESTMENT 5 High Selling to China: Commercial Options Issues: Stages 1 & 2 No Resource in China Resource in China High Stage #4 High Stage #3 RISK RETURN Stage #2 Stage #1 Low Low INVESTMENT Low Second* most cited business issue: Distribution / Channel Management Industrial Distribution Market Why??? U.S.A. Top 10 30% 1. Highly Fragmented Smallest of top 50 is about $100M China Top 10 1% Largest is about $60M 2. They cannot take much inventory and/or cannot trade in USD 3. Many, many more distribution points 4. If a distribution in the US requires X amount of time training, the Chinese distribution requires 3x 5. Greater instances of opportunistic behavior: Brand, Pricing, Service (Studies show a correlation between aggressively managed distribution and growth/profits) Third most cited business issue (LKS observes) lack of credibility in the feedback channel impacts adjustments necessary in: Product Development, Service, Brand Growth * Per American Chamber of Commerce Survey 6 High Selling to China: Commercial Options Issues: Stages 3 & 4 No Resource in China Resource in China High Stage #4 High Stage #3 RISK RETURN Stage #2 Stage #1 Low Low Low 3 jobs, 28x salary growth USD Base Annual Salary USD Base Annual Salary #1 most cited* business issue: Employee Retention Salary Growth 4 jobs, 14x salary growth Employee Turnover Avg. Annual Employee Turnover Today’s Ceiling “Ben there done that” – really expensive People looking for development Ceiling being noticed – Find the “Builders” * Per American Chamber of Commerce Survey 7 INVESTMENT High IP & Relationships IP Protection (It-is-Not a reason Not-to-Go) 1. China is one of Luis Vuitton’s largest markets for knock-offs and also one of its largest for real products 2. The baby carriers market consisted only of Baby Bjorn Knock offs which actually built the brand. It was known, and desired, when the real product arrived 3. Knock offs are not your competitors, they do not win on quality or service 4. But be smart about drawings, etc. Relationships 1. Relationships matter everywhere 2. As in the U.S. Service, Quality and Value will win out 3. The accessible market is growing 2000 China Industrial Market 20% Accessible 50% Non-accessible 80% Non-accessible 2011 50% Accessible Don’t allow Relationships / Culture to be an excuse for losing 8 Pitt-falls: Case Study I Situation Situation NYSE listed company selling in China for > 10 years, but yet to achieve scale Company was growing in the low teens Distributors were small and few, highly concentrated near Shanghai Most sales people could not sell enough to cover their costs Employee turnovers was low, but salesperson turnover high Objective: Improve Sales 9 Pitt-falls: Case Study I Brand Mapping Market Perceptions Brand Perception User Decision Attributes Perceived Brand Leader Quality Brand Awareness Client Positioning Co X, Co Y, Co Z Our client Co A was not strong anywhere Co X Had poor quality and delivery perception Price Co X, Co B Delivery Co X, Co B After Sales Service (Negative) Breadth of Line Co X, Co C Co X was mentioned most often and owned Brand Awareness Nobody owned after sales service – Negative! Why are you asking about quality and delivery, you are supposed to fix Sales! 10 Pitt-falls: Case Study I Sales Effectiveness Sales Function Success Quoting on Business Time at End Users 25% Hit 75% Miss Should be a $50M Business! New distributors signed in last 18 months 75% End Users 3 Generally a Mature Market characteristic Passive distribution management New or Current Distributors 25% Why can’t sales increase reach? 11 Pitt-falls: Case Study I The Fundamentals Perception vs Reality Delivery Warranty % 5 VOC 1 week 4.5 Complaint w/ abuse Complaint w/o abuse 4 Co X 3 days 3.5 3 2.5 2 weeks (China) % Co A Co A 2 1.5 5 weeks (Imports) 1 0.5 0 Jan Feb Mar Apr May Sales training, incentives and structure will not solve this problem! 12 Jun Pitt-falls: Case Study I Summary Summary Leadership: Someone with credibility in the home country Poor sales is usually a symptom of something other than a poor sales team / structure / incentive We see a lot of industries where “Service” is still an open attribute Don’t be distracted by FCPA, Sales Pressure, Retention Issues: Don’t forget the Fundamentals! Don’t let an export driven factory forget to measure domestic performance 13 Pitt-falls: Case Study II Situation Situation Selling in China for > 10 years, but was not satisfied with sales performance Sales people focused on finding and signing new distributors Sales were 30% “Standards,” 70% “Specials” <The opposite of the rest of the world> Their share of “Specials” was <0.1% in China Objective: Improve Sales…Again 14 Pitt-falls: Case Study II Product / Competitor Concentration Market Situation Specials vs Standards Competitor Concentration This client is good at Specials Specials 10% Others Standards 75% 90% Miss Specials: Fastest Growing Segment Major Global Players 40% 60% Global Majors had the Majority of the Market Specials are ignored by the biggest companies Specials sales require time at end users identifying and solving problems Distributors prefer to sell standards Like every other country, the client was focused on Standards 15 Pitt-falls: Case Study II Distribution Model Distribution Situation Standards: “Catalog” Sales Sales team was recruited from the global major competitors that had already been established in China Distribution network was set up just as in the US or as the other major competitors had done in China Nobody in the China organization understood how to build a network, or sales plan, focused on Specials Specials: End User Pull Model Distribution model and salesperson DNA need to fit your positioning 16 Pitt-falls: Case Study II Summary Summary If late to the market, you may grow faster, and more profitably focusing on your niche items If you build the organization around a “niche,” the “bulk” will eventually come – if you want it to! Be open to positioning your brand differently in China Don’t necessarily recruit from the same industry, recruit from the same business model Moving production etc. can ameliorate some of the delivery and cost issues, but not always 17 Shenyang Overview Capital of Liaoning Province and established as a major heavy industrial base 5th largest city in China Large companies in the city include: Brilliance China Auto, Shenyang Aircraft Corporation, Neusoft Group (the biggest software company in China), BMW, Toshiba Elevators, General Electric, Michelin (Tires), Coca-Cola, BASF Typical industries in the city include: Automotive, Aerospace, Software Quick Facts: Area: 13,308 km2 GDP: 501.7 B RMB (81 B USD) Imports: 3.78 B USD Population: 7.86 million GDP Growth: 14.1% Exports: 4.08 B USD Many businessmen have said that the business environment can be challenging and more bureaucratic than East China. This is related to the higher proportion of state-owned enterprises than elsewhere in the country, and the relative lack of experience in international business practices. However, Shenyang is in the process of reforming its 280 SOEs 18 Doing Business in China Summary Know your strategy Is this opportunistic or strategic? What is your positioning? Don’t be overwhelmed by culture, FCPA, bureaucracy etc. and remember the fundamentals are the same anywhere. Be flexible when building your positioning Your brand positioning or even product use may be different than in the US. (KFC - menu, MD – dating, Go-Thru, Gas Pumps, Micrometers) Include the China team If you are not going to listen to their feedback, don’t hire them Relationships They matter everywhere – build them – don’t use them as an excuse 19 Lancaster Consulting Management Team ALEX CLAYPOOL / Managing Director Alex has started-up, turned around and grown businesses in the US, China, Japan, Singapore and Belgium for US Fortune 500 corporations (Danaher Corporation, The Stanley Works) and US private equity firm portfolio companies. Alex attended Rikkyo University (Tokyo), the London School of Economics, has a BA from Washington & Lee University and an MBA from the University of Michigan. He is an advisory board member of XnI Consultancy Services Pvt. Ltd. a consulting firm in Delhi, India, and is an active member of the American Chamber of Commerce and Australian Chamber of Commerce in Shanghai. He has lived eleven of the last thirteen years in Asia and Europe, and currently resides with his wife and two sons in Shanghai. aclaypool@lancasterholdings.com LI XIAO / General Manager Li Xiao has led the establishment of over fifteen foreign businesses in China and has thirteen years of experience working for US, European and Indian multinationals. Prior to joining Lancaster, Li was responsible for the establishment of manufacturing operations and management of commercial operations for WIPRO Hydraulics China. Li has a BA from East China University of Science and Technology and a diploma from the Swedish Institute Management Program with a focus on Corporate Social Responsibility. Li currently resides with his wife and daughter in Shanghai. xil@lancasterholdings.com 20