General Information

advertisement

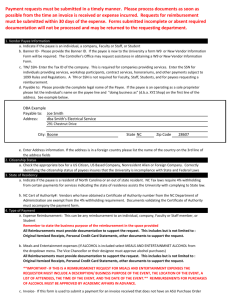

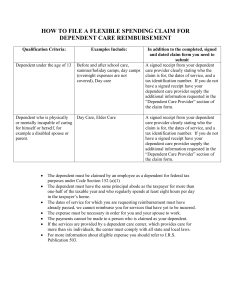

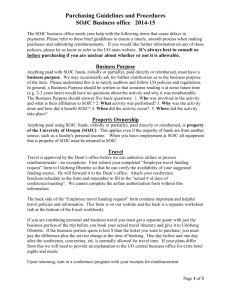

Killeen ISD Accounts Payable Department Carolyn Duncan Accounts Payable Specialist Who to Contact Carolyn Duncan Accounts Payable Specialist 336-0013 Miwa McFadden A/B/C 336-0014 Keria Degrate E/F/G/H 336-0015 Erica Hopkins I/J/K/L 336-0016 Andrea Sane Q/R/S/W/Z 336-0018 Angela Tucker M/N/O/P 336-2767 Toni Smith D/T/U/V 336-0154 Nenita Bone X/Y and KISD credit card 336-0017 **Consultants, Mileage & Travel are sorted by last name** Weekly Check Cycle Friday • Deadline to submit documentation to A/P for Tuesdays check run Monday • A/P prepares documents that have been submitted for payment. • If you have a CR or EAR that MUST be paid on Tuesdays check run, and are unsure if it has been paid, please contact the appropriate A/P clerk Tuesday • Vendor checks are printed by Treasury & submitted to A/P for review (this procedure takes approx. ½ day) Wednesday • Vendor checks are mailed out OR • Checks that are marked Hold For Pickup are available after 3PM. • Checks are available for pickup at the Treasury office Emergency Checks We are aware that emergencies happen, if a check is needed anytime outside the normal processing cycle, a check can be processed. • Please contact Carolyn Duncan, A/P Specialist, at 336-0013 for assistance with this matter Payment Information & Vendor Inquiries • • • Please do not make guarantees to individuals or companies regarding when a check will be ready. • Direct vendor inquiries about payment status to the appropriate A/P Clerk. • Please send emails to “DL – Accounts Payable,” or send invoices to Accounts.Payable@killeenisd.org instead, or contact the appropriate A/P clerk. Professional Leave Requests • Required when employees attend out-of-district conferences or meetings for half a day or more. • The Professional Leave Request should be submitted two weeks prior to departure. • Scan completed documents with signatures & attach to EAR in Teams. • The estimated expenses on the PL request may be adjusted after the trip is completed. These changes will be completed on the Professional Leave Reimbursement. **Professional Leave Request forms for Local & Federal Funds can be found on the Budget website** Professional Leave Reimbursements • Complete a Professional Leave Reimbursement form AFTER trip has been taken. Local fund Professional Leave Reimbursement forms are sent to Accounts Payable for payment. • Scan and attach final documents in Teams OR • Send hard copies to Accounts Payable. • • Federal fund Professional Leave Reimbursement forms are sent to Budget for verification before being sent to Accounts Payable. Originals MUST be submitted, along with receipts. Professional Leave Reimbursements Local • Employee & principal/director signatures on reimb. form • Hotel Receipt • Any Misc. costs receipts (cab fare, parking costs) • Any Registration fee receipt • Google map for any mileage reimb. Federal • Employee & principal/director signatures on reimb. form • ALL original receipts: meals, misc. costs, hotel, registration fees. • Google map for any mileage reimb. **Professional Leave Reimbursement forms for Local & Federal Funds can be found on the Budget website** Prepaid Registration Fees • Prepaid registration fees require a check request OR • Use of the district credit card to secure your spot • The supporting documentation should be a copy of the conference or workshop brochure/form and include the following information: • Total registration fee • Address to mail the registration fee • Name of the attendee • Date of conference or workshop Subscriptions & Renewals Magazines • Once the first issue is received on campus, please complete the Subscription Receiving Form OR email the Purchasing Department. Online Subscriptions • Once you have access to the online subscription please notify Purchasing via email. **Subscription Receiving Form can be found on A/P’s Website** Consultants • Payment for consultants are entered for payment on a Check Request • Payment cannot be processed with a contract • Consultant may provide an invoice OR • A consulting services form may be filled out and submitted for payment • Signatures from the consultant and principal/director are required **Consultant Services Payment Request forms can be found on the A/P website** Employee Reimbursements New Option for Employee Reimbursement Payments We now offer direct deposit to pay employee reimbursements. • The employee will need to inform the financial clerk if he/she would like to receive their reimbursement as a direct deposit. • The reimbursement will be deposited into employee’s current payroll bank account. • An employee will be able to view their reimbursements in the ESC under “My Employee Reimbursements.” • KISD Credit Card • KISD uses Citibank Card for Wal-Mart; hotel reservation and registration; invoice payment and etc. • The card is issued to the campus and departments by the • Purchasing Department. • Each month, the campus or department will go on the website to retrieve the statement. The statement will list the purchases or transactions that you made to that account for the month. Once the statement is downloaded, a Check Request is processed for all transactions. KISD Credit Card To process a check request: • • • Use vendor # 99005. The receipt and statement for all transactions must be provided or attached in the system. When making partial payment on your Wal-Mart receipt from Activity Fund Check, make sure to attach or include copy of the Activity Fund check, Wal-Mart receipt and a statement to your Check Request for the difference. Send your original Activity Fund checks to make payment for KISD Credit Card Fund; including the copies of the receipt and statement associated with that check. KISD Tax Exemptions Sales Tax Exemption • • • Date & seller information must be filled out by purchaser Present form at time of purchase Sales tax reimbursements will not be made to employees who fail to claim the exemption Hotel Occupancy Tax Exemption • • • Date & guest name must be filled out by you Present form at time of payment Hotel occupancy tax reimbursements will not be made to employees who fail to claim the exemption **Sales Tax & Hotel Occupancy Tax Exemption forms can be found on the A/P website** Other A/P Processes • A PO must reflect a ‘received in’ status on Teams before A/P can process a payment. • If, for any reason, items you ordered are received directly on campus (instead of Warehouse Services) immediately notify – via email, the warehouse of what items & how many items have been received. • A/P can only submit payment with an invoice on PO’s. Statements, packing slips, sales orders, etc. CAN NOT be used for payment purposes. • A/P can process payments on invoices that are over the PO amount by up to 15%. Invoices that are over 15% of the PO amount will require approval from the requisitioner, this includes shipping and handling. • A/P clerks, may require your help in obtaining an invoice, invoice correction or credit memo from the vendor. Please be willing to step in and help get any issues taken care of in a timely manner.