9.401 Auditing

advertisement

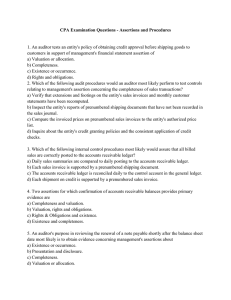

9.401 Auditing Chapter 6 Audit Evidence What is Audit Evidence? =Any information used by the auditor to draw conclusions regarding whether the information being audited is stated in accordance with the established criterion • Must be sufficient and appropriate at lowest possible cost Audit evidence decisions Nature What type of procedure to use and what evidence to gather Timing When evidence is gathered and covering what time period Extent How many items to test and which items to select Sufficient and Appropriate Evidence Sufficiency: • Refers to quantity • “Extent” evidence decision • Depends on expectations of errors, quality of controls, size of popn, materiality, level of assurance, etc. Appropriateness • Refers to quality • “Nature” and “Timing” evidence decisions • Depends on level of assurance needed • If evidence is not appropriate, sufficiency won’t help. To be appropriate… Relevance = addresses the objective or assertion Eg. Existence vs. completeness Auditor’s direct knowledge vs. otherwise Examination, observation, inspection or computation by auditor > someone else Independence of provider Provider external to org > external to acctg dept > acctg dept Documents external to org > external docs held by org > internal docs To be appropriate… Effectiveness of Internal controls Evidence from system of good I.C. > evidence from system of poor I.C. Qualifications of individuals providing the information Degree of objectivity of evidence (vs. subjectivity) Timing Auditor must express conclusion on information at balance sheet date. However, may gather information as at nonbalance sheet date and “roll forward” the conclusion by: Substantive tests Relying on internal controls Other procedures To do this, consider quality of internal controls, materiality of item and level of risk associated with item Types of Evidence 1) 2) Physical Examination • = inspection or count of tangible assets • Good evidence of existence, but not at all of ownership and not really of valuation Confirmation • = receipt of response from 3rd party verifying accuracy of info requested by auditor • Costly, but reliable evidence of existence • Usually required for A/R except in certain circumstances • Used for many other accounts as well • Must be kept under control of auditor Types of Evidence 3) 4) Documentation • = inspection of documents and records • Quality depends on quality of document (external vs. internal, internal control) • If electronic, auditors must assess controls over changes to documents Observation • = watching certain activities • Generally needs corroboration for assurance that conditions persist Types of Evidence 5) 6) Inquiries of Client • = written or oral representations of client in response to auditor’s request for information • Generally not conclusive, should be corroborated when possible • Underlines importance of mgmt good faith, care must be taken in choosing clients Reperformance • = auditor rechecking computations or other operations done by client • Particularly often used when testing controls 7. Analytical Procedures = using financial and non financial data in meaningful comparisons and relationships to determine whether account balance is reasonable Can be quite effective at low cost Reliability depends on quality of data, nature of analysis, skill of auditor, level of detail Purposes of Analytical Tests As audit evidence which enables the reduction of audit testing of details. Indication of errors in the statements requiring follow-up. Indication of financial difficulty. Understanding the client’s business and industry. An aid to management. When Analytical procedures are used: MUST be used in: planning final review MAY be used as a substantive test Analytical Procedures Comparison of Current year balances to: balances for one or more comparable periods. company’s budgets and forecasts. other current-year balances for conformity with predictable patterns based on the company’s experience. similar information for the industry in which the company operates. relevant non-financial information. Analysis of Un-audited Financial Statements Horizontal analysis examines changes of FS numbers and ratios across two or more years Vertical analysis examines FS amounts expressed each year as proportions of a base. Auditors look for relationships in accounts as indicators of problems and to plan further audit work Problems discovered by analytical procedures Account balances that seem high could indicate problems with: existence valuation ownership Account balances that seem low could indicate problems with: completeness valuation Conclusions from analytical procedures Don’t indicate definitively that there is an error. Unexpected fluctuations may be from error or non-error causes. Client explanations should be corroborated if they relate to a material item.