Chapter 3

advertisement

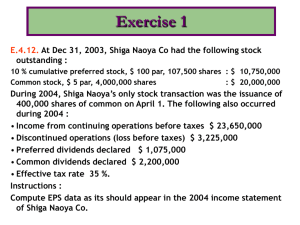

Chapter 3 Measuring Performance Cash versus Accrual Cash is basically a checking account method Cash in and cash out Statement of cash flows Less subject to manipulation Accrual Based on GAAP Income Statement Lots of discretion Accrual Accounting Revenue Recognition Expense matching Accruals Insurance $2,400 for a two-year period ended 12/31/07 What should be recorded: 01/01/06? 12/31/06? 12/31/07? Form Matters! Statement of cash flows Operating Investing Financing Income Statement Operating income Special items Statement of Cash Flows Cash from operations Direct method Indirect method Preparing Stmt of Cash Flows Class demonstration Alternative Measures of Cash Flow EBITDA Free Cash Flow Transitory Income Items & Core Earnings Estimation of stock prices entails forecasts of future earnings and cash flows. Forecasts are better when we can identify transitory items in reported earnings and cash flows and can eliminate those from our forecasts. Our goal is to identify core earnings and cash flows of the company. Core earnings and cash flows have the greatest persistence or predictive power and are, therefore, most useful for stock price estimation. Recognition of Gains on Assets Sales When assets are purchased they are recorded at their purchase price. Subsequently, they are carried at their historical cost, even if they appreciate in value, and are written down only if they suffer a permanent decline in value. When they are sold, the company recognizes a gain (loss) equal to the difference between their selling price and the amount at which they are carried on the balance sheet: Selling price of asset – Asset carrying amount from balance sheet = Gain (loss) on sale Gains (Losses) on Asset Sales Gain (loss) = sale proceeds – asset book value Assume that a company sells a machine for $10,000 that it carries on its balance sheet for $8,000 (historical cost of $12,000 less accumulation depreciation of $4,000). The company reports a gain of $2,000 ($10,000$8,000). This gain is reported in income from continuing operations. Restructuring Charges: Employee Severance Employee severance costs represent the accrual of estimated costs relating to the termination of employees as a result of a restructuring program. Asset write-downs: restructuring activities that usually encompass closure or relocation of manufacturing or administrative facilities. Inventory LT Assets Goodwill Transitory Income Items Discontinued Operations Extraordinary Items Changes in Accounting Principle Disclosure and Presentation Operating revenues and Expenses: usual and frequent Other revenues and expenses: unusual or infrequent Disposal of a segment Extraordinary items: unusual and infrequent Changes in accounting principles Discontinued Operations Discontinued operations refer to any separately identifiable business operation that the company intends to sell. Profits (loss) of the discontinued operations (net of tax), together with the gain (loss) on sale, of the segment are reported in a separate section of the income statement below income from continuing operations. Best Buy’s Reporting of Discontinued Operations Best Buy’s Reporting of Discontinued Operations Extraordinary Items Extraordinary items represent transitory events that are both unusual and infrequent. Extraordinary items are segregated from the rest of the income statement items and presented separately following income from continuing operations. The company makes the determination of whether an event is unusual and infrequent. Examples of Extraordinary Items (Not) • Write-down or write-off of assets • Foreign currency gains and losses • Gains and losses form disposal of specific assets or segments business • Effects of a strike • Accrual adjustments related to long-term contracts • Costs of defense against a takeover • Costs incurred as a result of the September 11, 2001 events. Change in Accounting Principle A change in accounting principle results from adoption of a generally accepted accounting principle different from the one previously used for reporting purposes. Pro Forma Earnings Earnings per Share (EPS)