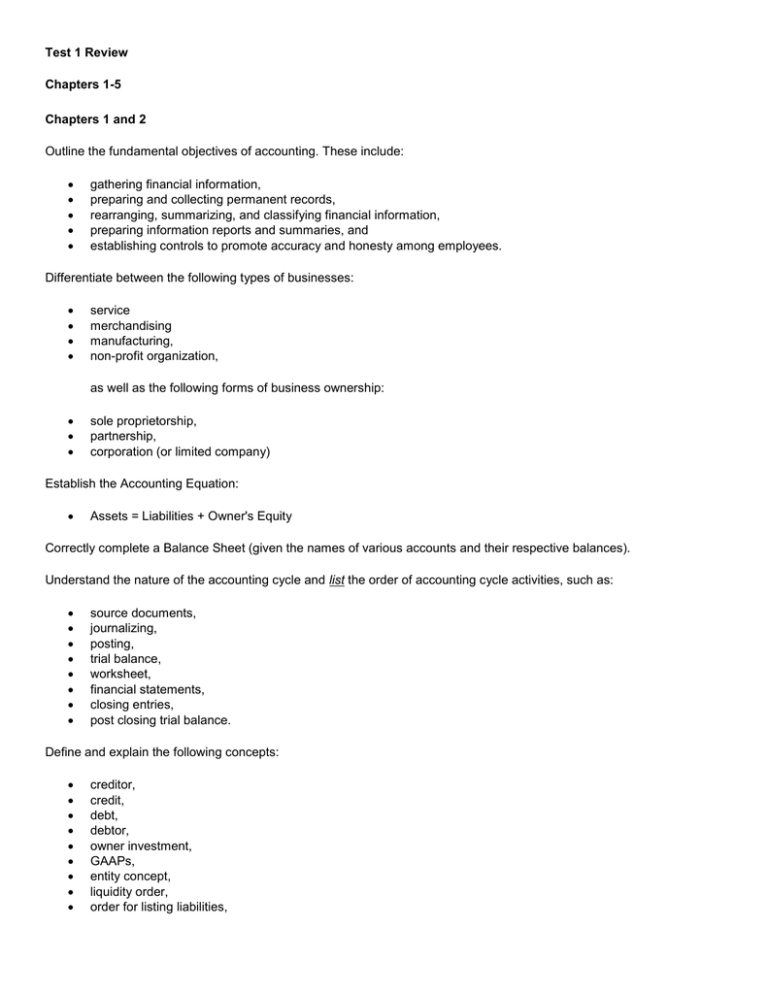

Test 1 Review

advertisement

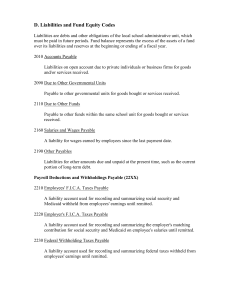

Test 1 Review Chapters 1-5 Chapters 1 and 2 Outline the fundamental objectives of accounting. These include: gathering financial information, preparing and collecting permanent records, rearranging, summarizing, and classifying financial information, preparing information reports and summaries, and establishing controls to promote accuracy and honesty among employees. Differentiate between the following types of businesses: service merchandising manufacturing, non-profit organization, as well as the following forms of business ownership: sole proprietorship, partnership, corporation (or limited company) Establish the Accounting Equation: Assets = Liabilities + Owner's Equity Correctly complete a Balance Sheet (given the names of various accounts and their respective balances). Understand the nature of the accounting cycle and list the order of accounting cycle activities, such as: source documents, journalizing, posting, trial balance, worksheet, financial statements, closing entries, post closing trial balance. Define and explain the following concepts: creditor, credit, debt, debtor, owner investment, GAAPs, entity concept, liquidity order, order for listing liabilities, Chapter 3, 4 and 5 explain the function and structure of the basic T-account; demonstrate an understanding of debit/credit theory by placing opening balances within asset, liability or owner's equity accounts; define any of the following concepts: o account, o debit, o credit, o account balance, and o ledger; complete a trial balance using the final balances from either T-accounts or from a Transaction Summary table; indicate the current balance of an asset, liability, or owner's equity account; prepare a Trial Balance. demonstrate an understanding of debit/credit theory by recording transactions within any variety of asset, liability, or owner's equity accounts, including: o capital, o drawings, o revenue, and o expenses. Understand the nature of accounts that would typically be placed within a Balance Sheet, such as: o cash, o accounts receivable, o furniture, o equipment, o supplies, o bank loan payable, o account payable, o mortgage payable, and o capital. Explain the functions of, and work with, the following types of owner's equity accounts: o revenue, o expense, o drawings, as well as the original o capital account. Understand and utilize the following new GAAPs associated with these new accounts: o the revenue recognition principle, o the expense recognition principle, and o the matching principle. Understand the following concepts related to the above principles: o Income Statement, o net income, o net loss, o fiscal period, and the o Chart of Accounts Record transactions within T-Accounts Prepare an Income Statement which includes an expanded Owner's Equity section Prepare a Balance Sheet which is related to the expanded Income Statement.