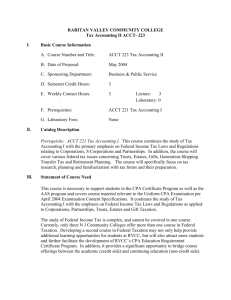

C6 - 1 Corporations, Partnerships, Estates

advertisement

Chapter 6 Corporations: Redemptions and Liquidations Corporations, Partnerships, Estates & Trusts Copyright ©2010 Cengage Learning Corporations, Partnerships, Estates & Trusts C6 - 1 Effect of Redemption (slide 1 of 3) • If qualified as a redemption: – Shareholder reports gain or loss on surrender of stock • Gain taxed at favorable capital gains rates (0%/15%) • Shareholder reduces gain by basis in stock redeemed • Capital gains may be offset by capital losses, if available Corporations, Partnerships, Estates & Trusts C6 - 2 Effect of Redemption (slide 2 of 3) • If transaction has appearance of a dividend, redemption will not be qualified: – For example, if shareholder owns 100% and corporation buys ½ of stock for $X, shareholder still owns 100% Corporations, Partnerships, Estates & Trusts C6 - 3 Effect of Redemption (slide 3 of 3) • If not qualified as a redemption: – Shareholder reports dividend income • Individual shareholders may be taxed at 0%/15% rates • But, redemption proceeds may not be offset by basis in stock surrendered • Cannot be offset by capital losses – Corporate shareholders may prefer dividend treatment because of the dividends received deduction Corporations, Partnerships, Estates & Trusts C6 - 4 Transactions Treated as Redemptions (slide 1 of 3) • The following types of distributions may be treated as a redemption of stock rather than as a dividend: – Distributions not essentially equivalent to a dividend (subjective test) – Disproportionate distributions (mechanical rules) Corporations, Partnerships, Estates & Trusts C6 - 5 Transactions Treated as Redemptions (slide 2 of 3) – Distributions in termination of shareholder’s interest (mechanical rules) – Partial liquidations of a corporation where shareholder is not a corporation, and either (1) Distribution is not essentially equivalent to a dividend, or (2) An active business is terminated (May be subjective (1) or mechanical (2)) Corporations, Partnerships, Estates & Trusts C6 - 6 Transactions Treated as Redemptions (slide 3 of 3) – Distributions to pay death taxes (limitation on amount of allowed distribution is mechanical test) • Stock attribution rules must be applied, so distribution which appears to meet requirements may not qualify Corporations, Partnerships, Estates & Trusts C6 - 7 Stock Attribution (slide 1 of 5) • Qualified stock redemption must result in substantial reduction in shareholder’s ownership – Stock ownership by certain related parties is attributed back to shareholder whose stock is redeemed Corporations, Partnerships, Estates & Trusts C6 - 8 Stock Attribution (slide 2 of 5) • Attribution from family members – Stock owned by spouse, children, grandchildren, or parents attributed back to individual Corporations, Partnerships, Estates & Trusts C6 - 9 Stock Attribution (slide 3 of 5) • Attribution from entity to owner: – Partner: deemed owner of proportionate number of shares owned by partnership – Beneficiary or heir: deemed owner of proportionate shares owned by entity – 50% or more shareholder: deemed owner of proportionate shares owned by corporation Corporations, Partnerships, Estates & Trusts C6 - 10 Stock Attribution (slide 4 of 5) • Attribution from owner to entity – Partnership: deemed owner of total shares owned by partner – Estate or trust: deemed owner of total shares owned by heir or beneficiary – Corporation: deemed owner of total shares owned by 50% or more shareholder Corporations, Partnerships, Estates & Trusts C6 - 11 Stock Attribution (slide 5 of 5) • Family attribution rules do not apply to redemptions in complete termination of shareholder’s interest • Stock attribution rules do not apply to partial liquidations or redemptions to pay death taxes Corporations, Partnerships, Estates & Trusts C6 - 12 Not Essentially Equivalent Redemptions (slide 1 of 3) • Redemption qualifies for sale or exchange treatment if “not essentially equivalent to a dividend” – Subjective test – Provision was added to deal specifically with redemptions of preferred stock • Shareholders often have no control over when preferred shares redeemed • Also applies to common stock redemptions Corporations, Partnerships, Estates & Trusts C6 - 13 Not Essentially Equivalent Redemptions (slide 2 of 3) • To qualify, redemption must result in a meaningful reduction in shareholder’s interest in redeeming corp • Stock attribution rules apply Corporations, Partnerships, Estates & Trusts C6 - 14 Not Essentially Equivalent Redemptions (slide 3 of 3) • If redemption is treated as ordinary dividend – Basis in stock redeemed attaches to remaining stock owned (directly or constructively) Corporations, Partnerships, Estates & Trusts C6 - 15 Qualifying Disproportionate Redemption (slide 1 of 4) • Redemption qualifies as disproportionate redemption if: – Shareholder owns less than 80% of the interest owned prior to redemption – Shareholder owns less than 50% of the total combined voting power in the corporation after the redemption Corporations, Partnerships, Estates & Trusts C6 - 16 Qualifying Disproportionate Redemption (slide 2 of 4) Corporations, Partnerships, Estates & Trusts C6 - 17 Qualifying Disproportionate Redemption (slide 3 of 4) Corporations, Partnerships, Estates & Trusts C6 - 18 Qualifying Disproportionate Redemption (slide 4 of 4) • Shareholder has 46 2/3% ownership represented by 35 voting shares (60-25) of 75 (100-25) outstanding voting shares • Redemption is qualified disproportionate redemption because: – Shareholder owns < 80% of the 60% owned prior to redemption (80% × 60% = 48%), and – Shareholder owns < 50% of total combined voting power of corporation Corporations, Partnerships, Estates & Trusts C6 - 19 Complete Termination Redemptions • Termination of entire interest generally qualifies for sale or exchange treatment – Often will not qualify as disproportionate redemption due to stock attribution rules – Family attribution rules will not apply if: • Former shareholder has no interest (other than as creditor) for at least 10 years • Agree to notify IRS of any disallowed interest within 10 year period Corporations, Partnerships, Estates & Trusts C6 - 20 Redemptions in Partial Liquidation (slide 1 of 3) • Noncorporate shareholder gets sale or exchange treatment for partial liquidation including: – Distribution not essentially equivalent to a dividend – Under a safe-harbor rule, distribution pursuant to termination of an active business Corporations, Partnerships, Estates & Trusts C6 - 21 Redemptions in Partial Liquidation (slide 2 of 3) • To qualify, distribution must be made within taxable year plan is adopted or the succeeding taxable year • Not essentially equivalent test looks at effect on corporation – Requires genuine contraction of the business of the corporation • Difficult to apply due to lack of objective tests • Advanced ruling from IRS should be obtained Corporations, Partnerships, Estates & Trusts C6 - 22 Redemptions in Partial Liquidation (slide 3 of 3) • Under the safe-harbor rule, to meet the complete termination of a business test, the corporation must: – Have two or more active trades or businesses that have been in existence for at least five years • Distribution must consist of the assets of a qualified trade or business or the proceeds from the sale of such assets – Terminate one trade or business and continue a remaining trade or business Corporations, Partnerships, Estates & Trusts C6 - 23 Redemptions to Pay Death Taxes (slide 1 of 2) • Allows sale or exchange treatment if value of stock exceeds 35% of value of adjusted gross estate – Stock of 2 or more corps may be treated as stock of single corp for 35% test if 20% or more of each corp was owned by decedent – Special treatment limited to sum of: • Death Taxes • Funeral and administration expenses Corporations, Partnerships, Estates & Trusts C6 - 24 Redemptions to Pay Death Taxes (slide 2 of 2) • Basis of stock is stepped up to fair market value on date of death (or alternate valuation date) – When redemption price equals stepped-up basis, no tax consequences to estate Corporations, Partnerships, Estates & Trusts C6 - 25 Effect of Redemption on Corporation (slide 1 of 2) • Gain or loss recognition – If property other than cash used for redemption • Corporation recognizes gain on distribution of appreciated property • Loss is not recognized – Corporation should sell property, recognize loss, and use proceeds from sale for redemption Corporations, Partnerships, Estates & Trusts C6 - 26 Effect of Redemption on Corporation (slide 2 of 2) • Effect on Earnings and Profits – E & P is reduced in a qualified stock redemption by an amount not in excess of the ratable share of E & P attributable to stock redeemed • Corporate expenditures incurred in a stock redemption are not deductible – e.g., accounting, brokerage, legal and loan fees Corporations, Partnerships, Estates & Trusts C6 - 27 Stock Redemptions—No Sale or Exchange Treatment • Redemptions not qualifying under previous provisions – Treated as dividend distribution to extent of E&P – Attempts by taxpayers to circumvent redemption provisions led to rules covering: • Preferred stock bailouts • Sales of stock to related corporations Corporations, Partnerships, Estates & Trusts C6 - 28 Effect of Preferred Stock Bailout (slide 1 of 4) • Preferred stock bailout involves: – Corporate distribution of nontaxable (nonvoting) preferred stock dividend on common stock – Portion of basis in common stock is allocated to preferred stock – Shareholder then sells the preferred stock to third party • Effect is bailout of corporate profits as a capital gain without reducing the shareholder’s percentage ownership in the corporation Corporations, Partnerships, Estates & Trusts C6 - 29 Effect of Preferred Stock Bailout (slide 2 of 4) • To minimize abuse potential, Code requires this treatment: – Shareholder has ordinary income (§306 taint) on sale of preferred stock to third party – Amount of ordinary income is FMV of preferred stock on date received as distribution from corporation • Treated as a dividend for purposes of the 0%/15% maximum tax on dividend income but has no effect on the issuing corporation’s E & P Corporations, Partnerships, Estates & Trusts C6 - 30 Effect of Preferred Stock Bailout (slide 3 of 4) • To minimize abuse potential, Code requires this treatment (cont’d): – No loss recognized on sale of “tainted” preferred stock – If stock is redeemed by corporation, proceeds treated as a dividend to the extent of the corporation’s E & P Corporations, Partnerships, Estates & Trusts C6 - 31 Effect of Preferred Stock Bailout (slide 4 of 4) • §306 stock is stock which is not common stock: – Received as a nontaxable stock dividend – Received tax-free in a corporate reorganization (plus other requirements), or – Has a basis determined by reference to other §306 stock • If a corporation has no E & P on the date of distribution of a nontaxable preferred stock dividend, the stock will not be § 306 stock Corporations, Partnerships, Estates & Trusts C6 - 32 Redemption with Related Entities (slide 1 of 2) • When one corp acquires stock in another corp from a shareholder and the shareholder controls both corps (i.e., direct or indirect ownership of at least 50%) – §304 requires that the redemption result in a reduction of ownership interest that would satisfy one of the qualifying stock redemptions of § 302 (e.g., disproportionate redemption) or § 303 • If the redemption does not qualify under those rules, the transaction is characterized as a dividend distribution Corporations, Partnerships, Estates & Trusts C6 - 33 Redemption with Related Entities (slide 2 of 2) • When brother-sister corporations are involved – Stock received by acquiring corp treated as a capital contribution • Corp’s basis in acquired stock is same as shareholder’s basis • Shareholder’s basis in acquiring corp is increased by basis of stock surrendered Corporations, Partnerships, Estates & Trusts C6 - 34 Corporation Division Under §355 • If one corp controls another corp – Stock in subsidiary can be distributed to shareholders tax free if requirements of §355 are met Corporations, Partnerships, Estates & Trusts C6 - 35 Liquidations—In General • Corporation winds up affairs, pays debts, and distributes remaining assets to shareholders – Produces sale or exchange treatment to shareholder – Liquidating corporation recognizes gains and losses upon distribution of its assets, with certain exceptions Corporations, Partnerships, Estates & Trusts C6 - 36 Liquidations—Effect on Corporation (slide 1 of 3) • Gain or loss is recognized by corporation on distribution in complete liquidation – Loss may be disallowed or limited if: • Property distributed to related parties • Property distributed has built-in losses • A subsidiary’s liquidating distribution to its parent corporation or to its minority shareholders – Property treated as if sold for FMV – Result: Liquidating distribution subject to corporate level tax (gain), and shareholder level tax (receipt of proceeds) Corporations, Partnerships, Estates & Trusts C6 - 37 Liquidations—Effect on Corporation (slide 2 of 3) • Limitations on losses—Related Party Situations – Losses are disallowed on liquidating distributions to related parties if: • Distribution is not pro rata – In pro rata distributions, each shareholder receives their share of each asset • Property distributed is disqualified property – Disqualified property is property acquired by corp in a §351 transaction during the five-year period ending on date of distribution Corporations, Partnerships, Estates & Trusts C6 - 38 Liquidations—Effect on Corporation (slide 3 of 3) • Limitations on losses—Built-in Loss Situations – Losses are disallowed when property distributed was acquired in a §351 transaction and principal purpose was to cause recognition of loss by corp on liquidation – Purpose is presumed if transfer occurs within two years of adopting liquidation plan Corporations, Partnerships, Estates & Trusts C6 - 39 Distribution of Loss Property in Liquidation Corporations, Partnerships, Estates & Trusts C6 - 40 Liquidations—Effect on Shareholder (slide 1 of 2) • Gain or loss recognized on receipt of property from liquidating corporation – Amount = FMV of property received - basis in stock • Generally, capital gain or loss – Basis in assets received in liquidating distribution = FMV on date of distribution Corporations, Partnerships, Estates & Trusts C6 - 41 Liquidations—Effect on Shareholder (slide 2 of 2) – Special rule for installment obligations • Shareholder may defer gain recognition to point of collection • Corporation must recognize all gain on distribution Corporations, Partnerships, Estates & Trusts C6 - 42 Liquidations: Parent-Subsidiary Situations (slide 1 of 4) • Parent corporation does not recognize gain or loss on liquidation of subsidiary – Also, subsidiary recognizes no gain or loss on property distributions to its parent Corporations, Partnerships, Estates & Trusts C6 - 43 Liquidations: Parent-Subsidiary Situations (slide 2 of 4) • To qualify: – Parent must own at least 80% of voting stock and value of subsidiary’s stock – Subsidiary must distribute all property in complete cancellation of all its stock within the taxable year or within 3 years from close of tax year in which first distribution occurred – Subsidiary must be solvent Corporations, Partnerships, Estates & Trusts C6 - 44 Liquidations: Parent-Subsidiary Situations (slide 3 of 4) • Liquidating distributions to minority shareholders – Subsidiary corporation treated same way as in nonliquidating distribution • Distributing corp recognizes gain but not loss – Minority shareholders recognize gain or loss • Amount = FMV of property received-basis in stock Corporations, Partnerships, Estates & Trusts C6 - 45 Liquidations: Parent-Subsidiary Situations (slide 4 of 4) • Basis of property received by parent – Has same basis as subsidiary’s basis (unless election is made under §338) • Parent’s basis in subsidiary’s stock disappears • Parent acquires tax attributes of subsidiary – e.g., NOLs, business credit carryovers, capital loss carryovers, subsidiary’s E & P • May result in some inequities Corporations, Partnerships, Estates & Trusts C6 - 46 Election Under §338 (slide 1 of 4) • Parent may elect to treat acquisition of stock in acquired corp as a purchase of the acquired corp.’s assets if: – Election is made by fifteenth day of ninth month following qualified stock purchase • Qualified stock purchase occurs when corp acquires stock representing at least 80% of voting power and value within a 12-month period • Must be acquired in taxable transaction – Stock purchases by affiliated group members count Corporations, Partnerships, Estates & Trusts C6 - 47 Election Under §338 (slide 2 of 4) • Tax Consequences – Parent corp has basis in subsidiary’s assets = basis in subsidiary’s stock • Subsidiary may, but need not, be liquidated Corporations, Partnerships, Estates & Trusts C6 - 48 Election Under §338 (slide 3 of 4) • Tax Consequences (cont’d) – Subsidiary is deemed to have sold its assets for an amount determined with reference to parent’s basis in subsidiary’s stock, adjusted for liabilities of subsidiary Corporations, Partnerships, Estates & Trusts C6 - 49 Election Under §338 (slide 4 of 4) • Tax Consequences (cont’d) – Gain or loss is recognized by subsidiary – Subsidiary is treated as a new corporation that purchased all of its assets on the day after the qualified stock purchase date Corporations, Partnerships, Estates & Trusts C6 - 50 If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu SUNY Oneonta Corporations, Partnerships, Estates & Trusts C6 - 51