Item 6A CRIM 2015 04 22 Former PFE Model v4

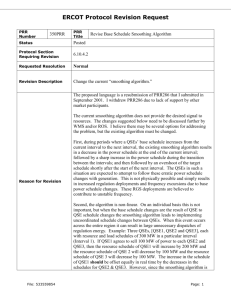

advertisement

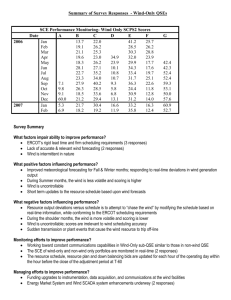

ERCOT Credit Loss Model Mark Ruane Credit Work Group / Market Credit Work Group ERCOT Public April 22, 2015 Former ERCOT Credit Loss Model ERCOT received Potential Future Exposure (PFE) estimates from Oliver Wyman in February 2008. In 2009, subsequent to the adoption of the Market Credit Risk Standard, PFEs were re-estimated quarterly using the Wyman model. Estimates were derived from two models: – Credit scoring model • Uses Counter-Party financial data to generate synthetic Counter-Party credit ratings and probabilities of default, which was an input to: – Credit loss model • • • Generates probability distribution of credit losses Excel front end with VB code Versions for zonal and nodal markets ERCOT Public Credit Scoring Model The credit scoring model estimated proxy ratings based on CounterParty financial ratios and qualitative assessment. Quantitative Inputs • Working Capital / Sales • Cash / Assets • Current Ratio • EBITDA / Interest Expense • FCF / Debt • Total Debt / Total Capital • Equity / Assets • EBITDA / Sales • Net Income / Assets • Total Assets • Sales / Assets ERCOT Public Qualitative Inputs • Policies • Management Quality • ERCOT Relationship • Performance / Strategy • Industry Characteristics Credit Scoring Model – Allowance for warning signal adjustments – Ratings of subsidiaries tied to parents with “group logic” scoring Group Logic Determinants • QSE and parent have same primary line of business • QSE covers a key geographical area for the parent • QSE covers a key customer segment for the parent • QSE fulfills an essential activity for the parent within a service line • QSE is clearly controlled by the parent through influence on management • QSE and parent share the same name • The parent has a minimum 45% ownership in the subsidiary – Default probabilities for ratings calibrated based on ERCOT historical average loss rate and assumed worst case default probability. ERCOT Public Credit Loss Model High-level model schematic Price module Simulated prices per day per hub1 Simulates daily prices per hub over the specified time horizon Default module List of defaulted QSEs by scenario Generates correlated default scenarios over the specified time horizon 1. Hub refers to a zone, settlement point, location or market NYC-ECO00111-007 ERCOT Public Volumetric exposure module Exposure by QSE Calculates exposure for defaulted QSEs using simulated prices and volumes Collateral module Collateral by QSE Calculates collateral for each of the defaulting QSEs Loss calculation Aggregate losses across all QSEs Based on exposure and collateral of defaulting QSEs, calculates loss (if any) for each simulation and summarizes results across all simulations Credit Loss Model Price module schematic Forward ERCOT price inputs Monthly natural gas futures price Convert natural gas monthly time series to daily time series Dependent on time horizon Store daily heat rate by hub Historical ERCOT price parameters Calculate implied ERCOT forward prices by hub Alternatively, these can be used directly once available ERCOT log forward prices by hub Nat gas price * heat rate Convert to log price Generate daily log price series and convert to $/MWh Based on monthly avg. heat rate/hub and starting month Hub correlations Mean reversion parameters Jump parameters Heat rate: (Ppower/Pnatgas) Time horizon To cover the default horizon Generate normal randoms and correlate them using Cholesky Correlated random normals NYC-ECO00111-007 ERCOT Public Combine base price and jump simulations Based on hub correlations for nonjump time series Generate uncorrelated uniform and normal random numbers Jump event parameters Max and mean jump size No jumps included Po = implied forward price for first forward month Uncorrelated uniform and normals Uniforms for jump placement Frequency of multiple day events Use mean reversion parameters, historical spot volatilities Base forward price simulations Normals for jump size Determine jump event probability based on historic jump parameters Probable number of jumps Simulate jump events (start day, number of days, and jump amount) Simulated prices per day per hub Jump simulations Uniform randoms determine numbers of common and unique jumps and their timing Jump size is lognormal, based on price cap and historical norms User input Input Process Calculation Output Credit Loss Model Default module schematic 1-yr PDs for each QSE Produced by Credit Scoring Model Time horizon of the simulation Set by user (in days) List of QSE type for each QSE Each QSE is segmented by type Default correlation between QSE types Calculation of time adjusted PDs Time adjusted PDs for each QSE Normalization of time adjusted PDs PDs are scaled exponentially (based on Poisson default arrival rate) PDs for each QSE scaled to length of simulation Time adjusted PDs are transformed to critical values using Inverse Normal CDF Creation of default correlation matrix and decomposition Correlation matrix for each QSE is produced based on QSE type and decomposed using a Cholesky decomposition Generate and normalize a set of random numbers Critical values Critical values represent the number of standard deviations from the mean that correspond (in likelihood) to the PD of each QSE Cholesky matrix Correlation matrix after decomposition Normalized random numbers Random numbers are generated (same # as # of QSEs) and normalized using Inverse Normal CDF Correlate random numbers using Cholesky matrix Matrix multiplication using set of random normals and the Cholesky matrix For each QSE compare critical value to its corresponding correlated random; if critical value is less than correlated random default has occurred Correlated random numbers ERCOT Public List of defaulted QSEs by simulation For each simulation record which QSEs default (if any) The set of random normals are now correlated based on the correlations between the QSE types User input NYC-ECO00111-007 For each QSE determine if default occurred Input Process Calculation Output Credit Loss Model Price module schematic Forward ERCOT price inputs Monthly natural gas futures price Convert natural gas monthly time series to daily time series Dependent on time horizon Store daily heat rate by hub Historical ERCOT price parameters Calculate implied ERCOT forward prices by hub Alternatively, these can be used directly once available ERCOT log forward prices by hub Nat gas price * heat rate Convert to log price Generate daily log price series and convert to $/MWh Based on monthly avg. heat rate/hub and starting month Hub correlations Mean reversion parameters Jump parameters Heat rate: (Ppower/Pnatgas) Time horizon To cover the default horizon Generate normal randoms and correlate them using Cholesky Correlated random normals NYC-ECO00111-007 ERCOT Public Combine base price and jump simulations Based on hub correlations for nonjump time series Generate uncorrelated uniform and normal random numbers Jump event parameters Max and mean jump size No jumps included Po = implied forward price for first forward month Uncorrelated uniform and normals Uniforms for jump placement Frequency of multiple day events Use mean reversion parameters, historical spot volatilities Base forward price simulations Normals for jump size Determine jump event probability based on historic jump parameters Probable number of jumps Simulate jump events (start day, number of days, and jump amount) Simulated prices per day per hub Jump simulations Uniform randoms determine numbers of common and unique jumps and their timing Jump size is lognormal, based on price cap and historical norms User input Input Process Calculation Output Credit Loss Model Exposure module schematic List of defaulted QSEs by simulation Defaulted QSEs output from Default Module Correlation of default and price by QSE type Identifies QSE types whose defaults are likely to be correlated with price Simulated prices per day per hub Place defaults in the simulation time horizon and determine default scenario For QSE types whose defaults have low market event sensitivity, the day of default is picked at random over the time horizon For QSEs types whose defaults have high market event sensitivity, a high price day (based on a four day rolling, weighted average of prices in hubs where the QSE has exposure) is randomly picked according to user defined parameters Day of default and associated prices Day of default and price as well as prices for days before and after Historic BES exposure and BES and total vol. by QSE by hub Exposure for each defaulting QSE Exposure calculation BES “escalation” type by QSE type Amount BES exposure may increase in a default Prices per day per hub over the specified time horizon from Price Module Based on the number of days of exposure (from the default type) and the prices on those days, as well as accounting for any BES escalation, the exposure is calculated as price times volume over each day and the total exposure is the sum of the daily exposures Default types and dimensions Identifies the types of default and the associated number of days of exposure NYC-ECO00111-007 ERCOT Public User input Input Process Calculation Output Credit Loss Model Key Assumptions – Default Module • Default probabilities from credit scoring model • Default correlations among market segments • QSE default sensitivity to market events • Default occurrence is a stochastic variable Key Assumptions – Price Module • Mean reversion and jump parameters • Implied ERCOT market forward prices (based on NG forwards) • Shape factors reflecting differences between simple average and load-weighted prices ERCOT Public Credit Loss Model Key Assumptions – Exposure Module • Distinguishes between market price events and non-market (random) shocks • Volume escalation, depending on nature of Counter-Party • Volume escalation and likelihood of default near a high-priced day are stochastic variables • Mass transition days Key Assumptions – Collateral Module • No excess cash collateral in base case • Illiquid collateral, eg guarantees, can be haircut • Collateral recomputed based on simplified EAL ERCOT Public Credit Loss Model Model Base Case – Did not include current (excess) collateral held by ERCOT – Represented what was enforceable by ERCOT under Protocols Model “Current Case” – Used actual levels and types of collateral – Assumed some degree of excess collateral would be maintained until a default event ERCOT Public Credit Loss Model Historic outcomes – Base Case Simulations using FYE-2009 and Q3-2009 Financials Potential Credit Loss - Base Case ($Millions) Horizon (in days) Simulations $180 $160 $140 $120 $100 $80 $60 $40 $20 $0 90% (1:10) 95% (1:20) 99% (1:100) 99.9% (1:1,000) Total defaults Simulations with defaults Simulations without defaults Default simulations with zero loss Total simulations with zero loss ($Millions) Expected Loss Median (1:2) FYE-2009 Q3-2009 90% (1:10) 95% (1:20) 99% (1:100) 99.9% (1:1,000) Max (1:10,000) FYE-2009 Base Case 214 10,000 FYE-2009 Base Case 365 10,000 Q3-2009 Base Case 365 10,000 58,849 9,741 259 2,218 2,477 59,362 9,775 225 2,087 2,312 44,782 9,546 454 3,670 4,124 $2.6 $0.2 $3.2 $0.3 $2.8 $0.0 $6.8 $11.7 $34.3 $86.5 $180.9 $8.4 $15.4 $43.6 $92.2 $153.3 $6.5 $12.9 $40.8 $152.8 $304.0 Note 1-year mean and median losses are higher than actual experience to date in nodal market. ERCOT Public Former ERCOT Potential Future Exposure Model Historic outcomes – Current Case Simulations using FYE-2009 and Q3-2009 Financials Potential Credit Loss - Current Case ($Millions) Horizon (in days) Simulations $100 $80 Total defaults Simulations with defaults Simulations without defaults Default simulations with zero loss Total simulations with zero loss $60 $40 $20 FYE-2009 Current Case 214 10,000 FYE-2009 Current Case 365 10,000 Q3-2009 Current Case 365 10,000 58,979 9,732 268 2,082 2,350 58,845 9,721 279 1,938 2,217 44,014 9,539 461 3,195 3,656 $4.8 $0.3 $5.4 $0.4 $5.1 $0.2 $16.2 $20.0 $30.7 $79.1 $212.2 $17.7 $22.6 $36.3 $78.1 $133.0 $17.3 $21.3 $35.6 $92.6 $204.4 $0 90% (1:10) 95% (1:20) 99% (1:100) FYE-2009 Q3-2009 99.9% (1:1,000) ($Millions) Expected Loss Median (1:2) 90% (1:10) 95% (1:20) 99% (1:100) 99.9% (1:1,000) Max (1:10,000) ERCOT Public ERCOT Public Credit Loss Model A model for the nodal market was prototyped but apparently never validated or run. Key Assumptions – Nodal Model • Price simulation in key locations only • DAM price locations considered as additional hubs with different parameters • Forward values for CRRs based upon implied ERCOT market forward prices • CRRs envisioned as one-month obligations only, settling in DAM • Exposure calculation similar to zonal, with additions of DALE, DAM invoices and Average Invoice Liability (AIL) ERCOT Public Former ERCOT Potential Future Exposure Model In 2011 ERCOT solicited bids to update the credit loss model for the nodal market. With a cost estimated at $400k - $800k, F&A elected to not update the model. The credit scoring model could be updated internally with Market input. ERCOT Public Credit Updates Questions ERCOT Public