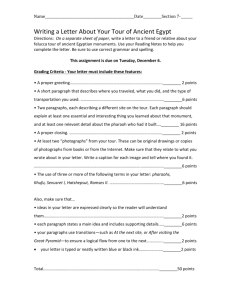

CRA Normal Template

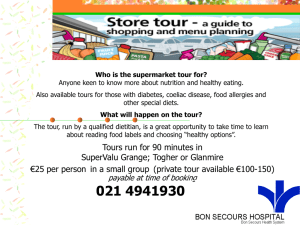

advertisement