Financial Executive - optimal university

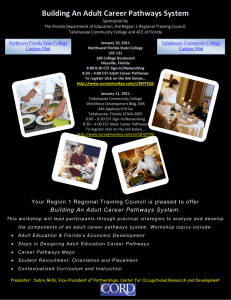

advertisement

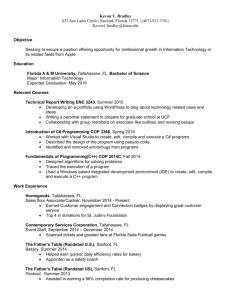

T Thomas Carman homas Carman, CPA 1023 W. Riviera Blvd. ● Oviedo, FL 32765 ● (850) 273-1830 ● Email: tom.carman@hotmail.com Financial Executive Certified Public Accountant holding a Masters in Management with a unique background spanning over 20 years. Knowledgeable in Debt, Treasury and Investment Management, General Accounting and Tax. Technical Skills: Microsoft Office Suite 2010 (strong Excel), Microsoft Outlook, PeopleSoft, Quick Books Pro, Peachtree Accounting, Paradox for Windows, PageMaker, Web Browsers, Email and Internet proficient. Expert Qualifications Include: Financial Analysis / Cash Management and Optimization / Debt Management Systems Development / Budgeting / Cost Reduction / General Accounting Banking and Treasury Functions / Financial Reporting (Shareholder and SEC) PROVEN AREAS OF EXPERTISE Strategic Investment Portfolio Planning, Management & Execution Strategic Debt Planning, Issuance, Bond Sales & Reporting Budgeting Analysis & Reporting Cost Analysis & Reporting Process Design & Productivity Improvement System Conversion Management & Roll-out Contract Negotiations & Strategic Alliances Systems & Technology Utilization Team Building & Performance Improvements Banking Activities Administration, Management & Compliance PROFESSIONAL EXPERIENCE DIGITAL ASSURANCE CERTIFICATION, Orlando, Florida Arbitrage/Rebate and Post-Issuance Tax Compliance Specialist, December 2011 – May 2012 – Department Eliminated Recruited to manage arbitrage rebate compliance department responsible for the analysis, identification, and noncompliance feedback processes for city, county, state and 501(C)(3) clients. Challenged to streamline and standardize processes to maximize efficiency and product consistency. Department eliminated due to saturation of market by existing providers. Due to small size of company, no other work available leading to my layoff. CITY OF TALLAHASSEE, Tallahassee, Florida Treasury Analyst & Cash Management Section Head, September 1998 – December 2011 Responsible for the direction, planning and management of key financial and accounting operations to maintain and enhance the financial health of the City of Tallahassee, in addition to completing city clerk duties, managing key finance staff and general accounting functions. Notable Achievements Investments - Portfolio Management, Pension & Non-Pension Being solely responsible for the generation of the city’s non-pension investment income through trade negotiation, management, monitoring and reporting processes of the city’s $800 million non-pension investment portfolio. Achieved 100% regulatory trading compliance through the refinement and management of the Broker Dealer Line-up due diligence process. Developed an Investment Maturities Visual Intelligence system to project 5 year cash flow through the customization of the City’s computerized accounting system (Tracker). This functionality greatly enhanced the City’s purchase planning capabilities and became standard to the vendor’s product. Regularly reviewed and successfully vetted selection and management of the Money Fund Manager Line-up, as a member of the Investment Advisory Committee. Staffed the Investment Advisory Committee to review performance of City’s Pension Plan, 401K & 457 Plans. Managed the City’s Investment policies & procedures guidelines to streamline all functions, standardize job descriptions and expectations. Standardized city-wide audit procedure to assure compliance with established policies, create efficiency & effectiveness and surface issues to be addressed. Thomas Carman, CPA Page 2 CITY OF TALLAHASSEE, Tallahassee, Florida, continued Debt Management Applied micro-strategy data collection and analysis to create clearer vision for the City’s annual Utilities Management budgetary process. Standardized system to determine and interact with financial entities responsible for maintaining the City’s Bond Deals. Achieved 100% on-time principal & interest debt payments through keen management of investment maturities and cash flow management. Streamlined and standardized the City’s Annual Report to Bondholders/ Disclosure Statement resulting in efficiency improvements, consistent archives and concise communication. Planned and converted the City’s Annual Report to Bondholders/ Disclosure Statement to digital format realizing efficiencies and cost savings. Cash Flow Management Developed and liaised highly synergistic relationships between the City, Custodial Banks and Broker/Money Fund Managers. Successfully managed capital contributions/distribution of Real Estate Funds. Planned and managed the conversion, roll-out and training of the City’s pay advice from centralized, manual and labor-intensive process to the PeopleSoft Self-Service, decentralized, paperless environment. Seamlessly achieved 90% employee analog to digital conversion with direct deposit functionality. Supported the achievement of better than index investment performance by successfully balancing the City’s cash needs with its investment opportunities. Through highly-effective team-building, strategic planning, organizational change and performance management, led a team of finance staff to 100% on-time check-disbursement, bank account reconciliation, payroll management and fund transfer to ensure daily cash operating needs were always met. General Accounting Management Established, prepared, reviewed standard journal entries for recording funds within the City of Tallahassee’s financial system (PeopleSoft). Prorated earnings to various City funds. Assisted in conversion and testing of system process to prorate earnings. Committee Memberships As co-founder and subsequent chair of the City of Tallahassee Rewards & Recognition Committee realized a $2 million cost savings through a 3-tiered Reward System. As a member of the In-house Investment Advisory Committee, proactively sourced and compiled due diligence data to optimize choice; proactively coordinated pre and post communication and task follow-up in addition to constructing standardized archives. TIME CUSTOMER SERVICE, INC., Tampa, Florida Financial Supervisor/Sr. Financial Analyst, April 1990 – August 1998 Maintained general ledger master files and internal cost statements. Coordinated monthly closings for parent and subsidiary companies, prepared annual insurance and census reports, assisted in resolution of various lease, rent, and tax questions. Provided financial information and research as required. Performed monthly uploads from Lotus into general ledger system on the mainframe. Created ad hoc reports with Paradox for Windows software on financial data used by management. Coordinate and prepare forms 10Q and 1120, personal property and intangible tax returns. Notable Achievements Successfully mapped and converted general ledger from MSA to Comshare resulting in consolidated financial statements and tax returns efficiencies. Eliminated $100,000 of tax property obligation over an 8 year period through proactive analysis and correction to inventory scheduling and valuations.. EDUCATION & EXECUTIVE DEVELOPMENT Certified Public Accountant – State of Florida IRS Paid Preparer – Expires January 2013 Masters of Science in Management Bachelors of Arts in Accounting Bachelor’s of Arts in History Florida Army National Guard – CAPTAIN