Word

advertisement

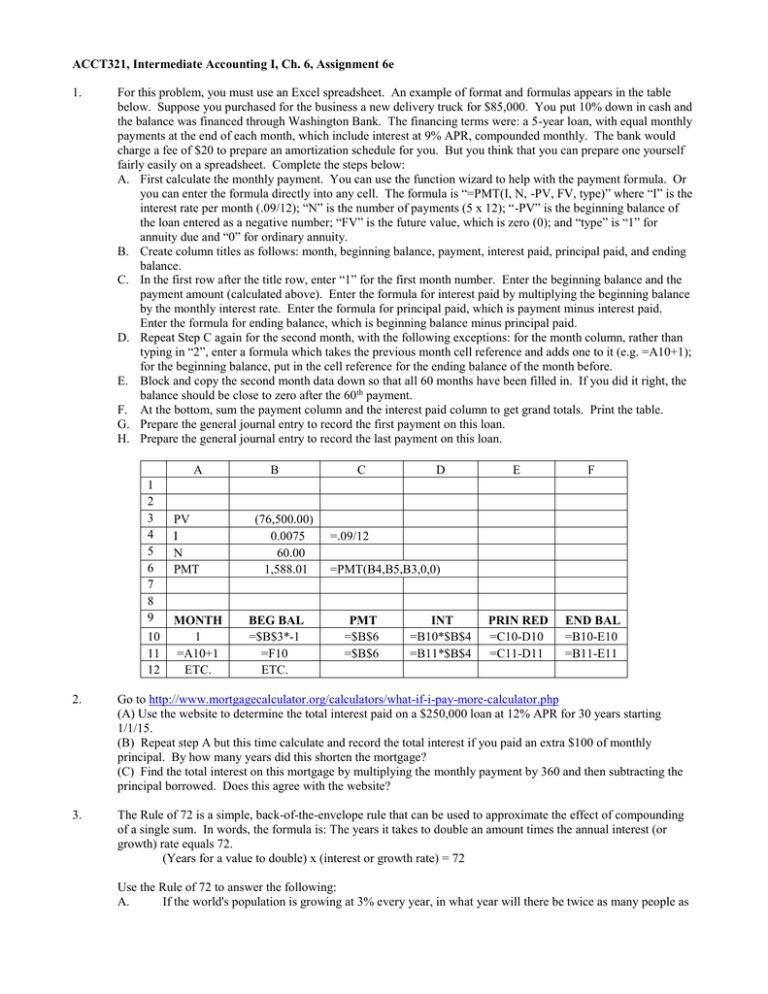

ACCT321, Intermediate Accounting I, Ch. 6, Assignment 6e 1. For this problem, you must use an Excel spreadsheet. An example of format and formulas appears in the table below. Suppose you purchased for the business a new delivery truck for $85,000. You put 10% down in cash and the balance was financed through Washington Bank. The financing terms were: a 5-year loan, with equal monthly payments at the end of each month, which include interest at 9% APR, compounded monthly. The bank would charge a fee of $20 to prepare an amortization schedule for you. But you think that you can prepare one yourself fairly easily on a spreadsheet. Complete the steps below: A. First calculate the monthly payment. You can use the function wizard to help with the payment formula. Or you can enter the formula directly into any cell. The formula is “=PMT(I, N, -PV, FV, type)” where “I” is the interest rate per month (.09/12); “N” is the number of payments (5 x 12); “-PV” is the beginning balance of the loan entered as a negative number; “FV” is the future value, which is zero (0); and “type” is “1” for annuity due and “0” for ordinary annuity. B. Create column titles as follows: month, beginning balance, payment, interest paid, principal paid, and ending balance. C. In the first row after the title row, enter “1” for the first month number. Enter the beginning balance and the payment amount (calculated above). Enter the formula for interest paid by multiplying the beginning balance by the monthly interest rate. Enter the formula for principal paid, which is payment minus interest paid. Enter the formula for ending balance, which is beginning balance minus principal paid. D. Repeat Step C again for the second month, with the following exceptions: for the month column, rather than typing in “2”, enter a formula which takes the previous month cell reference and adds one to it (e.g. =A10+1); for the beginning balance, put in the cell reference for the ending balance of the month before. E. Block and copy the second month data down so that all 60 months have been filled in. If you did it right, the balance should be close to zero after the 60th payment. F. At the bottom, sum the payment column and the interest paid column to get grand totals. Print the table. G. Prepare the general journal entry to record the first payment on this loan. H. Prepare the general journal entry to record the last payment on this loan. A 1 2 3 4 5 6 7 8 9 10 11 12 PV I N PMT MONTH 1 =A10+1 ETC. B (76,500.00) 0.0075 60.00 1,588.01 BEG BAL =$B$3*-1 =F10 ETC. C D E F PRIN RED =C10-D10 =C11-D11 END BAL =B10-E10 =B11-E11 =.09/12 =PMT(B4,B5,B3,0,0) PMT =$B$6 =$B$6 INT =B10*$B$4 =B11*$B$4 2. Go to http://www.mortgagecalculator.org/calculators/what-if-i-pay-more-calculator.php (A) Use the website to determine the total interest paid on a $250,000 loan at 12% APR for 30 years starting 1/1/15. (B) Repeat step A but this time calculate and record the total interest if you paid an extra $100 of monthly principal. By how many years did this shorten the mortgage? (C) Find the total interest on this mortgage by multiplying the monthly payment by 360 and then subtracting the principal borrowed. Does this agree with the website? 3. The Rule of 72 is a simple, back-of-the-envelope rule that can be used to approximate the effect of compounding of a single sum. In words, the formula is: The years it takes to double an amount times the annual interest (or growth) rate equals 72. (Years for a value to double) x (interest or growth rate) = 72 Use the Rule of 72 to answer the following: A. If the world's population is growing at 3% every year, in what year will there be twice as many people as B. C. 4. there are now? Suppose you just received a U.S. Savings Bond as a gift from Aunt Olga. The bond, which originally cost $50 and promises to return 6% interest compounded annually, can be redeemed at maturity for $100 (which includes interest). How many years until the bond matures? If you purchased a house in College Place 18 years ago for $50,000, and it was recently appraised at $100,000, what was the average annual appreciation rate over this period of time? Use the EAR formula (see instructor notes) to calculate how much would be in the bank after one year if you made one deposit of $100 now and left it there to earn interest at an annual percentage rate (APR) of 10 percent, assuming the interest is compounded: A. Annually D. Monthly B. Semi-annually E. Daily C. Quarterly F. Continuously** (** The effective annual rate for continuous compounding equals eqr - 1, where “e” is 2.7182 and “qr” is the quoted rate.) 5. Which is a better deal? Baker Boyer Bank offers 8.0% APR interest compounded quarterly. Down the street, Sterling Savings Bank promises 8.2% APR interest, compounded annually. In this problem, the EAR formula is one option that can be used to determine the effective annual rate. EAR = (1 + QR/m)m - 1, where “QR” is the quoted annual rate (APR) and “m” is the number of compounding periods per year. 6. A rule of thumb regarding retirement funding is to accumulate 10 or 12 times the amount of your total income the year before retirement. For most people with a comfortable retirement, this would mean at least $1 million. Assume that when you retire in 40 years, you want to have a million dollars and that you can earn 12% on your money (compounded annually). Note: large-cap stocks have returned close to 12% a year over the last 100 years. Answer each of the following independent questions: (A) How much do you need to deposit at the end of each of the 40 years (starting one year from today) in order to reach your goal of $1 million? (B) If you wait 10 years (30 years before retirement) to start saving, how much will you have to deposit at the end of each of the 30 years to reach your goal of $1 million? (C) Suppose you want to save each year for only the first 10 years, starting a year from today, and then leave that balance to earn interest for the remaining 30 years as a single sum. How much do you need to deposit each year for the first 10 years, in order to accumulate $1 million in year 40? (D) Compare part B and C. How much more did you deposit in B than in C? What’s the moral of the story?