chapter19 - YSU

advertisement

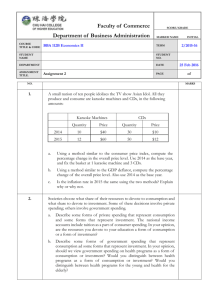

Chapter 19 The Classical Long-Run Model 1 Classical Model • A macroeconomic model that explains the longrun behavior of the economy • Classical model was developed by economists in 19th and early 20th, to explain a key observation about economy – Over periods of several years or longer, economy performs rather well • In the classical view, powerful forces drive economy towards full employment 2 Assumption of the Classical Model Markets clear • Price in every market will adjust until quantity supplied and quantity demanded are equal • Markets might not be clear in the short-run, but if we wait long enough, eventually, the change in price will equalize demand and supply. 3 The Classical Model • We’ll use classical model to answer important questions about economy in the long-run, such as – How does economy achieve full employment? – How much output will we produce? – What role is played by total spending? 4 Full Employment • Our first question is – How many workers will be employed in the economy? 5 Figure 1: The Labor Market 6 The Labor Market • Labor supply curve slopes upward As wage rate goes up, the opportunity cost of not working increases, so people are more willing to provide more labor • Labor demand curve slopes downward As wage rate goes up, the labor cost to firms increases, so firms tend to employ fewer workers than before • In classical view, economy achieves full employment on its own 7 Determining the Economy’s Output • The Production Function Relationship between total employment and total production in the economy Given that the amount of other resources and current state of technology are fixed 8 Figure 2: Output Determination in the Classical Model 9 Full Employment Output • In the classical or long-run view, economy reaches its potential output automatically Output reaches its potential, full-employment level on its own, with no need for government to maneuver the economy toward it 10 The Role of Spending • What if business firms are unable to sell all output produced by a fully employed labor force? – Economy would not be able to sustain full employment for very long • If we are asserting that potential output is an equilibrium for the economy – Total spending on output has to be equal to total production during the year – Can we be sure of this? • In classical view, the answer is YES 11 Total Spending in a Very Simple Economy • Imagine a world with just two types of economic units – Households and business firms • In a simple economy with just households and firms in which households spend all of their income – Total spending must be equal to total output • Known as Say’s Law 12 Figure 3: The Circular Flow 13 Total Spending in a Very Simple Economy • Say’s Law named after classical economist Jean Baptiste Say (1767-1832), who popularized the idea • Say’s law states that by producing goods and services – Firms create a total demand for goods and services equal to what they have produced or • Supply creates its own demand 14 Total Spending in a More Realistic Economy • In the real world – Households don’t spend all their income • Saving & taxes – Households are not the only spenders in the economy • Businesses and government buy some of the final goods and services we produce – In addition to markets for goods and resources, there is also a loanable funds market • Where household’s saving is made available to borrowers in business or government sectors 15 Some New Macroeconomic Variables • Planned investment spending (IP) IP = I – Δ inventories • Net taxes (T) T = total tax revenue – transfers • Household saving (S) Household sector’s disposable income » Disposable Income = Total Income – Net Taxes S = Disposable Income – C • Total Spending • Total spending = C + IP + G 16 Figure 4: Leakages and Injections 17 The Loanable Funds Market • Where households make their saving available to those who need additional funds • Supply of loanable funds – household saving • Demand of loanable funds – businesses and government 18 The Loanable Funds Market • Businesses’ demand for loanable funds is equal to their planned investment spending – Funds obtained are borrowed, and firms pay interest on their loans • Government’s demand for loanable funds – Budget deficit (G – T) Excess of government purchases over net taxes • Government’s supply for loanable funds – Budget surplus (T – G) Excess of net taxes over government purchases 19 Figure 5: Supply of Household Loanable Funds 20 Figure 6: Business Demand for Loanable Funds 21 Figure 7: The Demand for Funds 22 Equilibrium in the Loanable Funds Market • In classical view loanable funds market is assumed to clear – Interest rate will rise or fall until quantities of funds supplied and demanded are equal • Can we be sure that all output produced at full employment will be purchased? 23 Figure 8: Loanable Funds Market Equilibrium 24 Figure 9: An Expanded Circular Flow 25 The Classical Model: A Summary • Began with a critical assumption – All markets clear • In classical model, government needn’t worry about employment – Economy will achieve full employment on its own • In classical model, government needn’t worry about total spending – Economy will generate just enough spending on its own to buy output that a fully employed labor force produces 26