Health Insurance

advertisement

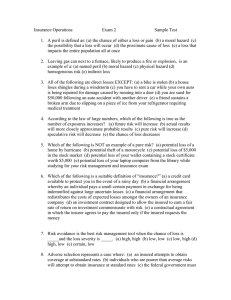

Life insurance is a contract specifying a sum to be paid to a beneficiary upon the insured’s death Beneficiary- the recipient of any policy proceeds if the insured person dies • To protect those who depend on you as a source of income Pay off home and debt at time of death Money for children whey they reach specific age Education for children Retirement income Savings A term policy is life coverage only • On the death of the insured it pays the face amount of the policy to the named beneficiary. • You can buy term for periods of one year to 30 years. • Benefits Cheap know exact amount paid out at death • Combination of a term policy with an investment component. Guaranteed face value will be paid The policy builds cash value that you can borrow against Riskier because of investment option Must stay in for 20 or more years to see benefits Expensive Disability Insurance replaces a portion of one’s income if they become unable to work due to illness or injury Short-Term Disability policies (STD) have a waiting period of 0 to 14 days with a maximum benefit period of no longer than two years. Long-Term Disability policies (LTD) have a waiting period of several weeks to several months with a maximum benefit period ranging from a few years to the rest of your life. based on • Age • Sex • Occupation • amount of potential lost income If you have paid in to SS, entitled to: • Payment if unable to work Physical or mental condition to prevents work Condition is expected to last 12 months or more • Benefits determined by Pay # of years covered by SS Health insurance provides protection against financial losses resulting from injury, illness, and disability. Entire group has same coverage Pay same premium Pro’s • Negotiate better coverage and lower premiums Con’s • If you are in good health pay more for others • Maternity? Insurer can’t cancel on any one person for medical reasons 1988 • 66% of large companies (200+ workers) offered retiree coverage 2009 • only 29% of large companies and 5% of smaller companies in 2009 Why is there such a gap between 1988 and 2009? High premiums/High deductibles Require a physical exam Insurer can refuse to cover certain health problems Co-pays- The amount an insured person is expected to pay for a medical expense at the time of the visit Co-insurance- the percentage of eligible charges payable by the insured for covered services • 80/20- insurance pays 80%, you pay 20% Out of Pocket Maximum- maximum dollar amount per year of eligible medical charges payable by the member directly to providers • Deductibles, co-pays, co-insurance Medical- routine visits, x rays, lab test • Prescription may be covered- use generic Hospital- bills for room, food, drugs Surgical- surgeon’s fees for operation • Cosmetic and elective no covered • Some surgeries may exlcuded Gives protection against catastrophic expenses of serious illness or injury Usually has a specified lifetime maximum Requires co-insurance • 20% Costs extra Can choose whether to enroll Different coverage for different plans Group of doctors and hospitals that work together to provide services at a set fee You must choose from doctors on list or it costs you more Co-payments Group plan offering prepaid medical care to members Has own facilities Must use a doctor on the HMO staff Routine physicals usually covered Co-pay required allows people who change jobs opportunity to continue group insurance for limited period of time (18 months) • Premiums paid by individual not • Purpose- give time to obtain other insurance from new employer or individual policy Medicare • Health insurance for people 65 and older • Are not fully covered until 67 • Paid for by employee payroll deductions Medicaid • Health insurance for people with low incomes and limited resources • Are limits and exclusions You hit and injure a pedestrian in a crosswalk Automobile! After losing her husband to a heart attack, the wife is left alone to care for 2 children Life! You need a cast after breaking an ankle while roller-blading Health! You apartment is broken into and your computer is stolen Renters! You are injured in an automobile accident and are unable to work for 2 months Disability! Your garage was destroyed by a fire which started by a lightning bolt hitting your home Homeowners! A daughter, who is financially responsible for her mother’s nursing home bills, dies from an undetected heart defect Life! A doctor diagnoses a child with tonsillitis during a visit to a clinic Health! Sick at home from food poisoning after eating a carnival corndog Nothing! You get pulled over and receive a speeding ticket on your way to the mall Nothing!