credit history & scores credit reports

advertisement

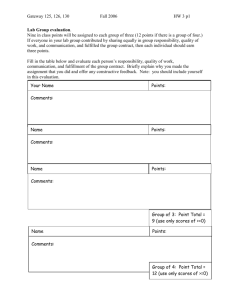

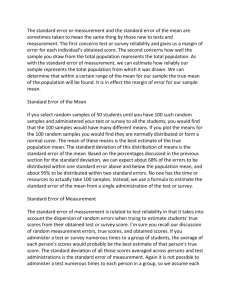

CREDIT HISTORY & SCORES CREDIT REPORTS aka: credit history 3 Credit Bureaus receive and maintain information on consumers: Experian, TransUnion, and Equifax This information helps lenders and others to make decisions about consumers. You are entitled to one free report each year from each credit Bureau (www.annualcreditreport.com) Credit scores are derived from your credit history Reports contain 4 categories of information Identification and Employment Payment History Inquiries Public Records Identification and Employment Name, address, and telephone numbers Social security number Spouse’s name Aliases Employment history, income Prior addresses Home ownership Payment History The Tradelines Accounts (installment, revolving, secured) Individual or joint Credit limits Current status How you have repaid Overdue information (30, 60, 90) Inquiries Credit reporting agencies record an inquire whenever your credit report is shown to another party, such as a lender, service provider, landlord, or insurer. Inquiries remain on your credit report for up to two years. Solicited vs. unsolicited How they impact your credit score Public Information Most public record information stays on your credit report for 7 years. Bankruptcies Liens and judgments Foreclosures Garnishments Late Child Support Payments What is not in your credit report? A credit report does not include information about: checking or savings accounts bankruptcies that are more than 10 years old charged-off or debts placed for collection that are more than seven years old gender, ethnicity, religion, political affiliation, medical history, or criminal records. Your credit score is generated by information on your credit report, but is not part of the report itself. Who can look at your credit report? Anyone with what is considered a permissible purpose can look at your report. Including: Potential and current lenders, landlords, & insurance companies Employers and potential employers (with your written consent) Companies you allow to monitor your account for signs of identity theft A state or local child support enforcement agency Any government agency Someone who uses your credit report to provide a product or service you have requested Someone that has your written authorization to obtain your credit report Fixing Errors on Your Report 1. Contact the Credit Reporting Agency 2. Contact the Creditor 3. Contact the other Credit Reporting Companies 4. Ensure the error is fixed within 30-45 days 5. If you cannot resolve the disputed information, add a brief statement to your file explaining the circumstances Additional Information about Credit Reports Negative Information stays on your report for 7 years, bankruptcies will show up for 10 years You are entitled to one free credit report each year; go to: www.annualcreditreport.com. You can also obtain a free copy if you are denied credit The Fair Credit Reporting Act (1971; amended in 1997 & 2003) is the federal law enables consumers to learn what information consumer reporting agencies have on file about them, and to dispute errors CREDIT SCORES A credit score is a rating used by a lender to help determine whether you qualify for a particular credit card, loan, or service. Based on information in your credit file, the credit reporting company analyzes your information using a complex mathematical model to yield your credit score. Why your score matters • Credit scores are used by lenders to estimate • if you'll pay off your loans and whether you'll pay on time. Because it's one of the most influential factors in deciding whether to grant you credit, knowing your score is important when you apply for a loan. It is used to determine the rates and terms of your loans. Why is credit scoring used? • It is fast • Scores are based on data and statistics • They are unbiased and nonjudgmental • It is a reliable tool to indicate risk Who calculates the score? Credit bureau scores are often called “FICO scores” because most credit bureau scores used in the U.S. are produced from software developed by Fair Isaac and Company. FICO scores are provided to lenders by the major credit reporting agencies. Names for FICO Scores Credit Reporting Agency FICO® Score Equifax BEACON® Experian Experian/Fair Isaac Risk Model TransUnion EMPIRICA® Your score ranges from 300 to 850, but the majority of scores fall within the 600s and 700s. Higher scores indicate a lower credit risk. For a score to be calculated, your credit report must contain at least one account that has been open for six months or more, and at least one account that has been updated in the past six months. What Factors Impact Your Score • • • • • • • Payment History Public Records Amount owed Length of credit history New accounts Inquiries Accounts in use How to improve your score • Keep account balances • • • • low Pay bills on time Don’t open credit cards/accounts you don’t need Have credit cards, but manage them responsibly Closing an account doesn’t make it go away What is not in your score? • • • • • • Gender Marital status Religion Ethnicity Nationality Bank Records