Auctions - Faculty Directory | Berkeley-Haas

Auctions

Strategic Situation

You are bidding for an object in an auction.

The object has a value to you of $20.

How much should you bid?

Depends on auction rules presumably

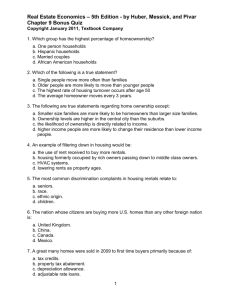

Review: Second Price Auctions

Suppose that the auction is a second-price auction

High bidder wins

Pays second highest bid

Sealed bids

We showed (using dominance) that the best strategy was to bid your value.

So bid $20 in this auction.

Review: English Auctions

An English (or open outcry) auction is one where bidders shout bids publicly.

Auction ends when there are no higher bids.

Implemented as a “button auction” in Japan

Implemented on eBay through proxy bidding.

What to Bid

Again, suppose you value the object at $20.

Dominance says to drop out when bid = value.

The fact that bidding strategies are the same in the two auction forms means that they are strategically equivalent.

Revenues

How much does the seller earn on the auction?

Depends on the distribution of values.

Suppose that there are 2 bidders and values are equally likely to be from $0 to $100.

The seller earns an amount equal to the expected losing bid.

Order Statistics

The seller is interested in the expected value of the lower of two draws from 0-100.

This is called the second order statistic of the distribution.

We will sometimes write this as E[V k

(n)

] where the k denotes the order (highest, 2 nd highest, etc.) of the draw and (n) denotes the number of draws.

So we’re interested in E[V 2

(2)

]

Order Statistics of Uniform

Distributions

There order statistics have simple regularity properties

The mean of a uniform draw from 0-100 is 50.

Note the mean could be written as E[V 1

(1)

].

100

0

50

Two Draws

Now suppose there are two draws.

What are the first and second order statistics?

0 33 66

100

Key Observation

With uniform distributions, the order statistics evenly divide the number line into n + 1 equal segments.

Let’s try 3 draws:

3rd

2nd

1st

50

0

25

75 100

Generalizing

So in general,

E[V k

(n)

] = 100* (n – k + 1)/(n + 1)

So revenues in a second price or English auction in this setting are:

E[V 2

(n)

] = 100 * (n – 1)/(n + 1)

As the number of bidders grows large, the seller’s revenues increase

As the number of bidders grows unbounded, the seller earns all the surplus, i.e. 100!

First Price Auctions

Now suppose you have a value of $20 and are competing with one other bidder in a firstprice auction

You don’t know the exact valuation of the other bidder.

But you do know that it is randomly drawn from 0 to 100.

How should you bid?

Setting Up the Problem

As usual, you want to bid to maximize your expected payoff

But now you need to make a projection about the strategy of the other bidder

Presumably this strategy depends on the particular valuation the bidder has.

Let b(v) be your projection for the bid of the other bidder when his valuation is v.

Bidder’s Problem

Choose a bid, B, to maximize expected profits.

E[Profit] = (20 – B) x Pr(B is the highest bid)

What is Pr(B is the highest bid)?

It is Pr(B > b(v))

What is Pr(B > b(v))?

b(v)

B

I win b -1 (B)

I lose v

Conjectures about b(v)

Suppose that I believe that my rival’s strategy is to bid a constant fraction of his value

Then b(v) = av

Where a is some fraction

I win whenever

B >= av

Or, equivalently

v <= B/a

So Pr(B > b(v)) becomes:

Pr( v <= B/a) = B/100a

Bidder’s Problem Revisited

So now I need to choose B to maximize

E[Profit] = (20 – B)(B/100a)

Optimize in the usual way:

(1/100a) x (20 – 2B) = 0

Or B = 10

So I should bid 10 when my value is 20.

Other Values

Suppose my value is V?

E[Profit] = (V – B)(B/100a)

Optimize in the usual way:

(1/100a) x (V – 2B) = 0

Or B = V/2

So I should always bid half my value.

Equilibrium

My rival is doing the same calculation as me.

If he conjectures that I’m bidding ½ my value

He should bid ½ his value (for the same reasons)

Therefore, an equilibrium is where we each bid half our value.

Uncertainty about my Rival

This equilibrium we calculated is a slight variation on our usual equilibrium notion

Since I did not exactly know my rival’s payoffs in this game

I best responded to my expectation of his strategy

He did likewise

Bayes-Nash Equilibrium

Mutual best responses in this setting are called Bayes-Nash Equilibrium.

The Bayes part comes from the fact that I’m using Bayes rule to figure out my expectation of his strategy.

Comments

In this setting, dominant strategies were not enough

What to bid in a first-price auction depends on conjectures about how many rivals I have and how much they bid.

Rationality requirements are correspondingly stronger.

Revenues

How much does the seller make in this auction?

Since the high bidder wins, the relevant order statistic is E[V 1

(2)

] = 66.

But since each bidder only bids half his value, my revenues are

½ x E[V 1

(2)

] = 33

Notice that these revenues are exactly the same as in the second price or English auctions.

Revenue Equivalence

Two auction forms which yield the same expected revenues to the seller are said to be revenue equivalent

Operationally, this means that the seller’s choice of auction forms was irrelevant.

More Rivals

Suppose that I am bidding against n – 1 others, all of whom have valuations equally likely to be 0 to 100.

Now what should I bid?

Should I shade my bid more or less or the same?

In the case of second-price and English auctions, it didn’t matter how many rivals I had, I always bid my value

What about in the first-price auction?

Optimal Bidding

Again, I conjecture that the others are bidding a fraction a of their value.

E[Profit] = (V – B) x Pr(B is the high bid)

To be the high bid means that I have to beat bidder 2.

Pr( B >= b(v

2

)) = B/100a

But I also have to now beat bidders 3 through n.

Probability of Winning

So now my chance of winning is

B/100a x B/100a x …B/100a

For n – 1 times.

Or equivalently

Pr(B is the highest) = [B/100a] n-1

Bidder 1’s optimization

Choose B to maximize expected profits

E[Profit] = (V – B) x Pr(B is highest)

E[Profit] = (V – B) x [B/100a] n-1

E[Profit] = (1/100a )n-1 x (V – B) x [B] n-1

Optimizing in the usual way:

(1/100a )n-1 x ((n-1)V – nB) [B] n-2 = 0

So the optimal bid is

B = V x (n-1)/n

Equilibrium

I bid a proportion of my value

But that proportion is (n-1)/n

As I’m competing against more rivals, I shade my bid less.

Since all my rivals are making the same calculation, in equilibrium everyone bids a fraction (n-1)/n of their value.

Revenues

How much does the seller make in this auction?

The relevant order statistic is E[V 1

(n)

] = 100* n/(n + 1)

But eveyone shades by (n-1)/n so

Revenues = (n-1)/n x E[V 1

(n)

]

Revenues = 100 x (n-1)/(n+1)

Comments

Revenues are increasing in the number of bidders

As that number grows arbitrarily large, the seller gets all the surplus, i.e. 100!

How does this compare to the English or

Second-Price auction?

Comparing Revenues

First-price:

R = (n-1)/n x E[V 1

(n)

]

R = 100 x (n-1)/(n+1)

Second-price:

R = E[V 2

(n)

]

R = 100 x (n-1)/(n+1)

The auctions still yield the same expected revenues.

Revenue Equivalence Theorem

In fact, revenue equivalence holds quite generally

Consider any auction which:

Allocates the object to the highest bidder

Gives any bidder the option of paying zero

Then if bidders know their values

Values are uncorrelated

Values are drawn from the same distribution

Then all such auctions are revenue equivalent!

Implications

This means that we can determine the revenues quickly and easily for all sorts of auctions

Consider an all-pay auction

Bidders submit cash payments to the seller

(bribes)

The bidder submitting the highest bribe gets the object

The seller keeps all the bribe money

This auction auction yields the same revenues as an English auction.

Other Strange Auction forms

Suppose that all bidders submit bribes to the auctioneer

The object is awarded to the person paying the highest bribe

And the seller gives back the bribe of the winner, but keeps all the others

This is also revenue equivalent.

Optimal Auctions

Revenue equivalence says that the form of the auction does not affect how much money the seller makes.

But there are other tools the seller has to make money.

One Bidder Auctions

Suppose that the seller is running an auction that attracts only one bidder.

What should he do?

If he goes with the usual auction forms, he’ll make nothing since the second highest valuation for the object is zero.

Monopoly

Since the seller is a monopoly provider of the good, maybe some tricks from monopoly theory might help.

Suppose a monopolist faced a linear demand curve and could only charge a single price

What price should he charge?

Monopoly Problem

P

Demand curve

Q

Monopoly Problem

The monopolist should choose p to maximize profits

Profits = P x Q(P) – C(Q(P))

Or equivalently, the monopolist could choose

Q to maximize profits

Profits = P(Q) x Q – C(Q)

P(Q) is the inverse demand function

Optimizing in the usual way, we have:

MR = MC

Monopoly Problem

P

Marginal Revenue

P*

MC

Q

Q*

Back to Auctions

What is the demand curve faced by a seller in a one bidder auction?

One can think of the “quantity” as the probability of making a sale at a given price.

So if the seller asks for $100, he will make no sales.

If he asks for $0, he will sell with probability = 1

If he asks $50, he will sell with probability .5

Auction/Monopoly Problem

P

100

50

0

1 Q = Pr of sale

1/2

Auction/Monopoly Problem

P

Q = 1 – F(p)

100

50

0

1 Q = Pr of sale

1/2

Demand Curve

So the demand curve is just the probability of making a sale

Pr(V > P)

If we denote by F(p) the probability that V

<=p, then

Q = 1 – F(p)

But we need the inverse demand curve to do the monopoly problem the usual way.

P = F -1 (1 – Q)

Auction/Monopoly Problem

Now we’re in a position to do the optimization.

The seller should choose a reserve price to maximize his expected profits

E[Profits] = p x (1 – F)

Equivalently, the auctioneer chooses a quantity to maximize

E[Profits] = F -1 (1 – Q) x Q

Optimization

As usual the optimal quantity is where MR =

MC

But MC is zero in this case

So the optimal quantity is where MR = 0

Auction/Monopoly Problem

P

Marginal Revenue

100

P*

0

1 Q = Pr of sale

Q*

So what is Marginal Revenue?

Revenue = F -1 (1 – Q) x Q

Marginal Revenue = F -1 (1 – Q) – Q/f(F -1 (1 –

Q))

where f(p) is (approximately) the probability that v = p

Now substitute back:

P – (1 – F(p))/f(p) = 0

Uniform Case

In the case where valuations are evenly distributed from 0 to 100

F(p) = p/100

f(p) = 1/100

So

P – (1 – P) = 0

Or

P = 50!

Recipe for Optimal Auctions

The seller maximizes his revenue in an auction by:

Step 1: Choosing any auction form satisfying the revenue equivalence principle

Step 2: Placing a reserve price equal to the optimal reserve in a one bidder auction

Key point 1: The optimal reserve price is independent of the number of bidders.

Key point 2: The optimal reserve price is

NEVER zero.

Conclusions

Optimal bidding depends on the rules of the auction

In English and second price auctions, bid your value

In first-price auctions, shade your bid below your value

The amount to shade depends on the competition

More competition = less shading

More Conclusions

As an auctioneer, the rules of the auction do not affect revenues much

However reserve prices do matter

The optimal reserve solves the monopoly problem for a one bidder auction