Chapter 14, 15

advertisement

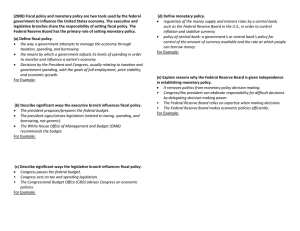

Unit III: Macroeconomics Chapter 14, 15: Fiscal Policy Chapter10/16: Monetary Policy Macroeconomic Concepts SSEMA1 The student will illustrate the means by which economic activity is measured. a. Explain that overall levels of income, employment, and prices are determined by the spending and production decisions of households, businesses, government, and net exports. b. Define Gross Domestic Product (GDP), economic growth, unemployment, Consumer Price Index (CPI), inflation, stagflation, and aggregate supply and aggregate demand. c. Explain how economic growth, inflation, and unemployment are calculated. d. Identify structural, cyclical, and frictional unemployment. e. Define the stages of the business cycle, as well as recession and depression. f. Describe the difference between the national debt and government deficits. SSEMA2 The student will explain the role and functions of the Federal Reserve System. a. Describe the organization of the Federal Reserve System. b. Define monetary policy. c. Describe how the Federal Reserve uses the tools of monetary policy to promote price stability, full employment, and economic growth. SSEMA3 The student will explain how the government uses fiscal policy to promote price stability, full employment, and economic growth. a. Define fiscal policy. b. Explain the government’s taxing and spending decisions. Unit III: Macroeconomics Chapter Chapter 12 Chapter 13 Chapter 14 Chapter 15 Chapter 16 Standards EMA1a,b,d,e EMA1c, EPF3a EPF 3,b,c EMA1f, EMA3,a,b EMA2a,b,c Standards Update Sheet Name:________________________________Class:_______________Instructor:___________________ + mastery Standard SSEMA1a SSEMA1b SSEMA1c SSEMA1d SSEMA1e SSEMA1f SSEMA1g SSEMA2a SSEMA2b SSEMA2c SSEMA3a SSEMA3b - needs improvement Activity Activity Activity Activity Activity Activity Activity Activity Activity Unit III: Macroeconomics 14: Vocabulary FIB Notes Daily 10 Current Events Chapter Activity Written Response Study Guide Participation Total 15: Vocabulary FIB Notes Daily 10 Current Events Chapter Activity Written Response Study Guide Participation Total 10/16: Vocabulary FIB Notes Daily 10 Current Events Chapter Activity Written Response Study Guide Participation Total Grade / / / / / / / / / Grade / / / / / / / / / Grade / / / / / / / / / Test Name Grade /100 /100 /100 /100 /100 /100 Final Unit II Test /100 Chapter 14 – Taxes and Government Spending Section 1 – What are Taxes? Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe I think Draw I think Draw • • • Tax – a required payment to a ______________________, ______________________, or ______________________ government – Income, _________________, property, ______________________, etc. Revenue – income received by the government from ___________________________ Tax Base – income, ______________________, ______________________that is subject to a tax Tax Structures • Proportional Tax – % of income taxes _________________________________________________ (__________ tax) • Progressive Tax – % of income paid in taxes ____________________________________________ (______________________tax) • Regressive Tax - % of income paid in taxes ____________________________________________ (_________ tax) Characteristics of a Good Tax 1. Simplicity – easy to ______________________, keep records, prepare ______________________, anticipate __________________________________ 2. Efficiency – easy to ______________________, taxpayers should not ______________________or take too much __________________ to pay 3. Certainty – clear ______________________, amount to be__________________, how ______________________ 4. Equity – ___________________, so not one person __________________________ or ______________________of the tax burden Individual Income Taxes • “Pay-As-You-Earn” Taxation – taxes are paid based on ___________________________; individuals pay income taxes _________________________________________ • Tax Withholding – tax payments taken out of employees pay ____________________________________________; ensures _______________________________________ • Tax Return – form used to __________________________________; declare _______________________________ • Taxable Income – A person’s gross income ______________________ exemptions and ______________________ • • • Personal Exemptions – set amounts that you ______________________ from your __________________________ • 0, 1, 2, 3, 4, 5, 6, etc Deductions – amounts you can ____________________, or ______________________from your gross income. • Interest on a _________________, children, ___________________, religious, ___________________, etc. Tax Bracket – scheduled rate at which you are ______________________ based on your ______________________ Corporate Income Taxes • FICA (Federal Insurance Contributions Act) – funds _________________________and ________________________ • Social Security – funds people of ______________________, survivors and ______________________, established in 1935, originally to provide ______________________pensions of workers • Medicare – national ___________________________program that helps pay for people over age of ________ or with ____________________________________ • Medicaid – national health insurance for people _______________________________________________________ • Unemployment – insurance for workers laid off through _____________________________________________ Other Types of Taxes • Excise tax – tax on ______________________, cigarettes, ______________________, phone service, cable, ______________________, etc. • Estate tax – “_________________ tax”, tax on ______________________ or value of money and ______________________ of a person who ______________________ • Gift tax – tax on money or ______________________ that one living person ____________________________; a person can give up to ______________________a year tax-free per individual • Tariff – ______________________ tax on foreign goods brought ________________________________________ Daily Assignment Questions – Ch. 14 Section 1 pgs. 359 – 360 *Answer in complete sentences* 1. How did taxes affect early American colonists? ________________________________________________________ 2. What gives the government the right to tax U.S. citizens? _______________________________________________ 3. What is the purpose of taxation? ___________________________________________________________________ 4. What are some things that are provided by the government through revenue? ______________________________ 5. Where is the power to tax found in the Constitution? ___________________________________________________ 6. What are the two limitations of taxes found in the taxation clause? _______________________________________ 7. What is Congress unable to tax? ____________________________________________________________________ 8. What is a tax base? ______________________________________________________________________________ 9. List the items that could be included in the tax base. ___________________________________________________ 14.2 and 14.3: Federal Taxes and Federal Spending Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe Definition Describe Definition Describe I think Draw I think Draw I think Draw Definition Describe I think Draw Fiscal Policy and The Federal Budget • Fiscal Policy – the use of government ______________________ and ______________________________ to ____________________________________________ • Federal budget – a written document indicating the _________________________________the government expects to ______________________ and how they will ______________________ – Released the first Monday in ______________________ each year • Fiscal year – ______month period, ______________________ 1 – ______________________ 30 Creating The Federal Budget • Step 1 – Federal agencies _____________________________; spending proposals are sent to the ____________________________________________ (OMB) • Step 2 – The OMB works with the ______________________ to create a ______________________, President presents to ______________________ • Step 3 – Congress ___________________________________to the budget and sends the amended budget to the ______________________ • Step 4 – The President ____________________________________________ Federal Spending • Mandatory Spending – programs that lawmakers are _____________________________________to spend money on (______________________, ______________________, ______________________, etc.) • Discretionary Spending – spending that government ______________________; ______________________ or ______________________ (______________________, environment, ______________________, etc.) Budget Deficits and the National Debt Balanced budget – money going into the U.S. Treasury is the same amount of money going out – Revenue _____ Spending – The last balanced budget occurred in ____________under President ______________________________ • Budget Surplus – occurs when the government takes in more than it spends – Revenue _____ Spending • Budget Deficit – occurs when the government spends more than it takes in – Revenue _____ Spending Dealing with a Budget Deficit • Create money – the government can ______________________or ________________________________________ • Borrow money – government borrows money by ________________________________ – Bond is a type of loan with a ____________________________________________ – Bonds sold ____________________________________________ – China owns ______________________dollars in U.S. bonds The National Debt • National debt – the total amount of money the federal government ______________________________________ • • Combination of all budget deficits over time Budget deficit – the amount of money the government owes to _________________________________________ Mandatory and Discretionary Spending Chart pgs. 371-373 Expansionary and Contractionary Fiscal Policies, pgs. 389-390 Word Definition Description 1. Purpose ________________________________ _______________________________________ Expansionary Fiscal Policies 2. Increase in government spending____________ _______________________________________ _______________________________________ 3. Cutting Taxes ___________________________ _______________________________________ 4. Purpose ________________________________ _______________________________________ Contractionary Fiscal Policies 5. Decrease in government spending ___________ _______________________________________ _______________________________________ 1. Cutting Taxes ___________________________ _______________________________________ Tools of Fiscal Policy Chart Fiscal Policy 1. The government cuts business and personal income taxes and increases its own spending. 2. The government increases the personal income, Social Security and corporate income tax. 3. Government spending goes up while taxes remain the same. 4. The government reduces the wages of its employees while raising taxes on consumers and businesses. Expansionary/ Contractionary Explanation Model of Aggregate Demand and Supply Model used to explain ______________________________in economic activity around its long-run trend • Aggregate - sum of all ____________________________________________________________________ • Two variables: ◦ Economy’s ________________________________________________ ◦ Average ___________________________________________ (CPI or GDP Deflator) Aggregate Demand Aggregate-_____________________________________________ Sum of ______+______+______+______ (real _________) at each price level _____________________________________________ Low price levels increase the quantity of _____________________________, vice versa Why is the AD Curve Downward Sloping? Wealth effect – consumers are ________________________, which stimulates the ________________________________________________ Interest rate effect – interest rates _____________________, which stimulates the ________________________________________________ Exchange Rate effect – currency ________________________, which stimulates the ________________________________________________ Why the AD Curve Might Shift? Shifts arising from changes in consumption ◦ Decreases in ________________________– people become more concerned with _______________________________________________________________ ◦ Increases in spending – _____________________________________________ Shifts arising from changes in investment ◦ Change in firm investing – tax ________________________, pessimism about _____________________________________________, interest rates Shifts arising from changes in government purchases ◦ Congress ________________________/decreases ________________________ Shift arising from changes in net exports ◦ Global ________________________ would cause a _____________________________________________ What Shifts the Aggregate Demand Curve? Situation Congress cuts taxes Change in AD New AD Curve Business spending decreases Government spending increases; no new taxes Survey shows consumer confidence jumps Stock collapses; investors lose billions President cuts defense spending by 20%; no increase in domestic spending Effects of Fiscal Policy Chart Scenario 1. National unemployment rate rises to 12% 2. Inflation is strong at a rate of 14% per year. 3. Surveys show consumers are losing confidence in the economy, retail sales are weak and business inventories are increasing rapidly 4. Business sales and investment are expanding rapidly, and economists think strong inflation lies ahead. 5. The government eliminates the deductibility of interest expense for tax purposes Expansionary/ Contractionary Effect on Federal Budget Objective for Aggregate Demand Action on Taxes Action on Gov’t Spending Effect on the National Debt Daily Assignment Questions State and Local Taxes and Spending 1. What does a states operating budget pay for? List examples. ____________________________________________ 2. What does a state’s capital budget pay for? List examples _______________________________________________ 3. How do the state budgets differ from the federal government? __________________________________________ 4. Where are taxes spent? Describe each of the following: 1. Education _______________________________________________________________________________ 2. PublicSafety ___________________________________________________________________________ 3. Highways and Transportation ________________________________________________________________ 4. Public Welfare ___________________________________________________________________________ 5. Arts and Recreation _______________________________________________________________________ 6. Administration ___________________________________________________________________________ CHAPTER 10 – Money and Banking Section 1 – The Evolution of Money Money – assets people use to ________________________________________________________ Three Functions of money: 1. ________________________________________________________ 2. ________________________________________________________ 3. ________________________________________________________ Functions of Money Medium of Exchange – payment for _____________________________________; buyers give sellers in exchange for _________________________________________________________ Barter system – economy that relies on ______________________________________________________________ Unit of Account– an expression of _____________________________; a means for comparing the _________________________ of _____________________________________________________ Keeps track of ______________________________ and __________________________________________ Store of Value – money keeps its value if you decide to _________________________________________________ Helps people convert ________________________________________from present to ________________________________________ Wealth – combination of all ________________________________________; both ________________________________________and ________________________________________ assets Forms of Money Commodity money – money that has an _____________________________________________________________ Gold, _______________________, oil, _____________________, wheat, ________________________, etc. Fiat – order/_________________________; ________________________________ issued money Paper/_____________________ Representative – money that can be ______________________________________________________________ – IOU, ______________________, bonds, etc. Currency – _____________________ and _____________________________ used as money Section 3 – Banking Today Measuring the Money Supply Money supply – quantity of ____________________________________________________ Liquidity – ease with which an ___________________________ (liquid asset) can be converted into ________________________________________/________________________________________ Liquid – ________________________________________ Nonliquid - ________________________________________ M1 – money that people can gain access to _________________________and ___________________________________; checkable ________________________________________________. – High liquidity - ________________________________________, traveler’s checks M2 – consists of all the assets in M1 plus __________________________________________________________ – Slightly less liquid - _________________________accounts, __________________________________, ________________________________, etc. – The Six Characteristics of Money – pgs. 245-246 Characteristic Description 1. Durability Examples 2. Portability 3. Divisibility 4. Uniformity 5. Limited Supply 6. Acceptability The Functions of Financial Institutions – pgs. 259 - 262 Characteristic Description 1. Storing Money 2. Saving Money 3. Loans 4. Mortgages 5. Credit Cards 6. Simple and Compound Interest 7. Banks and Profit Example s Chapter 14 - 15 Study Guide Taxes and Fiscal Policy – pgs. 359 – 409 1. A ___________________________________ is a required payment to local, state, or national government. 2. The income received by the government from tax collection is known as _____________________________________. 3. The use of government spending and revenue collection (taxation) is known as ____________________________ policy 4. A ____________________________________income, property, good or service that is subject to a tax. 5. The percentage of income taken in taxes remains the same with a ________________________________________ tax. 6. The percentage of income in taxes increases as income increases with a ___________________________________ tax. 7. The percentage paid in taxes decreases as income increases with a _______________________________________ tax. 8. List the 4 characteristics of a good tax: a. ______________________________________________________________________________________ b. ______________________________________________________________________________________ c. ______________________________________________________________________________________ d. ______________________________________________________________________________________ 9. The idea that you pay taxes throughout the year as opposed to one lump sum is known as _______________________________________________ taxation. 10. Tax _________________________________________ is the process of taking tax payments out of an employee’s pay before she or she receives it. 11. The form you use to file income taxes is known as a ____________________________________________________ 12. A person’s gross income minus exemptions and deductions is known as _______________________________________ 13. _____________________________________________ are set amounts that an individual can subtract from their gross income for themselves, their spouse, and any of their dependents. 14. ____________________________________________ are variable amounts that you can subtract or deduct from your gross income. 15. __________________________ taxes fund two large government programs, Social Security and Medicare. 16. ________________________ taxes are taxes on estate, or total value of the money and property of someone who has died. 17. The __________________________ tax is a tax on money or property that one living person gives to another. 18. Taxes on imported goods are known as ________________________________________. 19. A _______________________________________________ is the use of taxation to encourage or discourage behavior, such as an excise tax. 20. Mandatory spending refers to _________________________________________________________________________ 21. Discretionary spending refers to _______________________________________________________________________ 22. Entitlement programs are ____________________________________________________________________________ 23. Briefly describe each of the following entitlement programs: a. Social Security _______________________________________________________________________________ b. Medicare ___________________________________________________________________________________ c. Medicaid ___________________________________________________________________________________ 24. The largest portion of discretionary spending is budgeted for ________________________________________________ 25. Other than defense, what are some additional areas that fall under discretionary spending? ______________________ 26. A state’s ____________________________________________ budget pays for day to day expenses whereas their _____________________________________ pays for major capital investments in roads, buildings, etc. 27. List the two differences between a state and federal government’s budget: a. ______________________________________________________________________________________ b. ______________________________________________________________________________________ 28. List the 6 areas that a state government uses their taxes: a. ______________________________________________________________________________________ b. ______________________________________________________________________________________ c. ______________________________________________________________________________________ d. ______________________________________________________________________________________ e. ______________________________________________________________________________________ f. ______________________________________________________________________________________ 29. The federal government’s revenues and spending for the coming year is the _____________________________ budget. 30. A fiscal year is a ____________________________________________________________________________________ 31. Describe the 4 steps in creating a federal budget: a. Step 1______________________________________________________________________________________ b. Step 2______________________________________________________________________________________ c. Step 3______________________________________________________________________________________ d. Step 4______________________________________________________________________________________ 32. Fiscal policies that try to increase output in the economy are known as _______________________________________ 33. Fiscal policies intended to decrease output in the economy are ______________________________________________ 34. How did the perspectives of classical economists such as Adam Smith, David Ricardo and Thomas Malthus differ from that of John Maynard Keynes, Keynesian economics, with respect to fiscal policy (pgs. 395-396)? a. Classical Economics___________________________________________________________________________ b. Keyensian Economics_________________________________________________________________________ 35. A balanced budget is when ___________________________________________________________________________ 36. A budget surplus occurs _____________________________________________________________________________ 37. A budget deficit occurs ______________________________________________________________________________ 38. The national debt is _________________________________________________________________________________ 39. What is the difference between national debt and government budget deficits? ________________________________ 40. Two things that the government can do to deal with a deficit are: a. ________________________________________________________________________________________ b. ________________________________________________________________________________________ Chapter 16 – The Federal Reserve The Federal Reserve The Federal Reserve (“_________________________”) – the ____________________________________________ Created in _________________________ Monetary Policy – directly __________________________________________________ Responsible for regulating the __________________________________________________ Top of dollar “__________________________________________________” Structure of the Federal Reserve Board of Governors - run by a __________________________________________________ Appointed by the _________________________________, confirmed by the _______________________________ to __________________________________________________ Board is led by the _________________________ Current chairman – _________________________________________ Fed is comprised of _________________________________________________________ One Federal Reserve Bank for ______________________________ Each FRB ________________________________________________________________________________ The Federal Open Market Committee Structure and function: Run by a __________________________________________________and ________of the 12 regional bank presidents Increase or decrease the _________________________ The Fed’s Tools of Monetary Control Three monetary policy tools 1. __________________________________________________ 2. __________________________________________________ 3. __________________________________________________ Open-Market Operations – Open-Market Operations – the purchase and sale of _____________________________________________ – Most __________________________________________________ – Increase money supply, __________________________________________________ – Decrease money supply, _________________________________________________ Reserve Requirements Reserve Requirements – regulations on the __________________________________________________________ – _______ on M1 – Influences how much money __________________________________________________ (reserves) – Increase in RRR, banks must _____________________________________________, can __________________________________________ – Decrease in RRR, banks must _______________________________________, can __________________________________________ The Discount Rate Discount Rate – interest rate on loans the Fed _________________________; currently __________________% – Fed is the ______________________________________ – Banks borrow from Fed when it has _____________________________; too many loans, ______________________________________ – Lower discount rate ____________________________________________ – Higher discount rate ____________________________________________ Federal Funds Rate – _______________________ interest rate that banks charge each other for loans – Currently _________________% The Fed Today Video Questions 1. What is a U.S. $20 bill officially?_____________________________________________________________ 2. How many forms of currency existed at one time during the 1800s? ___________________________________ 3. Why did some people lose faith in the banking? _______________________________________________________ 4. What is the Fed’s primary goal? ___________________________________________________________________ 5. What can a fast/slow money supply lead to? _______________________________________ 6. Government securities are in the form of _____________ 7. What is the transfer of money from one bank to cover a check called? _____________________________________ 8. How many checks does the Fed clear per year? ____________________________________________________ Money Creation Fractional-reserve system – banks hold only a _________________________________reserves as opposed to a __________________________________________________ Reserve – money deposit ________________________________________________________________________ – Reserves and loans are _________________________ – Loans are __________________________________________________ Required Reserve Ratio – set by the Fed, minimum amount that __________________________________________ – Established by the Federal Reserve, _____/______ or _______% of M1 Excess Reserves – reserves in addition to ______________________________________________ – $1000 deposit, the bank would hold $_____________in reserve and have $______________for lending Money Multiplier Money multiplier formula – is the amount of money that the ____________________________________________ – MM = __________ – Initial Cash Deposit (_________________________) – The higher the ________________, the __________________________________________________ (vice versa) – 100 (1/10) = ____________________ – 100 (1/.05) = ____________________ Personal Deposit Person A Deposit (Money Supply) Required Reserves (Assets) Excess Reserves (Liabilities) $2,000 Person B Person C Totals RRR and Money Multiplier Review A $2000 deposit is made in the bank and the RRR is 12%. 1. How much must be held as required reserves? ___________________________ 2. How much will be available in excess reserves? ___________________________ 3. How much could the initial deposit increase the money supply if the RRR was 12%? _______________________ 4. How much could the initial deposit increase the money supply if the RRR was 10%? _______________________ 5. How much could the initial deposit increase the money supply if the RRR was 5%? _______________________ 6. Which RRR yielded the greatest amount? Explain why. ______________________________________________ ____________________________________________________________________________________________ 7. Chapter 10 + 16 Study Guide Chapter 10 – Money and Banking 1. ___________________________________ are the assets people use to buy goods and services. 2. Money is a ___________________________________________ , which serves as payment for products; buyers give sellers in exchange for goods/services. 3. An economy that relies on trade of one product for another uses a ____________________________ sytem. 4. An expression of worth; a means for comparing the values of goods and services is money as a ___________________________________________________ 5. Money as a _____________________________________ keeps its value if you decide to store it instead of spend it. 6. The combination of all stores of value; both money and nonmonetary assets is a person’s _____________________ 7. Money that has alternative use as a commodity such as gold, silver, oil, corn, wheat, cotton, etc. “order/decree” government issued money is known as a ________________________________________. 8. Money that can be exchanged for something of value IOU, Paper Receipts, bonds, etc. coins and paper bills used as money is ______________________________________________ money. 9. The total quantity of money in the economy is the __________________________________________. 10. __________________________________ represents the ease with which an asset (liquid asset) can be converted into money/medium of exchange. 11. Money that people can gain access to easily and immediately are known as _________________________deposits. 12. M____ represents the balances in bank accounts that have high liquidity - checking accounts, traveler’s checks 13. M____ consists of all the assets in M1 plus assets that are not as liquid that are slightly less liquid, savings accounts, money market 14. List the 6 characteristics of money 1) ____________________________________________ 2) ____________________________________________ 3) ____________________________________________ 4) ____________________________________________ 5) ____________________________________________ 6) ____________________________________________ Chapter 16 – The Federal Reserve and Monetary Policy Section 1 – The Federal Reserve System 15. The Federal Reserve was established in ________________ , the nickname for the system is ___________________ and is composed of ______________________________________________________________________________ 16. The Federal Reserve System is overseen by the _______________________________________________________, which is headquartered in ________________________________________________________________________ 17. How are the seven members appointed? ____________________________________________________________ ______________________________________________________________________________________________ 18. The process by which the government, central bank, or monetary authority of a country controls the supply of money, availability of money, and cost of money or rate of interest, in order to promote growth and stability of the economy is known as ________________________________________________ policy. 19. The Federal Reserve Act divided the United States into _______________ regional banks, one each serving their district. 20. What purpose does each Federal Reserve Bank in its district serve? _______________________________________ ______________________________________________________________________________________________ 21. What is the advantage to having the Fed independent of a governmental agency? ___________________________ ______________________________________________________________________________________________ 22. The Federal Open Market Committee makes key decisions about the nation’s money _________________________ Section 2 – Federal Reserve Functions Briefly describe each of service based roles of the Federal Reserve below: 23. Service Roles a. Federal Government’s Banker_____________________________________________________________________ b. Government Securities Auction ___________________________________________________________________ c. Issuing Currency________________________________________________________________________________ d. Check Clearing _________________________________________________________________________________ e. Supervising Lending Practices _____________________________________________________________________ f. Lender of Last Resort ____________________________________________________________________________ 24. Regulatory Roles g. Reserves ______________________________________________________________________________________ _____________________________________________________________________________________________ h. Bank Examinations______________________________________________________________________________ _____________________________________________________________________________________________ i. Regulating the Money Supply_____________________________________________________________________ _____________________________________________________________________________________________ Section 3 – Monetary Policy Tools 25. The ___________________________________________________ is responsible for manufacturing money, while the ________________________________________________ is responsible for putting dollars into circulation. 26. How does the bank make money on your $1,000? _____________________________________________________ 27. The amount that the bank is allowed to lend is determined by the ________________________________________ 28. If you deposit $1,000 of borrowed money in a bank checking account, how much is the bank allowed to lend? ______________________________________________________________________________________________ 29. The amount of money created in the end by an initial investment is the ____________________________________ 30. Reserves that are greater than the required amounts are known as _______________________________________ 31. How do banks respond to a lowered discount rate? ____________________________________________________ ______________________________________________________________________________________________ 32. How does a raised discount rate affect bank loans and the money supply? __________________________________ ______________________________________________________________________________________________ 33. What effect does the Fed’s purchase of government bonds have on the money supply? _______________________ ______________________________________________________________________________________________ 34. How does the Fed’s sale of the bonds reduce the money supply? _________________________________________ ____________________________________________________________________________________________ Math Practice – Required Reserve Ratio and the Money Multiplier 35. If $2,000 is deposited in the bank, calculate how much the bank must hold in reserve for each of the following reserve ratios, then calculate how much the bank can lend for each of the following reserve ratios. Required Reserve Ratio Required Reserves (Assets) Excess Reserves (Liabilities) 1% 5% 10% 36. To illustrate how money can be "created", fill in the form shown below. We will begin with a few assumptions. The Reserve Ratio is 10%. The bank lends all of its excess reserves to the next person on the list. That person deposits the loan into their checking account. Required Reserve Ratio Person A Checking Deposit (Money Supply) $2,000 Required Reserves (Assets) Excess Reserves (Liabilities) Person B Person C Totals 37. Calculate the money multiplier for each of the following reserve ratios. Required Reserve Ratio Initial Deposit 1% $2000 5% $2000 10% $2000 Money Multiplier Increase in Money Supply