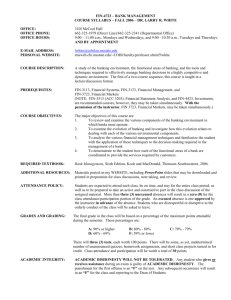

on Activities of the Hungarian Banking Association

advertisement