Jeremy Miller Financial Analysis

advertisement

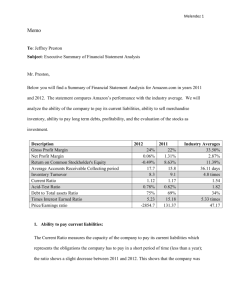

Jeremy Miller ACCT – 1120 Financial Statement Analysis Assignment Amazon.com Financial Statement Analysis Introduction: I am doing a financial analysis on the company Amazon and am going to tell of many attributes that contributes to its wellbeing. The things I will explain and tell about include its ability to pay current liabilities, its ability to sell merchandise inventory and collect receivables, its ability to pay long term debt, its profitability and its ability to gain and sustain profit through the years and I am going to evaluate its stock as an investment. For the most part, I will be analyzing its differences from the two previous years 2011 and 2012. Ratio analysis and horizontal analysis will be used in this paper by comparing financial statements and by comparing the differences between the years 2011 and 2012 respectively. Ability to pay current liabilities: To start with, we are going be using the working capital formula. Working capital is found by subtracting the businesses assets by its liabilities and is a good way to measure just how well the company will be able to pay off its current liabilities. In 2011, the working capital amounted to 2594 and in 2012 it was 2294. This is a difference of 300. The working capital from 2011 decreased in 2012 and we can easily explain this because the amount of liabilities in 2012 was more than in 2011. Now, onto the current ratio. The current ratio is found by dividing total current assets over total current liabilities. The current ratio in 2011 was 1.17, but it decreased to 1.12 in 2012. Amazon still had more current assets than they did current liabilities, but the liabilities had increased to a level where it made the ratio decrease. We will now use the acid-test ratio to determine how Amazon would handle its current liabilities if they happened to all become due immediately. The acid-test ratio is found by using the formula cash plus short term investments plus net current receivables (very liquid assets), all over the total current liabilities. In 2011, the acid-test ratio was .82 and in 2012 it was .78. Amazon would be wise to keep an eye on their current liabilities because they are not meeting short-term obligations. The industry average is 1.82 and Amazon is far below that number. They are below the average on being able to pay off their liabilities. Ability to Sell Inventory and Collect Receivables: Ratios are also going to play a big role in determining how well Amazon is able to sell inventory and collect receivables. To evaluate the ability to sell inventory, the inventory turnover ratio and the day’s sales inventory ratio will be used. The inventory turnover ratio is found by dividing the cost of goods by average merchandise inventory. Its 2011 amount was 9.1 for the inventory turnover and 8.3 in 2012. The day’s sales inventory will be calculated by dividing 365 days by the inventory turnover ratio. In 2011, it would take over 40 days to sell their inventory and about 44 days in 2012 to sell it whilst the average for this days sales inventory ratio is 75.42. Amazon is doing a much better job of getting its inventory out than the rest of the industry on average. We will now analyze Amazon’s ability to collect on receivables. The ratios that we will look at to determine this will be the gross profit percentage, which tells how much the company is making on its inventory, the receivable turnover ratio, which measures how many times receivables are collected every year, and the days sales in receivable ratio, which tells how long a company will take to collect their receivables. For gross profit percentage, gross profit will be taken and divided by net sales revenue. In 2011, the gross profit percentage 22% while it was 24% in 2012. Amazon increased efficiency in sales from 2011 to 2012. Alas, the industry average for gross profit percentage is 33.55% so Amazon is well beneath the average. For the accounts receivable turnover ratio, we will divide net credit sales by the average net accounts receivables. The days in sales receivables will be obtained by taking 365 days and dividing by your answer for the accounts receivable turnover ratio. In 2011, the days in sales receivable ratio was 15.8 days and in 2012 it was 17.7 days. This decrease is not preferred because generally, the faster that accounts receivables are collected the better. If we look at the industry average for the receivable turnover ratio, it comes to a 36.11 days compared to Amazon’s 15-17 days. Amazon is collecting its accounts receivables much faster than the industry average which is preferred. Paying Long Term Debt: In this section we will analyze the ability of Amazon to get rid of its long term debt. To do this we will take a look at their debt to total assets, debt to equity, and times interest earned. First comes debt ratio. This is obtained by dividing total liabilities by total assets. This shows proportion of assets that are financed with debt. Debt to equity ratio shows financial leverage and the formula for this is taking total liabilities and dividing it by the total equity. The times interest earned ratio will be formulated by taking the net income plus income tax expense plus interest expense and dividing all of that by the interest expense. This ratio will tell how many times a company will be able to pay off its interest expense. To start, the debt ratio was 69% and in 2012 it was 75%. This tells us that in 2012, 75% of its debt was financed with assets and the remainder was by the owner. The industry average is 34% meaning that Amazon is very risky when it is handling its debt. Second, the debt to equity ratio was 2.26 in 2011 and 2.97 in 2012. This tells us that Amazon generally finances more of its assets with debt over equity. The industry average for the debt to equity ratio is 52%, well above the Amazon’s ratio telling us more of how debt is handled riskily by Amazon. Thirdly, the times interest earned ratio was 15.18 in 2011 and 5.23 in 2012. This tells us that Amazon had enough income to pay off its interest 15.18 times, but in 2012 it could only pay it off 5.23 times which is a hefty decrease in this ratio. Still, the industry average is only 5.33 for this ratio meaning that Amazon is barely behind the rest of the industry when it comes to paying its interest expense Profitability: Furthermore, ratios will once again be used to determine a lot of the company’s profitability. The first is the profit margin ratio which tells us how much net income is earned on every dollar of net sales. For 2011, profit margin was 1.31% and in 2012 is was -.06%. This tells us that Amazon had a net gain/income in 2011, but a net loss in 2012. The industry average is listed at 2.87% meaning that Amazon earns well below average for every dollar of net sales. Next is the return on assets ratio. It was 8.63% in 2011 and it was -.49% in 2012. This ratio tells success of the company to earn income using its assets. This tells us that Amazon was much more unprofitable in 2012 than it was in 2011. The average for this ratio is 4.76% meaning that in 2012, Amazon was far below average on earning income with assets. Lastly, we will use the earnings per share ratio, which will tell us the amount of gain or loss per share of the company. Since it was lower in 2012 than it was in 2011 that shows that it had that much more of a loss in 2012 per share than it did gain in 2011. Seeing this information, we could conclude that Amazon was unfortunately not profitable in 2012. The 2011 story speaks a little differently. Evaluating efficiency in Investments: The ratio that we will be looking at to evaluate this is the price/earnings ratio. To calculate this, we take Market price per share of common stock and divide that by earnings per share. This ratio states that the amount of the ratio is the value that the stock market places on every dollar of a company’s earnings. For 2011, Amazon’s price/earnings ratio was 131.37 and it was -2854.70 in 2012. The industry average for the price/earnings ratio is 47.17 which says that Amazon would have been successful in 2011. Looking at 2012 however we could see that the company is losing money. Conclusion: Looking at all of the information above us could conclude a couple of different things both good and bad about the company. The difficulty of Amazon to be able to pay off liabilities is progressively becoming more of a trend and they could definitely use some work in that department seeing that the industry average is much above where Amazon is at. However, when it comes to selling and collecting receivables Amazon seems to be on the ball. They are far above the industry average in selling merchandise and collecting accounts receivables and efficiency is visible in this area. The debt of the company tells a different story in how Amazon is so risky when it comes to paying it off. This is another area where they are becoming progressively worse off in and they could definitely use some adjusting. Taking everything into consideration, Amazon had a pretty good year in 2011, but needs to make some changes to recover from this year of 2012. A lot of areas we looked at tell how much difficulty they had this year, though they also had successes. Seeing these statistics, I really wouldn’t fear for the company financially. The drop in success was only from one year to another and I feel that this could be turned around very quickly and efficiently with the right business choices and principles.