Reconcile a Bank Statement

advertisement

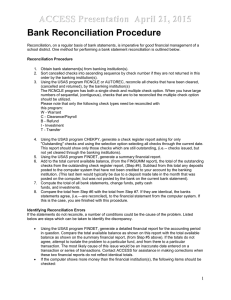

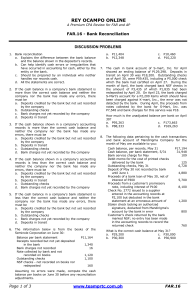

Reconcile a Bank Statement UNIT 1 LESSON 2 First… some definitions Bank statement Shows Statement period The all transactions that have occurred during the month dates in which the transactions occurred Starting balance The amount of money in the account at the beginning of the statement period… NOT when you opened the account! A Couple More… Ending balance The amount of money in the account at the end of the statement period Outstanding deposits Money that was put into the account that do not appear on the statement Outstanding checks Checks that have been written that do not appear on the statement How do we keep track? Customers keep a record of all transactions in their checking account in the check register Banks keep a record of the customer’s transaction on the bank statement Each month, the bank sends a statement showing the transactions that have affected the checking account It is your job to compare your register to the bank’s statement Why is this important? What is included on the bank statement? Your information (name, address, phone number) Your account number A list of all transactions that have occurred during the statement period The starting and ending balance Any fees charged to the account Any interest added to the account Example of a Bank Statement Deposits and Checks DEPOSITS The deposit section shows the money that was deposited into the account during the period CHECKS Checks that do not appear on the bank statement have not “cleared” the bank This means the money has not been withdrawn from your account You still must subtract them from your balance! These are called “Outstanding Checks” These are called “Outstanding Deposits” Reconciling a Bank Statement This means comparing what you have in your check register to what the bank says you should have This is VERY important You could have made a mistake and have less money than you thought—BIG TIME PROBLEMS! The bank could have made a mistake and you have more money than you thought—YAY YOU! How to reconcile an account: 1. Check off checks that have cleared the bank in your check register (verify check number and amount!) 2. Do the same with deposits 3. Record any service charges that the bank has CHARGED YOU in your check register 4. Record any interest that the bank has PAID YOU in your check register 5. Look to see if the final amounts are equal On the back of your bank statement, the bank provides you a reconciliation form to make this process easier for you! Example of a Reconciliation Statement Let’s Practice Page 124 & Reconciliation Form Check your understanding… Nancy has a balance of $1,078 in her check register. The balance on her bank account statement is $885.84. Not reported on her bank statement are deposits of $575, and $250 and two checks for $195 and $437.84. Is her check register balanced? Explain. Practice Problem Maria and Brian have a joint checking account. They have a balance of $3,839.25 in the check register. The balance on the bank statement is $3,450.10. Deposits of $2,000, $135.67, $254.77, and $188 are outstanding. Checks in the amounts of $567.89, $23.83, $598.33, and $1,000 are outstanding. Reconcile the bank statement. Your turn… Reading a Bank Statement WS Reconciling an Account WS Bank Reconciliation Activity Daily Grade 3-2 Reconcile a Bank Statement