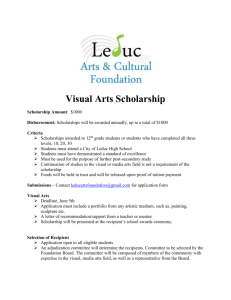

Scholarship / Financial Aid

advertisement

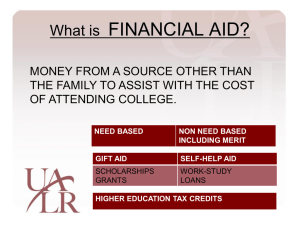

Scholarship & Financial Aid Information THORNTON HIGH SCHOOL OCTOBER 17, 2013 “If a man empties his purse into his head, no one can take it from him. An investment in knowledge always pays the highest return.” -Benjamin Franklin College Fair Fair was TODAY at THS. Seniors were allowed to attend from 1:00 – 2:00. What is Financial Aid? Financial aid consists of funds provided to students and families to help pay for postsecondary educational expenses What is Cost of Attendance (COA)? Direct costs i.e. tuition or housing (billed directly from college) Indirect costs i.e. books, transportation or personal care items (not billed through college) Colleges combine direct and indirect expenses into the cost of attendance Varies widely among different types of colleges Expenses Resident1 Tuition and Fees $ 10,529 On-campus Room and Board2 $ 12,258 Books/Supplies $ 1,800 On-campus Estimated Total3 $ 24,587 Types of Aid Grant: Award that does not have to be paid back, calculated from FAFSA Scholarship: Award that does not have to be paid back Loan: Borrowed money that has to be repaid, usually after college graduation Work Study: Money earned, usually through campus jobs, while attending college Types of Aid Need Based: Based on financial need. These awards are based only on the student’s financial need and not due to grades or other merit Merit Based: Awarded on the basis of a student’s ability, talent or unique characteristics, such as academic achievements, athletic ability, musical talent, or ethnic heritage Sources of Aid Federal government (FAFSA) State (COF) Private sources Civic organizations and churches Employers Regardless of how much money students accumulate prior to college (scholarships, savings, jobs), the majority of students end up with some sort of student loan….. “Welcome graduates, parents, guests, faculty, and home equity loan officers” What is FAFSA? Federal financial aid application How your Expected Family Contribution (EFC) is determined by collecting family’s financial information www.fafsa.ed.gov What is FAFSA? For 2013–14 academic year, the FAFSA may be filed beginning January 1, 2014 Colleges may set FAFSA filing deadlines Meeting or not meeting a college’s priority deadline may impact the amount of financial aid a student receives FAFSA PIN PIN is your Personal Identification Number PIN is needed for: Apply for PIN (keep in a safe place) To apply on-line for FAFSA (electronic signature) Make online corrections Access your FAFSA records at later date Will use annually to refile http://www.pin.ed.gov FAFSA Documents Needed Social Security Number Driver's license 2013 W2 forms Student federal income tax return Parent federal income tax return Untaxed income including social security, temporary assistance for needy families, and welfare documentation Current bank statements Veterans benefit records Current business, investment, business or farm records, stock or bond information, and mortgage information Alien registration or permanent residence card (if you are not a U.S. citizen) Expected Family Contribution (EFC) FAFSA will determine your EFC It is an estimate of the parents' and/or student's ability to contribute to post secondary education expenses The lower the EFC, the higher the financial aid award from the college may be Zero is the lowest EFC number, and 99,999 is the highest Financial Need Cost of Attendance (COA) - Expected Family Contribution (EFC) _______________________________ = Financial Need Subsidized vs. Unsubsidized Loans Stafford Subsidized Loans Federal loans based on financial need. Interest does not accrue on the loan while you are in school at least half time, or during any future deferment periods. The federal government "subsidizes" (or pays) the interest during these times. Additionally, there are maximum amounts you can receive per school year. Freshman: $3,500 per year Sophomore: $4,500 per year Junior: $5,500 per year Senior and 5th year: $5,500 per year $31,000 Total can be borrowed Stafford Unsubsidized Loans Federal loans that are not based on financial need. Interest does accrue from the time the loan is disbursed to the school. Additionally, there are maximum amounts you can receive per school year for dependent and independent students. Freshman: $2,000 for dependent students, $6,000 for independent students Sophomore: $2,000 for dependent students, $6,000 for independent students Junior: $2,000 for dependent students, $7,000 for independent students Senior and 5th year: $2,000 for dependent students, $7,000 for independent students $57,500 Total can be borrowed College Opportunity Fund (COF) In-State Financial Aid Application can be found: https://cof.college-access.net/cofapp/ The amount may differ each year. ($64/credit hour) It will be determined by the state legislature each spring for the upcoming academic year Net Price Calculator The U.S. Department of Education has mandated that each college make available a ‘Net Price Calculator’ You can find it on the college financial aid website. Financial Aid Resources Naviance www.fastweb.com www.finaid.org www.collegeinvest.com www.collegegold.com www.edupass.org www.collegegoalsundayusa.org www.studentaid.ed.gov www.mappingyour future.org ftc.gov/scholarshipscams studentaid.ed.gov/guide/ www.finaid.org/calculators Scholarships…. Scholarships require a lot of leg work! There is no magic answer, or easy way of accruing scholarships. There is no magic answer! Where to Look Online Naviance! www.collegeboard.com/student/pay www.scholarships4school.com www.cappex.com www.collegeinvest.com www.fastweb.com www.finaid.org www.gocollege.com www.salliemae.com www.scholarships.com NAVIANCE Scholarships Can be Awarded Based on… Need Based Talents Grades Height Test Scores Athletic Ability Ethnicity Club membership Religious affiliation Community Service Workplace Military service Family legacy Intended college major School involvement And more…. How to Recognize a Scholarship Scam “For a small fee, we’ll give you a list of scholarships” “We will do all the work for you” Indicates you won an award for which you didn’t apply Guarantees you will win an award Requires personal financial information Does not supply valid contact information College Credit ($$$) & the IB Diploma What exactly do I need to receive the full diploma? Do most students receive the diploma? Am I guaranteed college credit? Do all institutions accept IB credit? What if I go out of state? Do I need the full diploma to earn college credit? IB and AP Exam Fees Escape Grant Fill out paperwork and return by October 21st 2013 to Ms. Burns More IB Diploma Questions… How does IB credit transfer to different institutions? i.e. - Will Berkeley accept the same credit as CU Boulder? How will I know what scores I need to receive credit? What happens if I earn a ‘3’ on one exam? How do I find more information on IB credit? When will my scores be sent? Consider IB Friendly Colleges University of Tulsa: “Students who earn the IB Diploma with a total score of 28 points or more will be awarded at least 30 hours of university credit (sophomore standing).” “The University of Tulsa offers a merit scholarship for entering freshmen who complete all work toward the IB Diploma with a minimum high school g.p.a. of 3.0. This scholarship is renewable for eight semesters with a 3.0 cumulative grade point average.” University of Nebraska: “Students with an International Baccalaureate (IB) Diploma earn an average of 25-28 University credits, including 3 hours of credit in Philosophy for completing the Theory of Knowledge course.” “Once an IB student applies and is admitted to UNL, their IB Diploma may be worth a $50,000 scholarship (out-of-state students only). In addition, all IB Diploma candidate that submit an Informal Personal Statement are eligible for the $1,000 non-renewable IB Nebraska Legends Scholarship.” 12 Tips on How to Get a College Scholarship Start ASAP and Apply Early Many scholarships have early application deadlines Do not miss deadlines! Organize All Scholarship Materials Create a separate file for each scholarships and file by application date Keep a calendar of application deadlines and follow up appointments 12 Tips on How to Get a College Scholarship Search Locally Local scholarships are probably your best chance due to less applicants, therefore less competitive Local banks, grocery stores, libraries, clubs, businesses, organizations, churches, state websites Check Membership Organizations and Employers Organizations of all types and size sponsor scholarships – leave no stone unturned! Examples: religious, community service, military, union, or professional organizations Don’t forget your own employer. Check with human resources department If your student works, check their employer. Many fast food chains, supermarkets, and department stores give scholarships 12 Tips on How to Get a College Scholarship Check School Specific Scholarships Usually there are many school-specific scholarships available through the college you would like to attend Stay Active Participating in a sport, extracurricular activity, or community service will always better your chances. Consistency not quantity is best 12 Tips on How to Get a College Scholarship Read the requirements Make sure you are eligible Never EVER pay to apply for a scholarship Follow instructions carefully Any errors can get your application denied instantly Proofread! (or have someone help you) Do not go over essay length Do not send extra materials Communicate Do not leave items blank If you are not sure about something, don’t hesitate to ask 12 Tips on How to Get a College Scholarship Maintain your GPA Keep your grades up! A higher GPA will increase your chances of receiving funds Apply! Scholarships can be a lot of work but don’t make the mistake of not applying at all The Big Ones…. Boettcher Scholarship Merit Based Full ride to CO institution 27 or higher on ACT Top 5% of class Based on community service, academic achievement and excellent character Interview if selected as semifinalist Deadline: Oct 24 at 11:59 a.m. Daniels Fund Scholarship Must demonstrate financial need (EFC calculator) 17 or higher on ACT Not a full ride but covers all unmet need after EFC Can attend any 2 or 4 year institution in U.S. Based on character, willingness to work hard, passion to succeed, and commitment to giving back to community Interview if selected as semifinalist Deadline: November 15 College Searching and Applications The thing about schools like Harvard and Yale, is that they don’t care at all about the fact you have a high GPA. ALL students who apply have high GPAs What you need to do is highlight what makes you unique and special for admission or scholarship monies IB and AP Matters! GPA and rank are becoming less reliable measures of absolute academic achievement. IB curriculum, course content, and grading IS a reliable measure of academic performance…… use this fact and how the IB experiences has affected you in all your scholarship and/or college application essays and interviews! Colleges who know IB students, know that IB means students know how to think! Stress How IB Has Changed You… As an IB student, you have taken a very rigorous liberal arts education This is something that ALL scholarship and college applications, as well as recommendation letters should stress Be sure to include how IB has changed you, specifically in your actions This change makes you UNIQUE! NACAC Top Ten Tips for Writing a College Essay 1. 2. 3. 4. 5. Start early Be yourself – don’t write what you think others will want to hear Be honest – don’t “borrow” someone else’s story – college admission officers are experts at spotting plagiarism Take a risk – don’t write about what everyone is writing about Keep in focus – stick to the main theme NACAC Top Ten Tips for Writing a College Essay continued 6. Write and rewrite 7. Get a second opinion (criticism is good!) 8. Proofread (spell check, read your essay aloud) 9. Be accurate (if submitting online, don’t use “email language”). Use formal language 10. Don’t forget the “whole package” – academics, extracurricular, application, standardized exams Myths About College Senior Year doesn’t count You are responsible for maintaining your grades all year long Colleges are good or bad Rate the college according to your needs. Is it a good fit? Colleges that cost more or are harder to get into are of higher quality Cost is not a reflection on the standard of education Many schools have in- & out-of-state quotas Myths About College continued Colleges always choose the “best” students Admission officers are human Test scores are the most important criterion in college admissions For most colleges your high school transcript is more important Some secret strategy can get me admitted into a college You and record will! Pitfalls for Students to Avoid You vs your parents – communication is key Procrastination – break tasks down into smaller manageable tasks Disorganization You drove them to Kindergarten in the hopes that someday they will drive themselves to college. Letting your students take the wheel…. If you wish to receive scholarship notifications and information, please be sure to add your name to the IB Parents Distribution List QUESTIONS?